On-chain knowledge exhibits that the Bitcoin market cap to realized worth (MVRV) ratio, which has traditionally been vital for BTC, is being retested.

Bitcoin MVRV ratio is retesting its 365-day SMA

As one analyst defined in a CryptoQuant Quicktake submit, the Bitcoin MVRV ratio is retesting ranges which have served as vital psychological ranges prior to now.

The “MVRV ratio” right here refers to a well-liked on-chain metric that, merely put, compares the worth of buyers’ holdings (i.e. market cap) to the worth they used to buy cryptocurrencies (realized cap) Examine.

When the worth of this indicator is larger than 1, it implies that buyers can now be thought-about worthwhile. The upper the ratio above this degree, the extra doubtless a high is shaped as holders turn out to be more and more inclined to reap positive aspects.

However, an indicator beneath this water criterion implies that market losses dominate. This space might see a backside as sellers turn out to be exhausted on this space.

After all, the MVRV ratio is strictly equal to 1, displaying that buyers maintain equally between income and losses, so it may be assumed that the typical holder has simply damaged even on their funding.

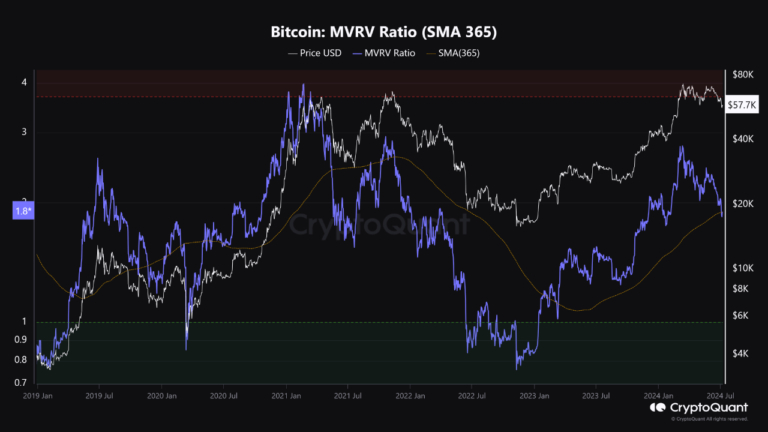

Now, the chart beneath exhibits the pattern of the Bitcoin MVRV ratio and its 365-day easy transferring common (SMA) over the previous few years:

As proven within the chart above, the Bitcoin MVRV ratio has been declining because the worth hit an all-time excessive (ATH) in March. This pattern is as a result of Bitcoin has been experiencing bearish momentum since then.

Buyers’ income, which had surged to comparatively excessive ranges as shares rose, took a substantial hit as costs fell. Nevertheless, holders nonetheless benefited drastically, because the indicator presently has a worth of round 1.8.

The chart exhibits that this degree is roughly the identical as the place the indicator’s 365-day SMA has been swinging just lately. Traditionally, this transferring common has been an vital degree for this indicator, typically appearing as assist throughout bullish tendencies.

An MVRV ratio beneath this line normally implies that Bitcoin will shift right into a bearish pattern. Due to this fact, the present retest between the indicator and the road might be vital for the cryptocurrency.

It stays to be seen whether or not this assist degree can maintain, or if the indicator will fall beneath it, doubtlessly resulting in an prolonged bearish interval for Bitcoin.

bitcoin worth

Bitcoin has solely recovered barely from its latest crash to this point, with its worth round $56,900.