Ethereum whale The market has been busy as on-chain knowledge reveals these buyers have been accumulating huge quantities of the second-largest crypto token by market capitalization. This comes amid falling costs Ethereum worthhas historical past suggestion Crypto token costs are more likely to see extra declines within the brief time period.

Whales accumulate extra ETH

Knowledge comes from market intelligence platform Enter the neighborhood Ethereum whales are proven shopping for 297,670 ETH ($1 billion) on July 24. Additional knowledge confirmed that flows into these sectors elevated by greater than 28%. whale tackle Inside the previous 7 days.

Associated Studying

The decline in outflows from these addresses additional highlights the bullish sentiment in the direction of Ethereum amongst these buyers, though poor efficiency. Outflows from these accounts have dropped by greater than 14% up to now seven days and by greater than 16% up to now 30 days.

this Internet circulate indicator of main shareholdersThe c on IntoTheBlock additionally highlights this wave of accumulation by Ethereum whales, with web visitors growing by greater than 313%. Which means these buyers are accumulating giant quantities of ETH, relatively than selecting to promote their ETH holdings.

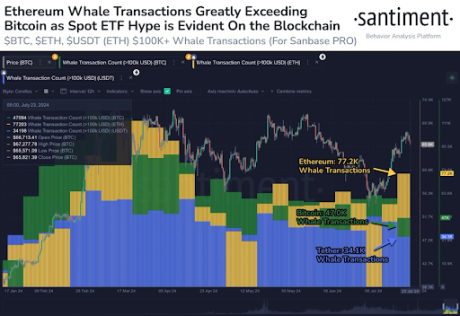

On-chain analytics platform Santiment notes that the numerous improve in ETH whale exercise is because of Spot Ethereum ETFBuying and selling begins on July 23. Out greater than 126%. Ethereum community.

The Spot Ethereum ETF definitely confirmed a bullish outlook for Ethereum even earlier than its launch, as crypto analysts like RLinda say anticipated Thanks to those funds, ETH may rise to $4,000. Due to this fact, it’s no shock that Ethereum whales proceed to build up crypto tokens in anticipation of rising ETH costs.

Ethereum ETF spot launch could encounter resistance at first

Spot Ethereum ETF Sure Anticipated turn out to be inspiring mass gathering The worth of ETH, that is more likely to occur in some unspecified time in the future. Nevertheless, historical past reveals that these funds could initially act as a headwind for Ethereum, just like the destiny that Bitcoin suffered instantly after Ethereum exploded. Spot Bitcoin ETF launched earlier this 12 months.

Associated Studying

Bitcoin worth drops sharply, largely attributable to capital outflows Grayscale Bitcoin Belief (GBTC). An identical scenario has performed out for ETH with Grayscale’s Ethereum Belief (ETHE). Apparently, the grayscale ETHE skilled The web outflow on the primary day of buying and selling was US$484.1 million, which was a lot bigger than the online outflow of GBTC on the primary day, and GBTC was even bigger.

With this in thoughts, Ethereum could face important promoting strain from Grayscale ETHE. knowledge Knowledge from Farside Buyers reveals that the spot Ethereum ETF skilled a web outflow of $326.9 million on July 24 (Day 2), which can be only the start of what may finally be a large outflow from the fund.

Featured picture created utilizing Dall.E, chart from Tradingview.com