On-chain information reveals that whale exercise on the Ethereum blockchain has been fairly excessive not too long ago attributable to pleasure over spot exchange-traded funds (ETFs).

Ethereum whale exercise is considerably increased than Bitcoin whale exercise

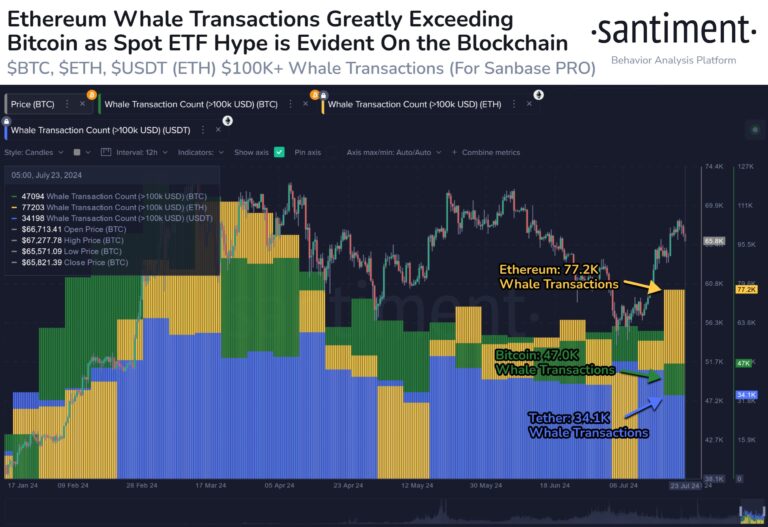

Ethereum whales have proven appreciable exercise not too long ago, in accordance with information from on-chain analytics agency Santiment. The related metric right here is “whale transaction rely,” which tracks the full quantity of transfers value no less than $100,000 that happen on any given community.

Associated Studying

Transfers above this quantity are sometimes related to whales, so the worth of this metric can present perception into the exercise of those huge buyers.

When the indicator worth is excessive, the blockchain is at the moment observing many giant transactions. This pattern means whales are actively fascinated by buying and selling the asset.

However, low indicators recommend that whales might not pay a lot consideration to the cryptocurrency as a result of they don’t switch as many transfers.

Now, the chart under reveals the pattern in whale commerce counts for the reason that begin of the 12 months for the highest three cash within the business – Bitcoin (BTC), Ethereum (ETH), and Tether (USDT):

As you’ll be able to see from the chart above, Ethereum has had the best variety of whale transactions not too long ago amongst these three property. Extra particularly, for the reason that seventeenth of this month, ETH has seen 77,200 whale transactions, considerably increased than BTC’s 47,000 or USDT’s 34,100.

The sharp spike in exercise for the asset is probably going because of the hype surrounding the spot ETF, which after a lot anticipation has lastly launched after receiving approval from the U.S. Securities and Change Fee (SEC).

Whale commerce counts present whales had begun repositioning themselves forward of this launch. Nonetheless, it’s troublesome to say based mostly on this metric alone what kind of actions these main shareholders are concerned in.

Provided that the occasion is taken into account bullish, it could make sense if whales have been shopping for. Knowledge from market intelligence platform IntoTheBlock confirms that giant holders have not too long ago elevated provide.

IntoTheBlock defines “giant holders” as buyers who personal no less than 0.1% of your complete circulating provide of Ethereum. It’s clear from the chart that internet flows into this group’s wallets have remained constructive over the previous week, which coincides with intervals when whales are lively.

Associated Studying

Yesterday alone, giant Ethereum holders bought 112,900 ETH, equal to roughly $391 million at present trade charges. “This accumulation considerably exceeded the $106 million in internet inflows into the ETF,” the analyst agency famous.

Ethereum value

As of this writing, Ethereum is buying and selling at round $3,460, unchanged from per week in the past.

Featured photographs from Dall-E, IntoTheBlock.com, charts from TradingView.com