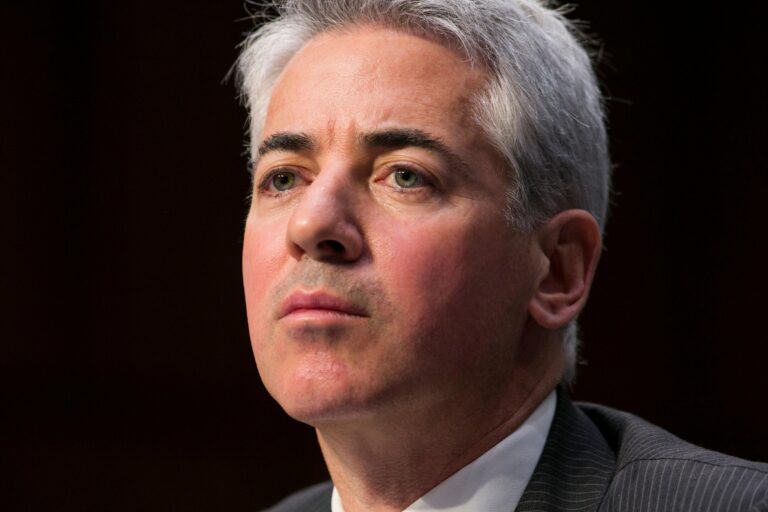

Invoice Ackman, whose Pershing Sq. Holdings is without doubt one of the largest shareholders in Common Music Group (UMG), has considerably lowered its IPO goal for its new U.S. closed-end fund worth.

Ackman will get a whole lot of media consideration Pershing Sq. Capital Administration (PSCM)—the unique funding supervisor of Pershing Sq. Holdings—bought 10% June sale of shares to a bunch of funding funds $1.05 billionestimate PSCM as $10.5 billion.

This reportedly added some to Ackman’s personal internet value $4 billion.

It additionally sparked heated discussions once more Pershing Sq., USA, Ackman’s new closed-end fund plans to record on the New York Inventory Change. (His current fund, PSH, trades on the Amsterdam alternate, like UMG itself.)

Ackman targets IPO worth, based on Bloomberg $25 billion For Pershing Sq. USA, that may make it essentially the most extremely priced closed-end fund ever.

Report suggests worth could also be tied to social media affect Ackerman Progress in comparison with final 12 months. Ackerman has turn out to be a celeb on X (previously Twitter) for his posts criticizing the expansion of anti-Semitic sentiment in American politics for the reason that Oct. 7 Hamas assault on Israel.

Nonetheless at this time (July 30), Pershing Sq. America, Inc. Affirmation of replace filed with the U.S. Securities and Change Fee (SEC) Signifies that the corporate’s whole issuance dimension is $2 billion—— lower than one tenth initially anticipated $25 billion worth.

The corporate expects whole issuance to be 40 million The inventory is priced at 50 U.S. {dollars} In response to at this time’s submitting, each one.

BloombergIn response to studies, the IPO is predicted to cost after the New York Inventory Change closes subsequent week on August 5, and shares will start buying and selling the subsequent day (August 6).

The anticipated sharp drawdown surrounding the fund raises some questions concerning the dimension of the capital Pershing Sq., USA Investments can be made, together with potential investments within the music business.

In an evaluation final month, MBW suggestion $25 billion A fund managed by Ackman might be excellent news for the music business, and Common Music Group particularly, as Ackman has been a supporter of each industries, arguing that music is undervalued and Common Music Group is the business’s largest. One of many good bets.

In a letter launched final Wednesday (July 25), Ackman promoted to the market a discount within the dimension of the IPO, saying pershing sq. Already “transformed” [its] The transaction was thought-about after quite a few conferences with potential buyers within the capital markets sector”.

“All in all, transaction dimension could be very delicate. Particularly given the novelty of the construction and the very damaging buying and selling historical past of closed-end funds, buyers would want to take an enormous leap of religion and in the end cautious evaluation and judgment to acknowledge this closed-end fund.” Firms will commerce at a premium post-IPO as traditionally few have completed,” Ackman wrote.

“this $25 billion Figures within the media initially led buyers to suppose the deal was too large. Finally, I hope this ‘anchoring’ will assist with the ultimate end result.

Ackman added in that letter: “Now we have dedicated to limiting provide and potential demand in an effort to [Pershing Square USA] Shares are buying and selling effectively within the aftermarket, together with the announcement of a tough cap of $10 billion.

Even on the new worth level, Pershing Sq. America’s IPO can be one of many largest IPOs of the 12 months New York Occasions reported.

“The $25 billion determine within the media initially led buyers to suppose the deal was too large. Finally, I hope this ‘anchoring’ will assist with the ultimate final result.

Invoice Ackerman, Pershing Sq.

As of final depend, Ackman’s Pershing Sq. Holdings, the European fund, held some 10.25% Common Music Group (UMG) turns into its third largest shareholder Tencentled consortium Concerto Associate (roughly 20%) and ex Vivendi President Vincent Bollore (18%).

UMG is a crucial a part of the PSH portfolio and is equal to 24.9% internet property, based on the fund’s most up-to-date annual report.

Ackman’s portfolio took a success final week, with shares of Common Music Group (UMG) plunging by double digits following a second-quarter earnings report that, whereas typically sturdy, confirmed paid streaming subscription income slowed greater than anticipated , promoting help income fell.international music enterprise