After a monotonous week characterised by plummeting or sideways costs for Bitcoin, Ethereum, and Solana, costs rebounded strongly by the tip of final week.

Notably, Ethereum’s losses had been contained as the worth recovered from round $3,000. In the meantime, Bitcoin and Solana moved increased, closing at $70,000 and $200 respectively.

Curiosity surges in Bitcoin, Ethereum and Solana

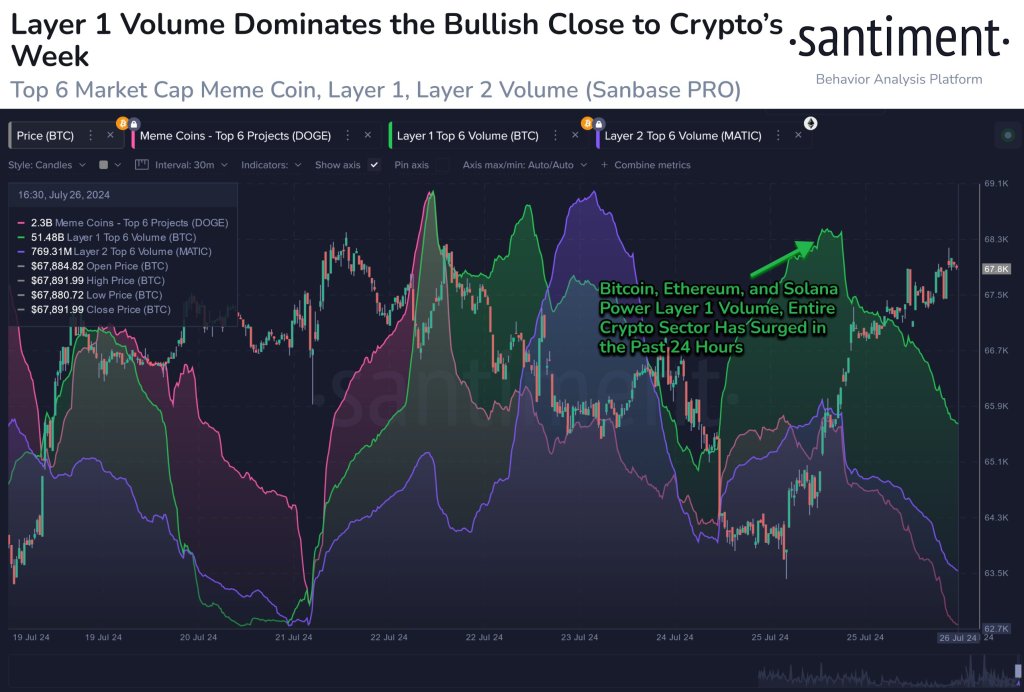

In keeping with Santiment knowledgeRegardless of the general weak point, there have been indicators of energy on the finish of final week. Notably, Solana, Bitcoin, and Ethereum have seen vital spikes in transaction quantity amid renewed curiosity.

Associated Studying

When quantity surges, it normally means market individuals are curious and prepared to take part, particularly if costs are rising. As these prime tokens maintain agency in worth and refuse to take losses, particularly beginning on Friday, July twenty sixth, consumers have stepped in trying to capitalize.

As Santiment analysts level out, the efficiency of Bitcoin, Ethereum, and Solana tends to have an effect on your entire market. For instance, if Ethereum rebounds, it should profit the broader Layer 2 and Layer 3 ecosystem. This can additional promote the additional improvement of meme cash and even decentralized finance (DeFi) actions.

There are a number of elements behind this curiosity. Within the case of Bitcoin, a shift within the regulatory perspective on the world’s most beneficial forex and rising recognition from politicians, particularly in the US, might clarify why extra individuals are prepared to be taught in regards to the forex.

Impression of Trump, Spot Ethereum ETF and SOL flipping BNB

Over the weekend, former President and presidential candidate within the upcoming November election, Donald Trump, delivered the keynote handle on the lately concluded Nashville Bitcoin Convention. Trump expressed help for Bitcoin and stated he would make the US the house of cryptocurrencies.

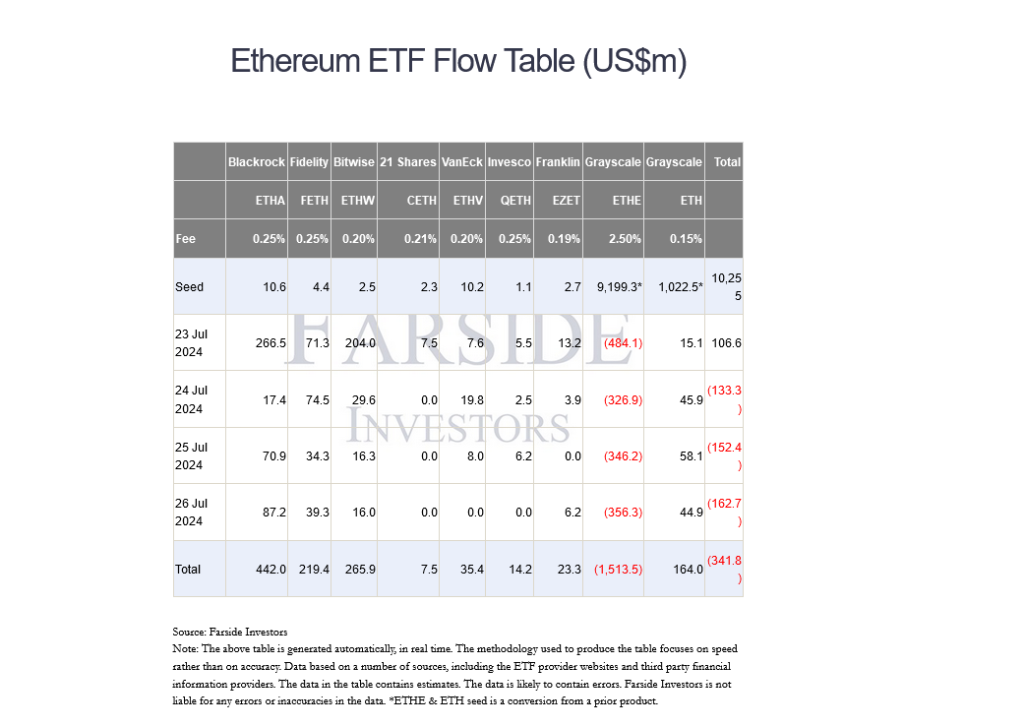

In the meantime, Ethereum has been thrust into the highlight after the U.S. Securities and Trade Fee (SEC) accredited a spot ETF. Though the spinoff began buying and selling on main exchanges such because the New York Inventory Trade and Chicago Board Choices Trade, inflows remained low.

If any, the distant knowledge present As of Friday, the spot Ethereum ETF had skilled three consecutive days of outflows. The principle purpose for this phenomenon is the outflow of funds from Grayscale ETHE. Even with this surprising improvement, BlackRock’s spot Ethereum ETF product nonetheless noticed over $87 million in inflows on July 26.

Associated Studying

Merchants are additionally taking note of Solana after it overtook BNB because the third most beneficial cryptocurrency (excluding stablecoins). In keeping with CoinMarketCap knowledge, SOL’s market capitalization was US$88.5 billion on July 29, whereas BNB’s market capitalization was US$86.5 billion.

SOL has been trending barely increased over the previous few weeks. Wanting on the numbers, SOL is up 56% from its July low. If consumers break $200, it might set new highs in Q3 2024.

Characteristic photos are from DALLE, charts are from TradingView