Welcome to “Entrepreneurship Weekly”—— TechCrunch’s weekly look again at the whole lot you possibly can’t miss within the startup world. Enroll right here Get it delivered to your inbox each Friday.

Essentially the most attention-grabbing startup tales of the week

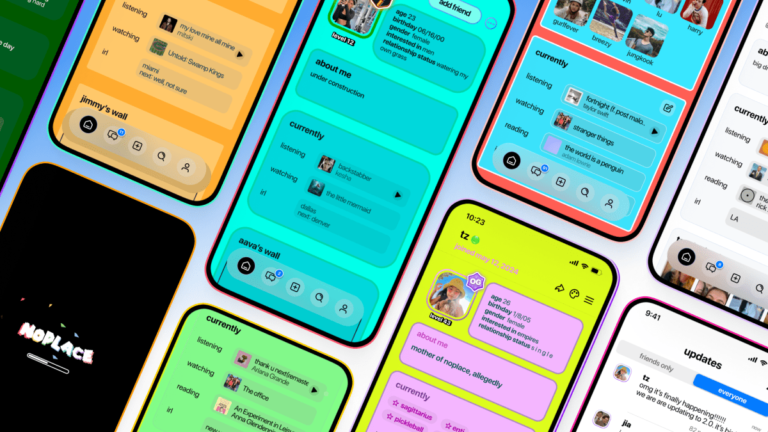

Even seemingly crowded classes see newcomers rating. That features social media: a brand new app known as noplace is No. 1 on the App Retailer after launching an invite-only mannequin.

In addition to confirming person curiosity within the new type of social media, it additionally suggests it might nonetheless go viral in 2024 just like the French app 10 10 did earlier this 12 months. Each apps additionally present that there is worth in revisiting previous expertise concepts – Myspace for nospace, Walkie-Talkie for 10 to 10.

It is also a reminder that shopper tech can discover enterprise capital backers. That is an space that nobody is aware of a lot about, and CEO Tiffany Zhu is aware of all of it too properly. She helped Binary Capital discover early-stage shopper offers earlier than launching the corporate and elevating cash from buyers together with Alexis Ohanian’s 776 and Forerunner Ventures, then creating early-stage shopper fund Pineapple Capital.

- lookup: Hebbia, a startup that makes use of generative AI to go looking giant paperwork and return solutions, has raised almost $100 million in Collection B funding, led by Andreessen Horowitz, sources advised TechCrunch.

- former planet: Robinhood acquired Pluto Capital, a synthetic intelligence-driven analysis platform, so as to add new instruments and options to its investing app, resembling real-time portfolio optimization.

- Don’t we want academic expertise?: Unacademy cuts one other 250 jobs as Indian edtech continues to wrestle within the post-Covid world.

- new grasp: Amazon employed the Adept co-founder and a part of his workforce when it licensed the expertise. However the AI startup will nonetheless exist and refocus on “options that assist agent AI.”

- An oasis in a cryptocurrency drought?: CoinDCX, India’s main cryptocurrency trade, valued at $2.1 billion in a 2022 funding spherical, is increasing internationally by way of the acquisition of BitOasis, a digital asset platform within the Center East and North Africa.

Essentially the most attention-grabbing fundraisers of the week

One space of expertise that is notably promising is startups preventing most cancers, and getting enterprise capital for them. One in every of them is biotech startup Granza Bio, which raised $7 million in seed funding from Felicis, Refactor and Y Combinator to advance most cancers remedies.

Granza Bio is a Y Combinator winter 2024 graduate, and YC hopes to assist extra comparable startups. The Request for Startups (RFS) YC shared in February included a name to “discover a solution to finish most cancers.” The principle focus of RFS is on startups that may scale back the price of MRI—not an ideal reply, since MRI is thought to supply false positives. So it is price noting that accelerators are literally approaching most cancers from a number of angles, together with biotechnology.

One other attention-grabbing observe: Felicis is a normal enterprise capital agency however invests 10% to fifteen% of its capital in bio-focused startups. It is also an indication that biotech is changing into mainstream, and another excuse to concentrate to rising startups within the area.

- new centaur: HR expertise is in excessive demand all over the world, together with in Japan, the place SmartHR raised $140 million in Collection E funding after hitting $100 million in annual recurring income (ARR).

- materials world: French deep tech startup Altrove has raised about $4 million to make use of synthetic intelligence fashions and laboratory automation to create new supplies.

- Purchasing cart path: Robotics startup Cartken raised $10 million in a latest funding spherical led by 468 Capital. It is also seeing demand for its small autonomous robots past sidewalk deliveries and is exploring indoor use circumstances.

- blissful time: Apiday has raised €10 million in Collection A funding that may assist it double down on funding in Europe, the place regulatory tailwinds are driving the expansion of its ESG (environmental, social and governance) reporting platform.

Essentially the most attention-grabbing fund information this week

- local weather change: Spanish enterprise capital firm Seaya Ventures will make investments 300 million euros in local weather expertise by way of the particular fund Seaya Andromeda.

- Made in Switzerland: Forestay, a self-described “near-growth” Swiss fund, raised $220 million to spend money on Europe and Israel, with a deal with enterprise and SaaS.

- past protection: J2 Ventures, a agency led primarily by U.S. veterans, has raised $150 million for a second fund that’s “adjoining to nationwide safety” and also will spend money on healthcare.

- olympic path: A few former Olympians are looking for to lift $50 million to spend money on influential shopper manufacturers by way of their fund, Freedom Path Capital.

- Deep area: Deep tech enterprise capital agency Driving Forces is closing after sole normal associate Sidney Scott concluded the surroundings was too difficult for a small fund like his.

final however not least

The Evolve Financial institution information breach has despatched shockwaves by way of the fintech sector, placing a number of startups in hassle. Yieldstreet confirmed that a few of its clients and Clever had been affected. In the meantime, FinTech Enterprise Week author Jason Mikula stated he has obtained cease-and-desist letters from banks and is worried that every one affected fintech corporations could not but have obtained particulars about what data was stolen within the breach .