Bitcoin flash plummeted on July 4-5, extending the decline from its all-time excessive to about 30%. BTC stays in a bearish formation regardless of a relieving rally over the weekend that compelled the world’s Most worthy coin to realize practically 11%.

Bitcoin retracement not over but: Will bears break $50,000?

One analyst mentioned take to Since Bitcoin just isn’t out of the woods but, no less than based mostly on the technical form, analysts are predicting that Bitcoin won’t solely fall under final week’s lows, however will possible break by means of the psychological $50,000 mark.

The coin famous that historic value motion means that Bitcoin might fall to $48,000 within the coming days, down roughly 40% from its all-time excessive.

When this occurs, following the worth motion of 2017, when the coin additionally plunged 40% after a neighborhood peak, the coin will resume its upward development.

Even so, the Fibonacci retracement device’s anchoring of swing highs and lows stays subjective when it comes to analyst assessments. At the moment, if the September 2023 to March 2024 vary serves because the swings and lows, then a 40% decline from native highs would drop Bitcoin by $10,000 to round $37,000.

Cracks are beginning to seem within the weekly chart. After final week’s decline, the coin closed firmly under the 20-period transferring common, maintaining sellers in management. Affirmation of final week’s losses might result in issues persevering with, triggering extra losses within the quick time period, pushing the world’s Most worthy coin to $50,000 and even $40,000.

How excessive will BTC leap after the pullback?

Nevertheless, after cooling off, depth now not issues and one other analyst predicts a powerful rebound for the coin. If BTC finds assist round $47,000 to $50,000, likelihood is excessive that it’ll float to no less than $102,000.

That is the primary degree of Fibonacci growth. Within the subsequent few buying and selling days, the coin might surge to a most value of $242,000.

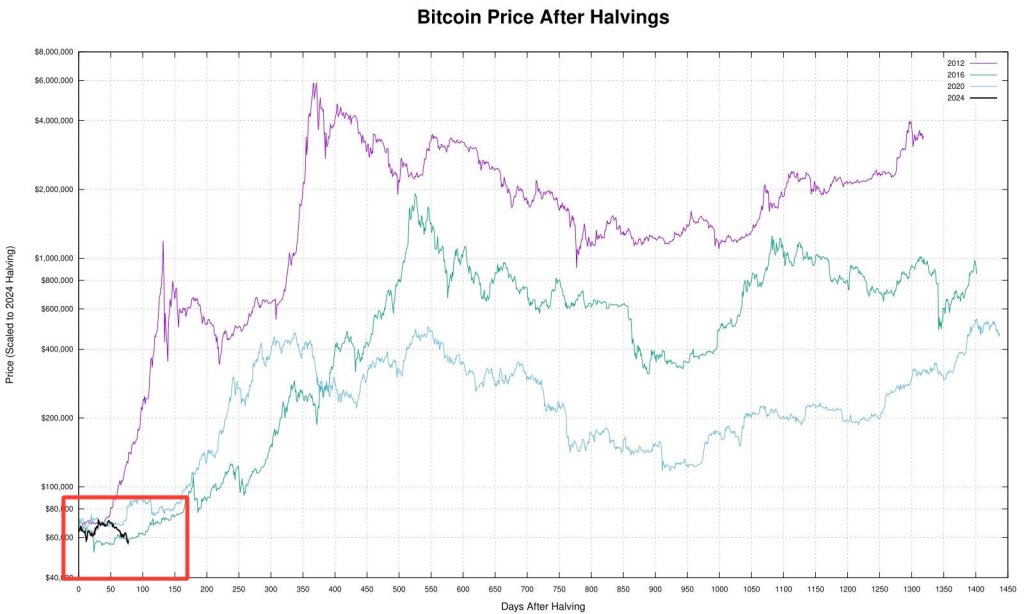

Confidence in Bitcoin rebounding after the present sell-off, which was largely triggered by Mt. Gox liquidation considerations and ongoing promoting by the German authorities, is well-founded. After the halving, the worth of Bitcoin has stabilized and rebounded.

If obtainable, an analyst clarify Holders shouldn’t panic promote within the first 79 days after the halving occasion. Marking the start of the fifth epoch, the community lowered miner rewards on April 20 (about three months in the past).

Characteristic footage are from DALLE, charts are from TradingView