Bitcoin stays secure at time of writing, floating above fast help and only one step away from reclaiming the all-important native liquidation line round $66,000. Whereas the broader cryptocurrency group expects consumers to step in and push costs larger, there are some thrilling developments supporting the outlook.

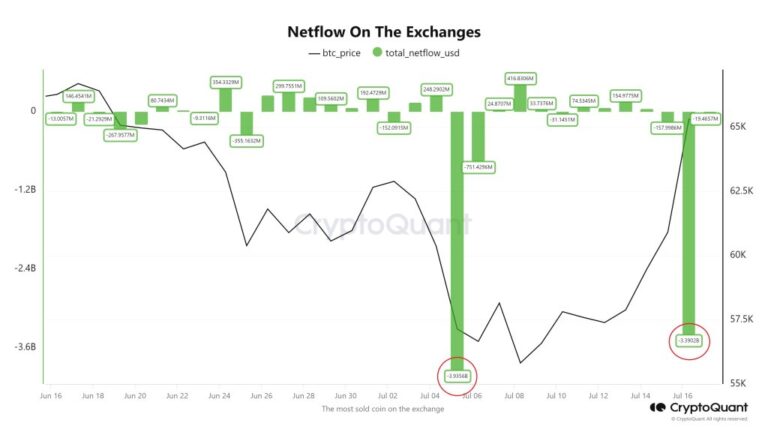

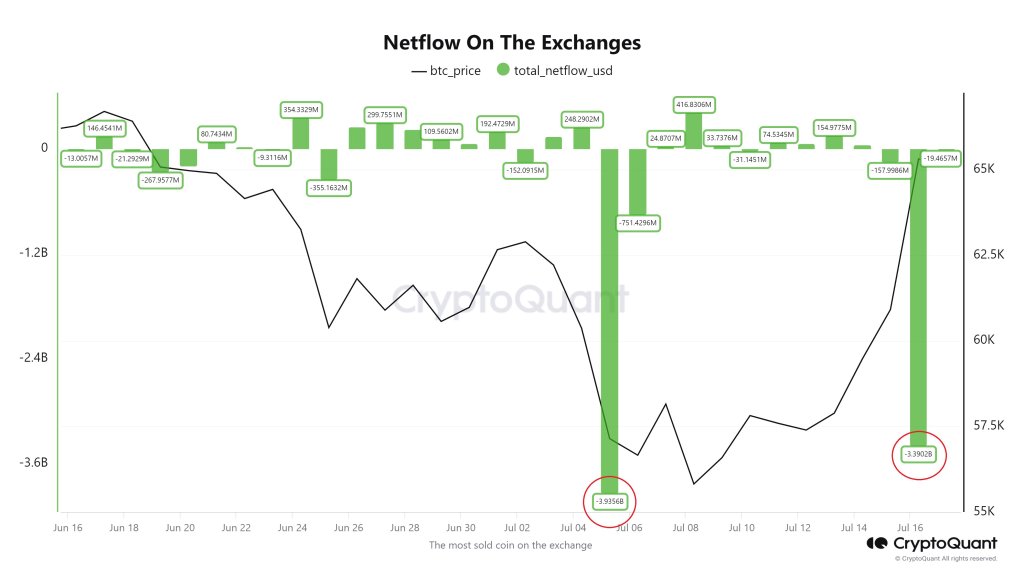

Billions price of Bitcoin faraway from exchanges

In accordance with alternate knowledge shared Bitcoin holders are more and more withdrawing their cash from exchanges, an analyst at X stated.

On July 5, as Bitcoin costs plummeted, pushing the world’s most respected foreign money to almost $50,000, a staggering $3.8 billion price of Bitcoin was moved from exchanges.

As soon as this occurred, the value rapidly rebounded, rising from a low of $53,500 set earlier this week to $65,000. Though the value has been shifting horizontally above $62,500 just lately, extra BTC is on the best way out. On July 16, BTC house owners withdrew one other $3.4 billion price of Bitcoin.

Associated Studying

Though there is no such thing as a Clear If previous efficiency is any information, the value may edge larger because it did after the crash to $53,500.

Usually, analysts interpret overseas alternate outflows as constructive for costs. At any time when a token holder transfers property to a non-custodial pockets, they need to management their tokens. Subsequently, they could be reluctant to promote.

Their choices assist help the value as a result of they would not promote on demand in the event that they wished to, as they might in the event that they held them on crypto platforms like Binance or Coinbase. Moreover, as fewer Bitcoins grow to be obtainable on exchanges, bulls have a tendency to profit from elevated shortage.

Is Bitcoin poised to interrupt $72,000 once more?

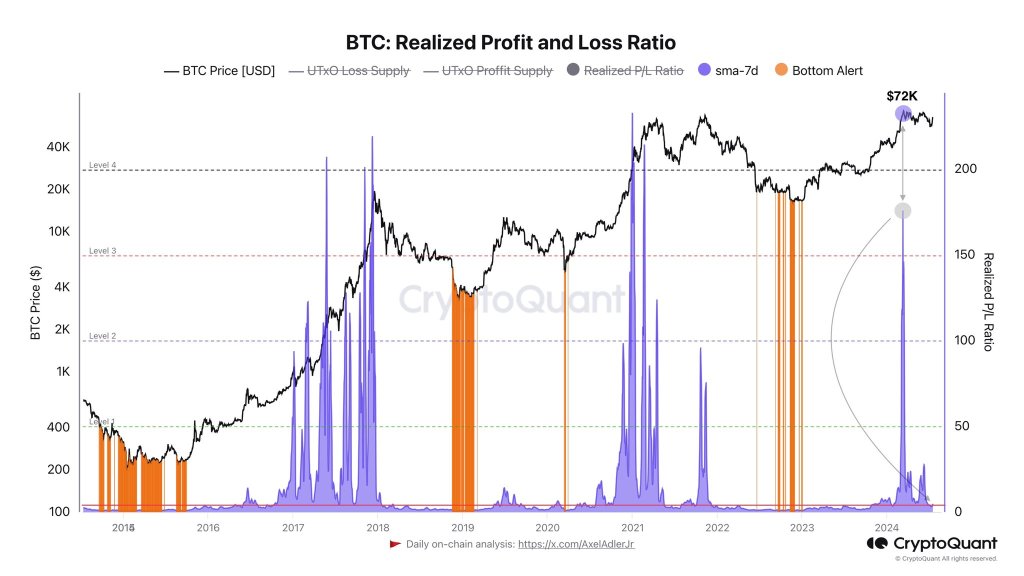

Along with this growth, one other analyst famous that the realized revenue and loss ratio metric has Fallen and are at multi-month lows. This indicator is used to measure market sentiment and is primarily influenced by positive factors and losses at any cut-off date.

This decline means that traders who wished to exit on the highs have taken income. For now, merchants should anticipate these indicators to rise, maybe to multi-month highs, ideally above $72,000 and $74,000, earlier than resuming profit-taking.

Associated Studying

Bitcoin has additionally regained its common short-term holder (STH) price foundation as the value recovered above $62,000. Those that bought inside the final 155 days have now made cash. Earlier than realizing income, they could maintain on and count on to make extra positive factors within the coming buying and selling days.

CryptoQuant analysts stated that previously, at any time when the common price base was exceeded, costs tended to rise by greater than 30%.

Characteristic footage are from DALLE, charts are from TradingView