As Bitcoin falls under the $55,000 mark, the influence on cryptocurrency mining is important, sparking considerations throughout the business. Specifically, the current decline within the worth of Bitcoin has pushed the working capabilities of many miners to the restrict.

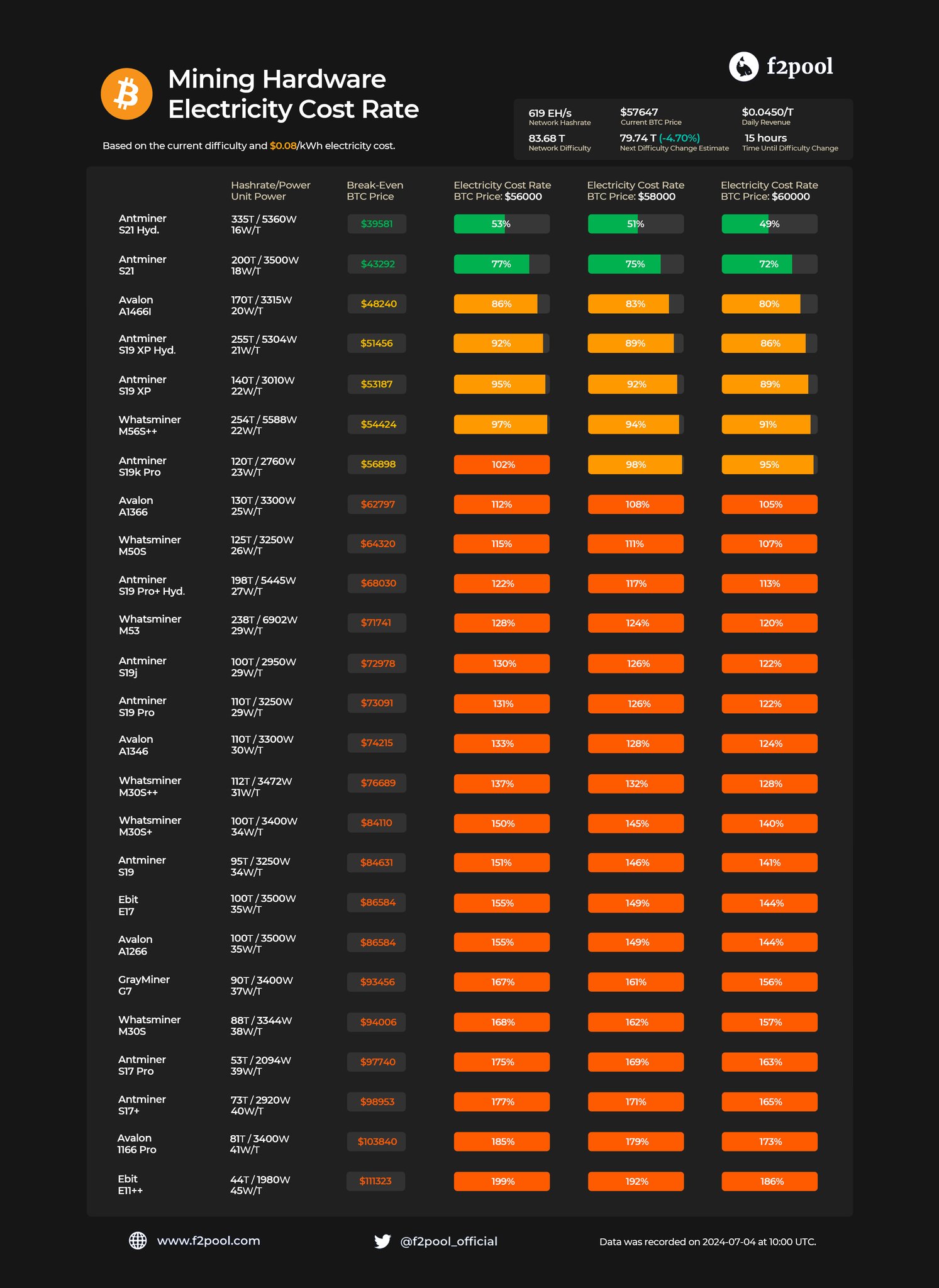

A report from main Bitcoin mining pool F2Pool highlights that only some of the various miners available on the market are worthwhile below present financial circumstances.

Adapting to new realities: Market circumstances put stress on miners

F2Pool’s evaluation exhibits that solely 5 ASIC (Software Particular Built-in Circuit) fashions are nonetheless worthwhile at present Bitcoin value ranges. These embody Antminer S21 Hydro, Antminer S21, Avalon A1466I, Antminer S19 XP Hydro, and Antminer S19 XP.

The breakeven factors for these machines vary from $39,581 to $53,187, making them the final bastion of profitability amid continued value declines.

However, fashions just like the Whatsminer M56S++ hover on the fringes, with breakeven costs very near present BTC costs, highlighting the slender working margins of miners.

⛏️With #bitcoin Buying and selling under $58,000, what’s the present profitability of mining?

At a fee of $0.08/kWh, ASICs with efficiencies lower than 23 W/T will lose cash.

For extra particulars on mainstream mining machines, please consult with the desk under. pic.twitter.com/hJS1lsVnmK

— f2pool 🐟 (@f2pool_official) July 4, 2024

In the meantime, the BTC community is reflecting these challenges by a major drop in hash fee, a measure of the entire computing energy used to mine and course of transactions.

A part of this discount is because of the truth that following BTC’s current halving occasion, which noticed block rewards cut back from 6.25 BTC to three.125 BTC, much less environment friendly miners shut down or scaled again operations in response to the discount in rewards.

On Friday, the issue was adjusted negatively by 5%, aiming to make it simpler for remaining miners to seek out blocks. This adjustment may immediately tackle the discount in competitors and assist stabilize mining income that’s nonetheless within the recreation.

Regardless of these changes, miners’ total profitability stays below stress, with vital penalties not just for particular person operations however for the broader market.

Bitcoin plunges 10%

BTC has skilled a large 10% drop over the previous week, falling to the present buying and selling value of $55,177. This sharp drop brought on the worldwide cryptocurrency market worth to fall by 4.1%, wiping out greater than $100 billion previously day.

This downturn has severely affected merchants, inflicting widespread losses. Knowledge from Coinglass exhibits that 207,067 merchants have been liquidated previously day, with a complete liquidation of $580.18 million. Amongst them, the BTC liquidation quantity was US$186.99 million, primarily from lengthy positions.

Featured picture created utilizing DALL-E, chart from TradingView