Sure – hips

Russell 2000 (RTYIWM took a breather on Thursday, however the current growth has lifted it 8% year-to-date, and plenty of movers consider the small-cap inventory might be sturdy within the second half of 2024, the Carson Group chief govt stated. Market strategist Ryan Detrick.

The Russell 2000 Index (RTY) gained 10% in a five-day successful streak that ended on Tuesday earlier than retreating on Wednesday and Thursday. Buyers’ rotation into small-cap shares from large-cap tech shares like Nvidia (NVDA) and Meta (META) has helped the Russell 2000 (RTY) modestly shut the hole with the S&P 500 (SP500) (SPY) year-to-date acquire of 16%, Nasdaq The Gram Composite Index (COMP:IND) (QQQ) soared 19%.

“We have appreciated small caps all yr, however we’ll be the primary to confess they have been irritating,” Detrick stated in a word. Nevertheless, “we expect this underappreciated, underappreciated and underowned space might see large development within the second half of ’24,” he stated.

Among the many elements:

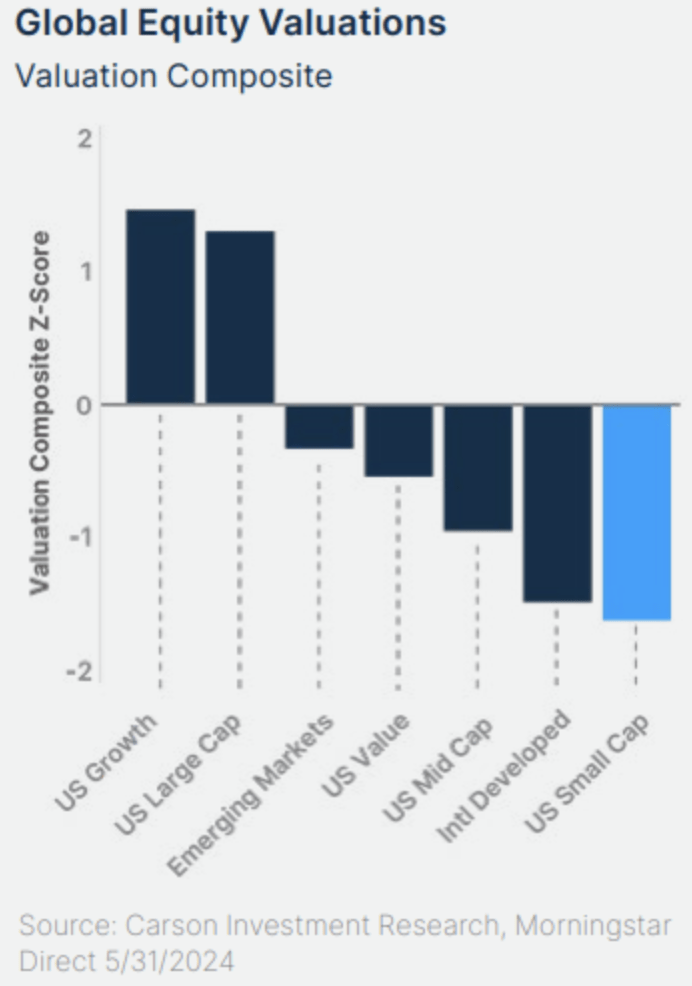

Small-cap shares have traditionally been low cost

He stated shopping for low cost shares will help buyers modify their portfolios as soon as different drivers are in place. “The final time small-cap shares had been this low cost relative to large-cap shares was 1999, when small-cap outperformance started a 13-year run.” This is a chart from The Carson Group:

Future income will see “explosive” development

This yr, the S&P SmallCap 600 Index (SP600) is predicted to put up earnings development of 4.1%. However for 2025 and 2026, analysts anticipate potential growth in S&P small caps of 17.7% and 12.5%, respectively.

“On condition that we stay optimistic in regards to the U.S. economic system, we expect these headline earnings numbers might even be higher,” Detrick stated.

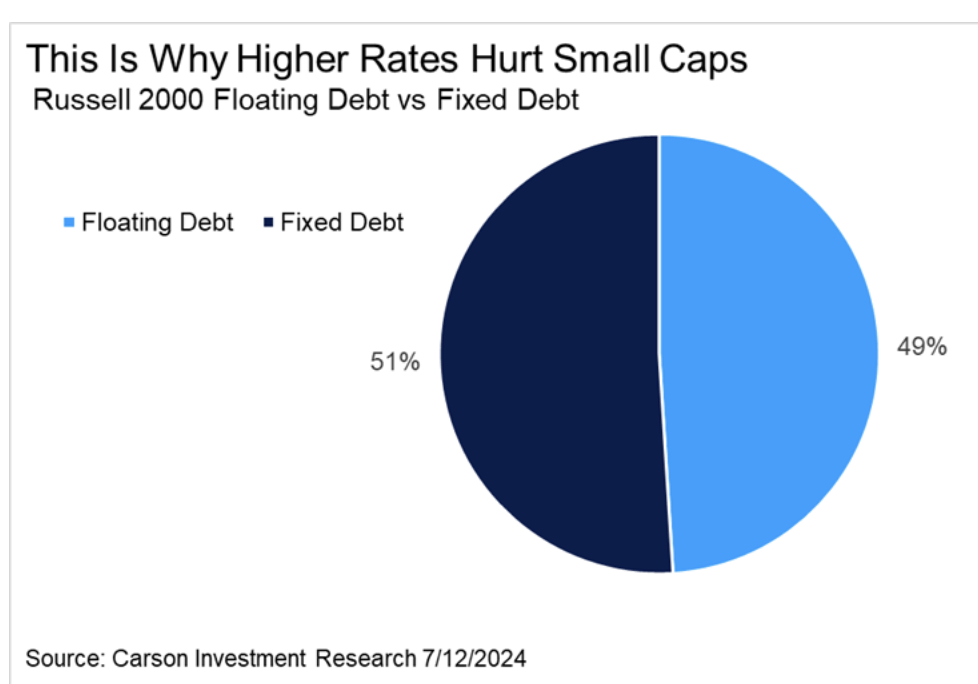

Fee cuts ease debt ache for small companies

Detrick stated slowing inflation has prompted merchants to cost in expectations of two charge cuts by the Federal Reserve in 2024, with the third charge minimize being like a “coin toss.” In contrast with just some years in the past, massive S&P 500 corporations have locked up 90% of their debt at extraordinarily low rates of interest, whereas small corporations have solely about half of their complete debt in fixed-rate debt.

“Decrease rates of interest, even barely decrease, may very well be an enormous tailwind for small-cap shares,” he stated. This is one other chart: