Knowledge exhibits that customers on social media platforms have been calling for the sale of Bitcoin after the newest Bitcoin crash, and contrarian merchants could also be ready for this sign.

Bitcoin sentiment on social media has turned fairly bearish

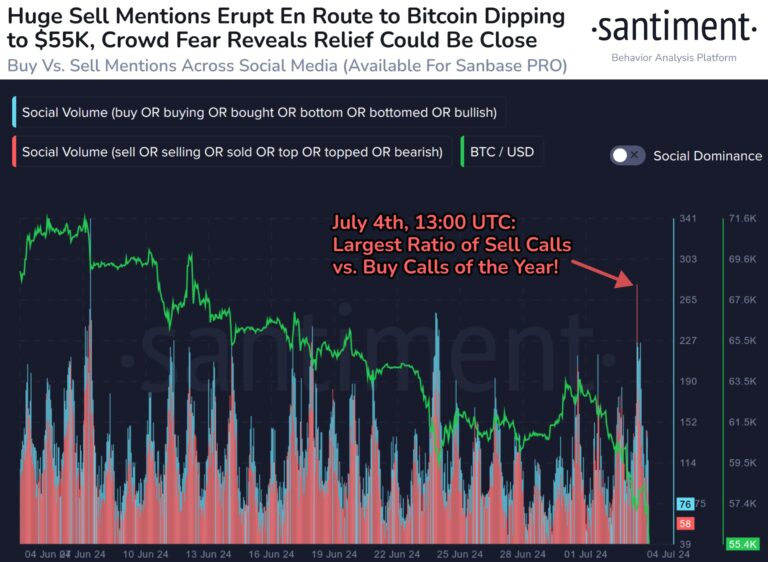

In line with knowledge from analytics agency Santiment, FUD on social media is at an all-time excessive amid the market downturn. The metric of curiosity right here is “social quantity,” which mainly tells us the extent of debate round a given matter or time period that customers on main social media platforms are at the moment partaking in.

This indicator works by searching posts/threads/messages on these platforms to search for mentions of key phrases. The metric then counts the variety of posts that comprise not less than one such point out.

Associated Studying

The explanation social quantity doesn’t merely depend mentions themselves is that mentions themselves don’t comprise any details about whether or not social media as an entire is following the pattern.

For instance, typically a subject could have a excessive variety of mentions, however most could also be restricted to a distinct segment circle (i.e., inside a small variety of posts). On this case, social quantity received’t naturally spike, however it can when customers throughout platforms put up concerning the time period.

Now, what the analytics agency has accomplished is apply sentiment-related phrases to social quantity to distinguish discussions associated to constructive sentiment from destructive sentiment.

Beneath is a chart shared by Santiment displaying how the social quantity of destructive and constructive sentiment has modified with latest Bitcoin volatility:

To determine sentiment, the analyst agency chosen phrases reminiscent of “purchase,” “backside,” and “bullish” within the case of constructive sentiment, and “promote,” “high,” and “bearish” within the case of destructive sentiment. the time period.

As you’ll be able to see from the determine, as the value of Bitcoin plummeted, the latter class of key phrases noticed an enormous spike in social quantity. This implies there are a number of bearish posts on social media.

The indicator additionally spiked in phrases related to constructive sentiment, however clearly, the dimensions was smaller than that of bearish phrases. Actually, the newest put and name ratios are literally the most important ratios noticed to this point this 12 months.

Consequently, social media customers as an entire seem like scared of Bitcoin. Nevertheless, this might truly be a constructive growth for the cryptocurrency, as traditionally its costs usually tend to transfer in the other way to widespread expectations.

Associated Studying

It is clear from the chart that purchasing calls have spiked a number of occasions over the previous month after the value plummeted, however this optimism has solely led to continued losses for the asset.

With the latest crash, market sentiment appears to have lastly turned and Bitcoin merchants are beginning to surrender. “It is a window for daring merchants, a few of whom could need to turn into a real contrarian and capitalize on the anger and frustration of the lots,” Santiment famous.

bitcoin value

Throughout the plunge, Bitcoin briefly fell under $54,000 ranges, however the asset seems to have since rebounded to $55,400.

Featured pictures from Dall-E, Santiment.internet, charts from TradingView.com