One analyst famous how Bitcoin is returning to its price foundation for short-term holders, which might be a bullish signal for the asset.

Bitcoin returns to actual worth for short-term holders

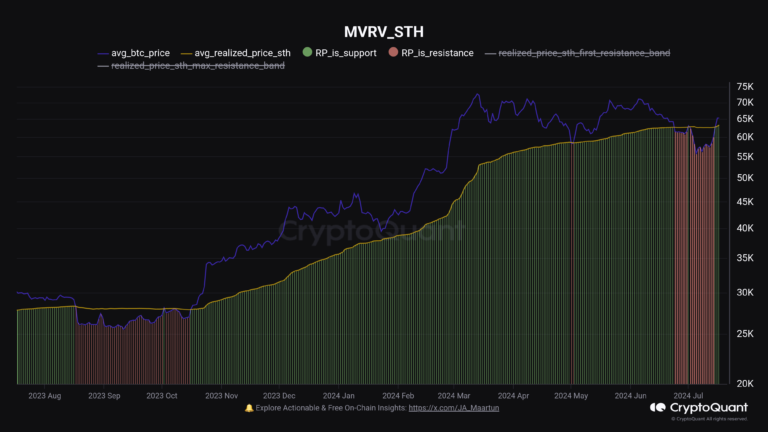

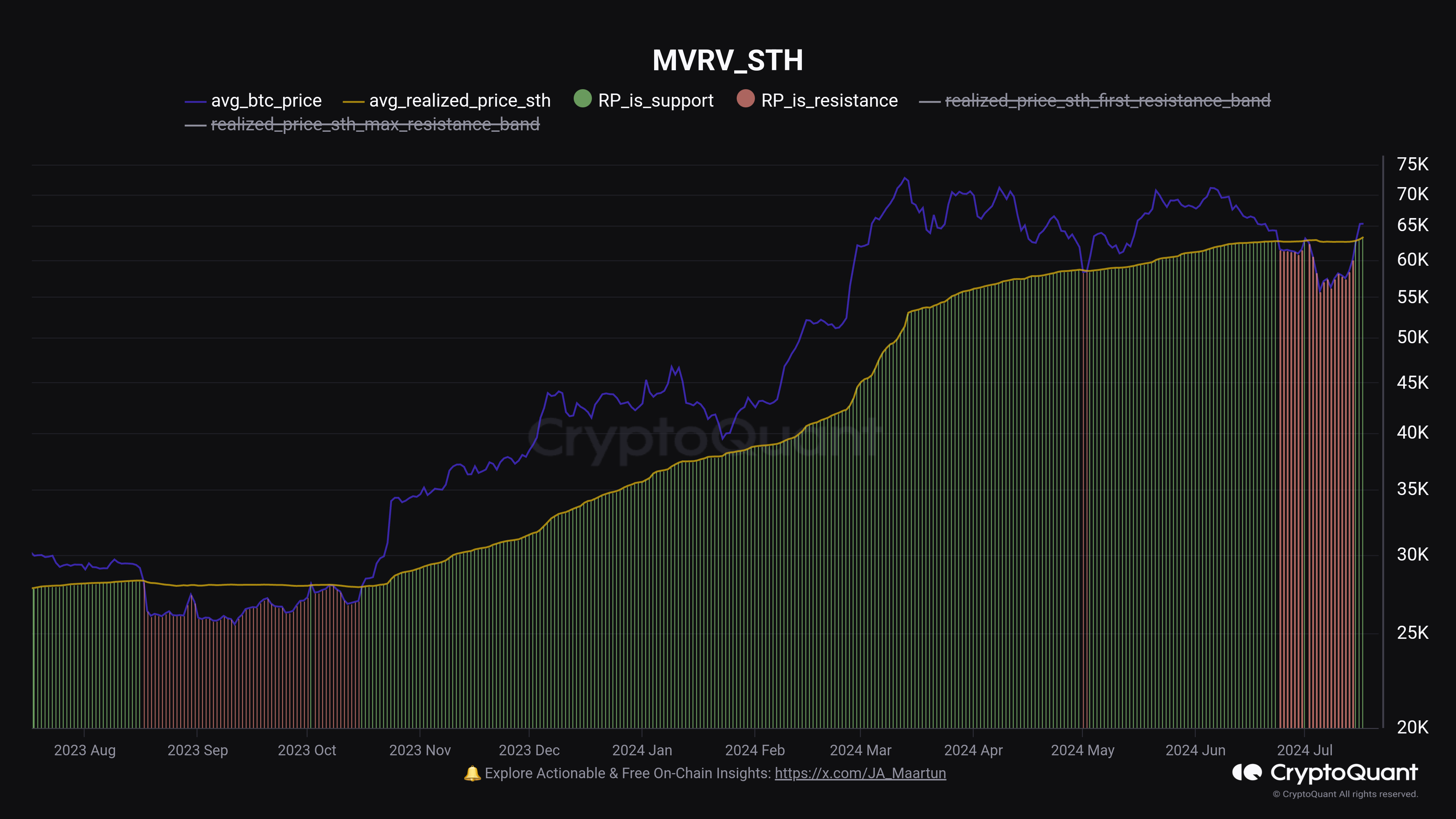

As CryptoQuant group supervisor Maartunn explains in a brand new article on X, BTC has recouped the true worth to short-term holders. Merely put, “precise worth” right here refers to a metric that tracks the typical price foundation of buyers within the Bitcoin market.

When the worth of this indicator is bigger than the spot worth of a cryptocurrency, it may be assumed that the typical holder of the sector is holding some unrealized earnings. Alternatively, the indicator being under the BTC worth signifies that losses dominate the market.

Associated Studying

Within the context of the present dialogue, we have an interest not within the precise worth of your complete person base, however within the precise worth of 1 a part of it: short-term holders (STH). STH refers to Bitcoin buyers who bought its token inside the previous 155 days.

This group kinds one of many two major segments of the BTC business based mostly on holding time, with the opposite phase of the market being often called long-term holders (LTH).

Now, the chart under reveals the Bitcoin realized worth pattern for this group over the previous 12 months:

As could be seen from the chart above, the spot worth of Bitcoin has fallen under the realized worth of STH final month, which signifies that the group has entered a internet loss.

Nevertheless, after spending a while under the road, the cryptocurrency has risen above the indicator in its latest rally, bringing the group again into the black.

“That is often a really optimistic signal,” Mathurn stated. The chart reveals that the final time the asset broke above this stage after a protracted interval under it was in October final 12 months. This surge again above the road triggered a rally that finally led the coin to a brand new all-time excessive (ATH).

As for why the value of BTC breaking by STH has all the time been bullish, the reply lies within the psychology of buyers. STHs are comparatively inexperienced and could also be delicate to cost modifications. Extra particularly, they might exhibit reactions when their common price base undergoes retesting.

When these buyers are bearish, they might determine to promote when the value rises to price foundation as a result of they might be involved that the rise won’t proceed. Likewise, they react by accumulating additional throughout bullish intervals as a result of they will view their price foundation as a profit-making level for getting extra shares.

Associated Studying

Since BTC has not too long ago damaged above this line, it doesn’t seem that STH is offering resistance for the time being and due to this fact bullish sentiment stays dominant.

bitcoin worth

Bitcoin was again above $66,000 yesterday, however has since seen some pullbacks, with its worth now all the way down to $64,800.

Featured photographs from Dall-E, CryptoQuant.com, charts from TradingView.com