Bitcoin skilled a powerful rebound on Saturday, climbing above $58,250. Regardless of this uptrend, it was unable to maintain momentum and closed above the 200-day exponential transferring common (EMA). This resulted within the formation of a bearish engulfing candlestick sample on Sunday, signaling potential draw back momentum. Presently buying and selling beneath $56,000, Bitcoin is at a essential juncture based mostly on technical evaluation and market sentiment.

Sina G, Chief Working Officer and Co-Founding father of twenty first Capital, detailed the components influencing Bitcoin’s present worth development, highlighting the current downward development and assessing its undervalued standing by means of refined indicators. Ranging from a historic evaluate, Sina identified that Bitcoin has fallen sharply by 26% from its March peak of $73,000, and has stabilized at round $56,000 in current weeks.

Associated Studying

This sharp decline is attributed to a number of macroeconomic and industry-specific components. He stated that Bitcoin’s fall from its peak of $73,000 in March to $56,000 is per historic bull market corrections, which usually characteristic important however momentary pullbacks.

The affect of Bitcoin ETFs is essential. Initially, these ETFs contributed considerably to the worth surge from $16,000 to $73,000 as buyers closely adopted a “purchase the rumor, purchase the information” technique. “As of mid-March, ETF flows had been very robust and the market was rising. Since then, ETF progress has slowed and bankruptcies outflows have ensued, leading to weak worth motion, all the best way all the way down to $56,000.

A notable current affect on Bitcoin costs has been the sale by the German authorities, which disposed of Bitcoins seized from pirated content material platform Movie2k.to in 2013. “The federal government’s determination to liquidate roughly 10,000 cash in three transactions coincided with important worth drops on particular dates in June and July,” he famous. The sell-off led to a 24% plunge in June and July, and the flood of Bitcoin getting into the market made issues worse.

Associated Studying

Is Bitcoin undervalued?

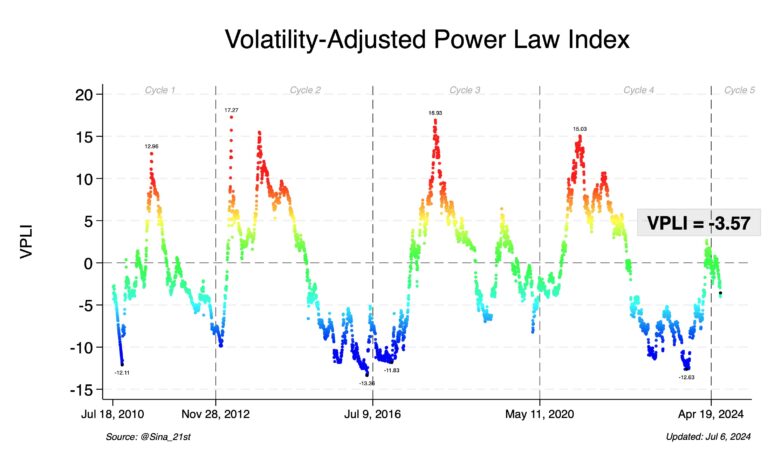

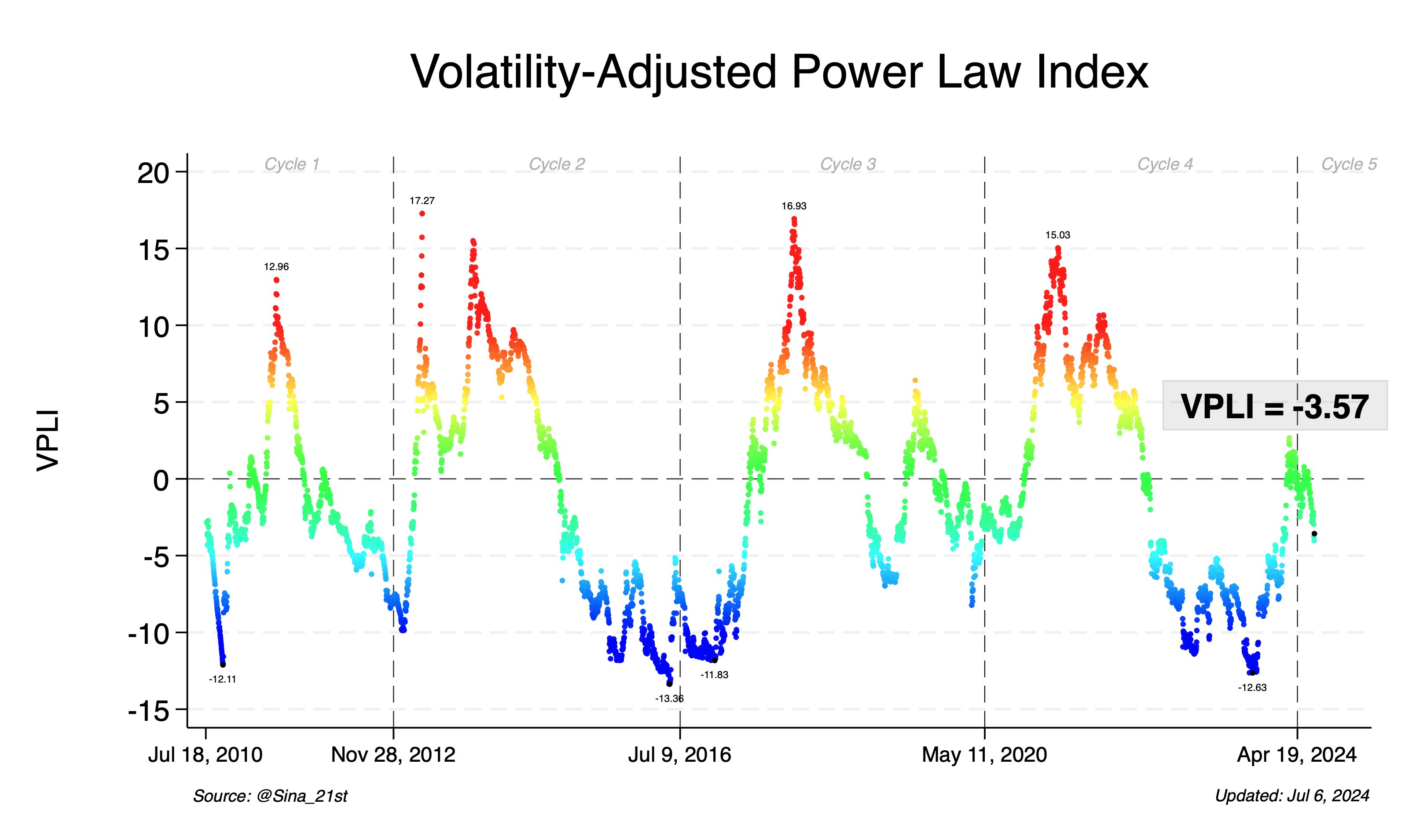

To deal with the query of whether or not Bitcoin is at the moment undervalued, Sina turned to the Volatility Adjusted Worth Stage Index (VPLI), a proprietary indicator developed by twenty first Capital. “Presently, our VPLI is -3.57, which signifies that Bitcoin is way beneath its cheap worth,” Sina stated. He additional clarified that traditionally, a VPLI rating of -10 corresponds to a bear market backside, placing the present studying into context that means Bitcoin could also be undervalued.

“This places us on the forty first percentile of worth, i.e. Bitcoin has solely spent 41% beneath this VPLI studying (most of which was throughout bear markets). So the risk-reward steadiness is favorable,” he added .

Wanting forward, Sina highlighted two key short-term indicators that would decide Bitcoin’s rapid worth course: the German authorities’s continued gross sales of Bitcoin and the efficiency of perpetual swap funding charges. “Lately, funding charges have been adverse, which is normally a bearish signal. This means that many merchants are taking brief positions in anticipation of additional worth declines, which can point out {that a} market backside is imminent.

At press time, BTC was buying and selling at $55,835.

Featured picture created with DALL·E, chart from TradingView.com