Mirroring the efficiency of Bitcoin and different prime altcoins, Ethereum is again above $3,000 simply days after falling beneath $2,800. An in depth above $3,200 is essential to spur demand because the second Most worthy coin recovers, injecting optimism amongst battered token holders and merchants.

Ethereum Rising: Will Bulls Break Above $3,200?

In keeping with a report by IntoTheBlock on July 10, if Ethereum higher edge The $3,200 stage can be an enormous growth for merchants. When this occurs, an estimated 2 million entities buying and selling ETH at this worth level will revenue.

Subsequently, those that are lengthy can exit at breakeven if the value retests this stage. Alternatively, different “diamond gamers” anticipate higher features on the horizon and might double down and journey the momentum.

Associated Studying

Up to now, there are indicators of energy. Nonetheless, whereas sellers stay in management, a break above $3,300 will probably be essential within the quick to medium time period. Wanting on the ETHUSDT candlestick association on the each day chart, the $3,300 stage was beforehand help however is now resistance.

A breakout (ideally on increased quantity) may very well be the premise for extra features, pushing the coin in direction of the important thing liquidation stage of $3,700 and later to $3,900.

Conversely, if sellers take over, reverse current features and match the losses seen on July 4 and 5, a break beneath $2,800 would sign a continuation of the pattern. Judging from the candlestick association, on this situation, Ethereum will fall to new multi-week lows and even fall to $2,500.

Take note of spot ETFs, as ETH turns into scarce, whales are gathering cash

Total, analysts are optimistic and anticipate Ethereum to maneuver increased. The anticipated launch of a spot Ethereum exchange-traded fund (ETF) within the coming days is a big catalyst behind this bullish outlook.

Similar to how the invention of a Bitcoin ETF opened the floodgates for institutional funding on the earth’s Most worthy token, Ethereum will seemingly see the identical inflows. As institutional demand will increase, proponents see ETH heading increased, topping $4,100 and setting new 2024 highs within the coming months.

Associated Studying

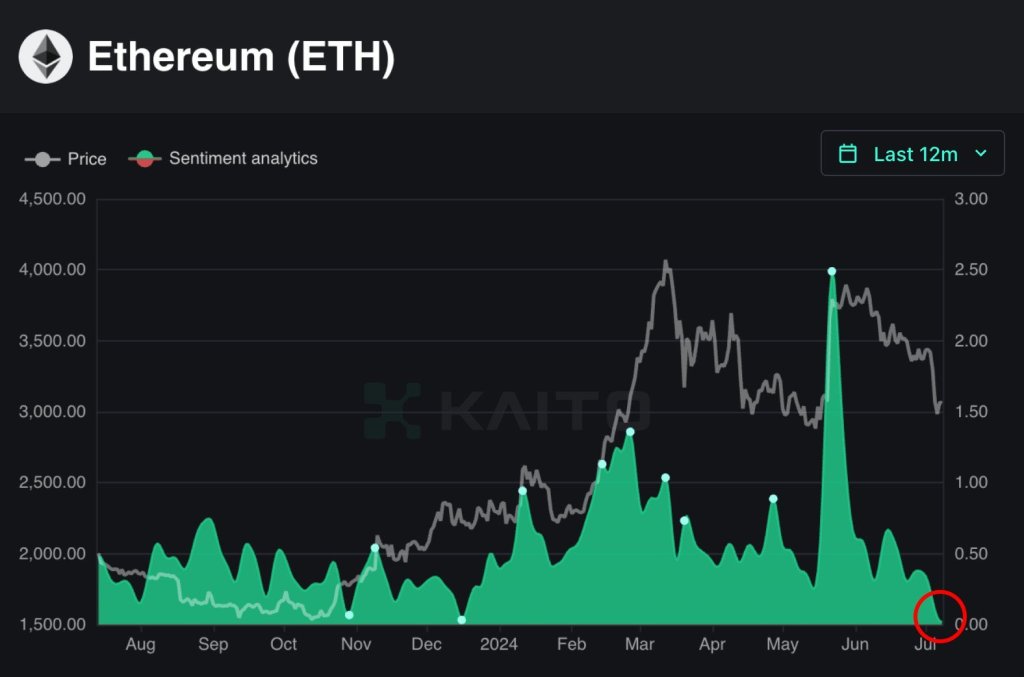

Curiously, even the anticipation of a bodily Ethereum ETF launch doesn’t appear to have modified merchants’ outlook. On-chain information reveals bullish sentiment is at excessive ranges One-year lowdeclaring that ETH holders must be cautious.

On the similar time, as on-chain information illustrateLately, exchanges have seen a rise in ETH outflows. All exchanges together with Binance and Coinbase management 10.17% of the ETH circulating provide. Parallel information additionally programme The opposite half (28% of the full ETH in circulation) is pledged.

Characteristic footage are from DALLE, charts are from TradingView