You continue to have to file your taxes correctly utilizing IRS Type 8936, and you have to conform to switch the credit score to Carvana after you file. So whereas Carvana does not make tax season simpler, it does provide a decrease value of entry to purchasing an electrical car, which might assist push clients taken with electrical autos to take the step.

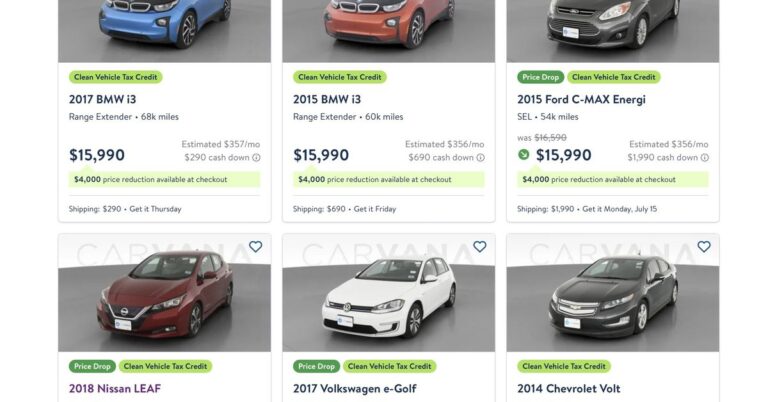

Now you can benefit from the provide on the Carvana app or web site by trying to find an electrical or plug-in hybrid car with a inexperienced tax credit score banner. As said within the Biden Administration’s Inflation Discount Act, not all used clear autos will qualify. It should have a battery of at the least 7 kWh and price lower than or equal to $25,000 (together with delivery and supply charges). It is also solely legitimate for the car’s first two mannequin years.

For instance, in order for you a Chevrolet Spark EV as a result of it is small, quick and matches in any parking house, solely the 2015 and 2016 fashions will qualify. Carvana sells them for about $11,000 to $14,000 every, so incentives might deliver them right down to $10,000 or much less (though as of this writing, I seen a few of them now not have promoting low cost banners).

At checkout, you have to affirm your eligibility, which incorporates the requirement that your revenue doesn’t exceed $150,000 for married {couples} submitting collectively or $112,500 when submitting as head of family, or $112,500 for married {couples} submitting individually, individually, or in any other case. To not exceed US$75,000.

You can’t declare the credit score for a car that has been bought utilizing the Clear Used Automobile Tax Credit score, or in case you have used the profit inside the previous three years (which isn’t technically attainable but). Both method, sooner slightly than later, as a result of the Republicans might find yourself killing it.