In a forecast launched Friday by way of “Bitcoin has a 90% probability of reaching a brand new ATH earlier than March 2025,” Peterson declared.

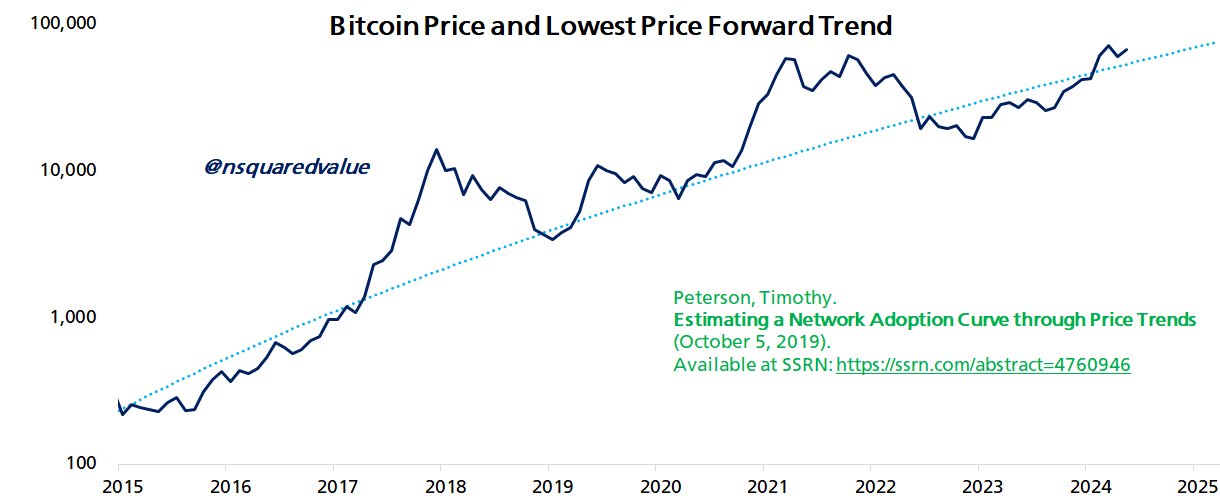

Peterson, recognized for works equivalent to Metcalfe’s Regulation as a Mannequin of Bitcoin Worth, bases his predictions on an analytical framework detailed in his analysis paper titled Minimal Value Ahead: Why Bitcoin Costs By no means Flip Again . The paper, first revealed in 2019 and subsequently revised, introduces an revolutionary strategy to understanding Bitcoin’s worth trajectory by specializing in Bitcoin’s all-time low worth, generally known as the “by no means look again worth” (NLB). This NLB marked the final time Bitcoin traded at a selected worth level, with Bitcoin by no means falling to that degree once more.

Associated Studying

Peterson’s strategy includes plotting these NLB information factors on a lognormal scale, adjusted by what he calls a “sq. root time” scale. This unconventional metric helps present a deeper understanding of Bitcoin’s long-term development sample and successfully compares it to the diffusion course of noticed in expertise adoption in different areas.

Bitcoin adoption is essential

On the coronary heart of Peterson’s evaluation is Metcalfe’s Regulation, which he elaborates as “the worth of a community is proportional to the sq. of the variety of its customers.” By making use of this precept to Bitcoin, Peterson believes that because the digital foreign money’s person base expands, its intrinsic worth is anticipated to develop exponentially. The paper particulars use the “sq. root time” mannequin to mix the normal idea of time worth of cash with the non-linear development charge typical of community economics, offering a convincing case for Bitcoin’s future valuation trajectory.

Peterson’s strategy particularly incorporates parts of conservative monetary evaluation by highlighting Bitcoin’s all-time low worth. “By specializing in the bottom worth, the evaluation inherently takes a conservative stance, underestimating fairly than overestimating worth,” Peterson famous, which helps “reduce the chance of overestimation and be sure that forecasts are usually not overly relied upon that will not be Optimistic state of affairs for realization”.

Associated Studying

Peterson’s paper additionally discusses potential anomalies and market manipulation that would distort worth perceptions. By specializing in NLB, this evaluation filters out such distortions, offering a purer view of Bitcoin’s worth appreciation, unaffected by short-term speculative pressures or exterior shocks equivalent to market abnormalities brought on by COVID-19 in 2021.

Peterson predicted a brand new all-time excessive by March 2025, reflecting broader confidence within the continued development of the Bitcoin community. Because the adoption curve continues to rise and community results additional solidify Bitcoin’s worth, this prediction will not be solely speculative however relies on quantifiable and noticed historic traits.

Peterson concluded: “So long as adoption continues, the worth of Bitcoin (as represented by the NLB worth) will rise. If adoption is hindered, then the value will stagnate or fall.

At press time, BTC was buying and selling at $58,192.

Featured picture created with DALL·E, chart from TradingView.com