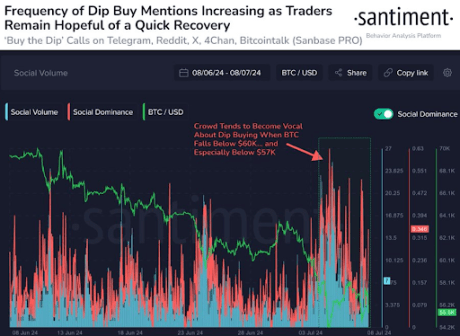

this On-chain evaluation platform Santiment Gives helpful insights for traders contemplating a purchase order Bitcoin falls. The worst will not be over but, because the flagship cryptocurrency might nonetheless fall farther from its present value vary, the platform mentioned.

To purchase or to not purchase when Bitcoin drops?

In X (previously Twitter) postalMarket individuals are additionally anticipating a rebound, Santiment mentioned to these contemplating shopping for the dip. They added that these sharp drops, just like the one Bitcoin has skilled lately, are sometimes skilled FUD (Worry, Uncertainty and Doubt).

Associated Studying

This means that these trying to purchase into Bitcoin because it falls could need to watch out as Bitcoin might fall additional as folks panic promote as soon as the flagship cryptocurrency recovers. Relating to FUD, there are additionally requires Bitcoin to nonetheless be potential Drop to $40,000 vary. Subsequently, such statements might be detrimental to the value of Bitcoin, inflicting it to fall additional.

Santiment, in the meantime, famous that Bitcoin sometimes recovers from such sharp declines after common merchants surrender hope on the cryptocurrency. Cryptocurrency Analyst CrediBULL Crypto There are additionally phrases for these trying to purchase the dip in Bitcoin’s present value vary. He talked about in an article X posts Anybody trying to purchase at present value ranges have to be keen to be “underwater” for some time.

Anybody who would not really feel comfy spending time underwater ought to wait till some optimistic value motion happens, he added. He famous that such optimistic value motion might ideally come within the type of “a large wave of liquidations (open curiosity reset) or some LTF impulse value motion.

The cryptocurrency analyst additionally addressed spot Bitcoin consumers. He assured them that they don’t have to fret concerning the present value vary and claimed that Bitcoin might decline on the upper timeframe (HTF) with out invalidating the HTF bullish construction. Based mostly on Bitcoin’s bullish construction, he talked about {that a} value correction following a downtrend will result in Flagship cryptocurrency to $100,000.

Institutional traders purchase on dips

Newest knowledge from Farside traders reveals company investor Shopping for Bitcoin on Dips. On July 8, the spot Bitcoin ETF recorded a complete internet influx of US$294.8 million. BlackRock’s IBIT, Constancy’s FBTCand Grayscale GBTC All these initiatives recorded spectacular internet inflows of US$187.2 million, US$61.5 million and US$25.1 million respectively.

Associated Studying

These Spot Bitcoin ETF Internet inflows of $143 million have been additionally recorded on July 5, marking a turnaround contemplating there had been two consecutive days of outflows. These inflows into Bitcoin have fueled the flagship cryptocurrency’s current value rally.

As of this writing, Bitcoin is buying and selling round $57,100, up greater than 2% prior to now 24 hours knowledge From CoinMarketCap.

Featured picture created utilizing Dall.E, chart from Tradingview.com