Loyalty enterprise on Fiat requirements

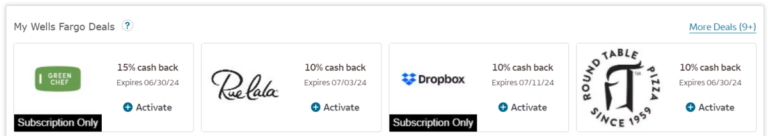

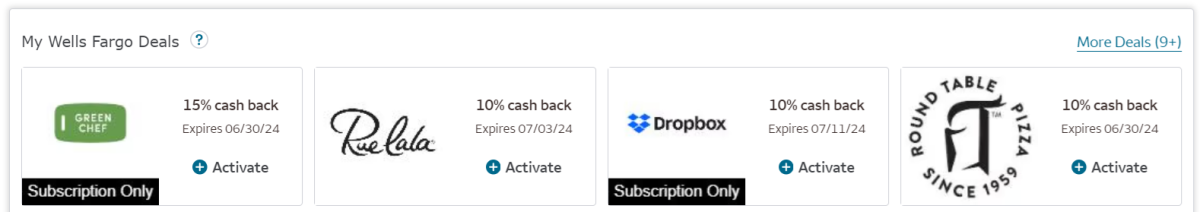

I spent the previous ten years working in Mastercard’s San Francisco workplace constructing card-related provide options to drive service provider loyalty. It is an enchanting enterprise that enables cardholders to obtain service provider provides by their financial institution and obtain reductions in the event that they make qualifying purchases at taking part retailers. Beneath is a pattern of those provides/offers from my private Wells Fargo account.

These provides can drive new buyer acquisition, reactivate misplaced prospects, and improve buy frequency and “basket dimension” for current prospects. General, advertising and marketing options are very efficient in driving incremental spending habits, primarily by bank card (and a few debit card) fee channels.

Enter Bitcoin

Bitcoin would not get a number of consideration as a medium of change as a result of Bitcoin holders are supposed to carry on to their Bitcoins, and there is comprehensible anxiousness about spending making a taxable occasion, however placing these issues apart, Let’s check out the enterprise alternatives driving businessmen’s allegiance to Bitcoin fairly than fiat currencies. What’s modified? It’s no exaggeration to say that Bitcoin has revolutionized the worth proposition, delivering unprecedented financial surpluses with efficiencies and use instances that fiat currencies can not match.

price

Offering any fiat forex service provider low cost program is an costly job that requires a big and sophisticated expertise stack and personnel workforce: certifying taking part retailers, confirming service provider contracts, allocating reductions to cardholders primarily based on predicted advertising and marketing budgets, and testing {qualifications} spend occasions, redeem cardholders by invoice level rewards, compile studies for retailers to indicate program efficiency, and reconcile payments. The underside line is that each one client spending is pushed by the most costly fee channel (for retailers); bank cards.

Bitcoin Orbit provides up a ton of steps within the course of. Retailers can take part in a extra Google Adwords-like mannequin through a self-service portal, immediately funding advertising and marketing budgets by pledging Bitcoin for verification (this may also be deserted immediately – by no means attainable in statutory provide applications). Banks and card processors now not function gatekeepers for end-to-end options; they and their related prices/charges are utterly faraway from the worth chain. Better of all, redemption transactions are actually all pushed on low-cost Lightning Community rails, eliminating not solely the direct price of bank card charges (sometimes 3% or extra), but additionally the oblique prices of chargebacks and fraud.

new paradigm

Fiat Rail means shoppers taking part within the financial institution’s service provider provide program sometimes do not obtain any notification on the level of sale that they’ve efficiently obtained a reduction, and the low cost itself would not present up as an announcement credit score till days later. Banks can put money into instant-notice offer-and-redemption options, however doing so is expensive and sophisticated and have to be completed on a bank-by-bank foundation; few do, and there’s no common protocol that may be leveraged.

Retailers should fund statutory provides upfront by pre-financing of a dedicated finances, or by chasing funds by a typical “30-day” kind credit score settlement (backed by contractual obligations).

Bitcoin Orbit utterly turns these conventional frameworks on their head. Customers not solely obtain notify Acquire immediate peace of thoughts on the level of sale once they benefit from Bitcoin native provides, however they obtain low cost Additionally in actual time. Not solely that, however applied sciences like LN Bits and Bolt 12 additionally help “cut up funds,” the place Bitcoin-native provide suppliers/firms can receives a commission immediately on the identical point-of-sale occasion. This basically renders the statutory “billing” step out of date. Retailers also can change the provide worth, minimal spending threshold, and most significantly inventory They need the remaining provides/reductions (advertising and marketing finances) dedicated instantly; this transformation is unimaginable to attain by statutory channels, which require finances commitments weeks upfront. I’ve solely scratched the floor of the lengthy checklist of unfair benefits that Bitcoin brings in relation to providing service provider low cost applications, however I’ll depart it there for now.

Precautions

Attain: Provides applications are basically a two-sided market, and it’s vital to have the most important attainable client viewers to make service provider participation worthwhile. The viewers of Bitcoin holders, and what I name the “keen on Bitcoin” viewers, whereas rising, continues to be a comparatively small group.

Objective: The Fiat service provider provide program has a panacea that’s at the moment unachievable on Bitcoin, no less than indirectly; the buyer’s transaction historical past. This historical past permits retailers to fastidiously spend their advertising and marketing budgets on particular client teams, akin to new, lapsed, and dependable teams. This is a useful software for making certain the best return on advert spend (ROAS), and in addition offers insightful pre- and post-testing and managed “incremental” reporting to show marketing campaign spend enhancements, for retailers who want it. Very convincing and helpful.

That mentioned, I believe it’s attainable for retailers to attraction to the Bitcoin consumer base, even in a broad and untargeted manner, mitigating these caveats as a result of that group is so helpful; skewing in direction of the rich, influential, and fanatically loyal Bitcoiners Pleasant enterprise.

The above are examples of how Bitcoin removes prices from legacy programs like by no means earlier than, unlocking increased income for retailers and delivering a extra direct, visceral and satisfying client expertise. This lengthy checklist of unfair benefits supplied to Bitcoin-native retailers can’t be replicated by any competitor working on the fiat observe. That is primarily based on my expertise engaged on CLO service provider loyalty applications over the previous ten years.

Michael Thaler says “Purchase Bitcoin and wait”. For many people Bitcoin fans, we’ve got the chance to not simply “wait in” however to proactively assist drive hyper-Bitcoinization. I am taking this step in direction of service provider provides, utilizing my experience and expertise to make Bitcoin native provides a actuality. I’m curious to see what large price financial savings and new, distinctive use instances different Bitcoin customers can uncover by reflecting on their fiat mining expertise and experience and reimagining it by the lens of Bitcoin.

It is a visitor publish by John McCabe. The views expressed are totally their very own and don’t essentially mirror the views of BTC Inc or Bitcoin Journal.