Paris-based music firm Consider has introduced its monetary efficiency for the primary half of 2024 (the six months ended June 30).

Consider trades on Euronext Paris and generates income of EUR 474.1 million euros (roughly US$510 million) your entire enterprise within the first half.

Reflecting development, Consider’s first-half income rose by 58.7 million euros from 415.4 million euros within the first half of 2023, in accordance with a submitting printed by Consider on Thursday (August 1). Annual enhance of 14.1%.

Consider’s income development on an natural/fixed foreign money foundation Annual enhance of 12.3%together with what it reported had been “embedded foreign money headwinds” in digital gross sales at its Superior Options section.

The adjusted natural development price within the first half of 2024 will attain 15.4%.

Consider reported Thursday that its “paid streaming developments had been strong” within the first half, “and continued to be bolstered by worth will increase on a number of giant digital platforms within the fourth quarter.” [2023]”. Nevertheless, it added that “monetization of ad-funded streaming stays weak, notably in Asia”.

consider Splits its world operations into two divisions:

- (i) DIY supplier Tuning (referred to as is “Automation Options” in its outcomes); additionally

- (ii) Its core premium report label and artist companies enterprise (known as “High quality answer”)

firm’s’Superior options‘Income development Annual enhance of 13.5% – from €388.5 million First half of 2023 – to €440.9 mega First half of 2024.Superior optionsIncome elevated by 11.7% year-on-year.

Consider reported that its paid streaming developments “remained secure” all through the primary half, whereas ad-funded streaming exercise “remained considerably subdued in Asia and didn’t get well on the finish of the second quarter.” [2024] Simply because the group initially anticipated.”

On the similar time, in accordance with the corporate’s newest monetary outcomes, within the first half of 2024 automation answer Division income development Annual enhance of 23.4% arrive 33.2 million euros. On an natural foundation, automation answer Income elevated by 20.5% year-on-year.

Consider additionally broke down its income by geography, reporting sturdy development within the Americas and Europe.

firm sees Annual enhance of 24.7% Income development in Europe (excluding France and Germany), producing €152 million space within the first half of this yr. european consultant 32.1% Proportion of Consider’s whole income within the first half of the yr.

The corporate mentioned it had achieved sturdy development in Japanese Europe and Spain within the first half, whereas “the enterprise in Italy remained strong” and “revenues in Turkey elevated considerably”.

Consider mentioned the corporate’s UK outcomes had been “penalized” because of the reallocation of Sentric’s income to the US within the second quarter of 2024, which “subsequently hampered the idea of comparability to the second quarter of 2023 as all Centric Then the revenue is distributed on this market.”

“Because of the higher integration of the group’s programs, Sentric’s income is now divided by area, whereas beforehand income was accounted for in Europe excluding France and Germany,” the corporate defined within the submitting. The work was accomplished within the second quarter [2024] A lot of the revenue is redistributed to america.

Consider acquired Sentric from Utopia Music in March 2023 for $51 million.

Elsewhere on this planet, Consider’s income grew within the Americas Annual enhance of 21.8% arrive 73.9 million euros Accounting for 15.6% of the corporate’s whole income within the first half of 2024.

Consider famous that its enterprise exercise ranges in Mexico had been sturdy, whereas income development in Brazil “recorded a slowdown.”

exist FranceConsider’s income development Annual enhance of 17.9% arrive 78.4 million euros Within the first half of 2024, accounting for 16.5% Wider firm earnings.

exist Asia Pacific and Africa, income development Annual enhance of three.7% arrive €116.3 millionn stands for 24.5% A share of an organization’s first-half income. Based on Consider’s submitting, the corporate “had a gradual begin to the yr because of weak spot within the ad-funded streaming market,” however returned to income development within the second quarter.

I consider that its efficiency is in Larger China Japan “has been sturdy from starting to finish” [H1]”. Elsewhere within the area, Consider mentioned its income was “up barely in India and down in a number of Southeast Asian markets as each areas rely extra on ad-funded streaming.”

Lastly, in Germanyincome fell Annual enhance of 1.2% In H1 to €53.5 million Accounting for 11.3% of the corporate’s income. In Germany, Consider mentioned its “digital gross sales rose barely” within the first quarter of 2024 and “additional progress” was made within the second quarter.

Nevertheless, it added that non-digital gross sales available in the market “continued to say no” within the first half “because of Consider’s proactive determination to speed up its exit from contracts that had been too reliant on bodily gross sales and merchandising”.

“Consider continued to ship strong earnings development in the course of the semester regardless of continued market headwinds in a few of our key geographies.”

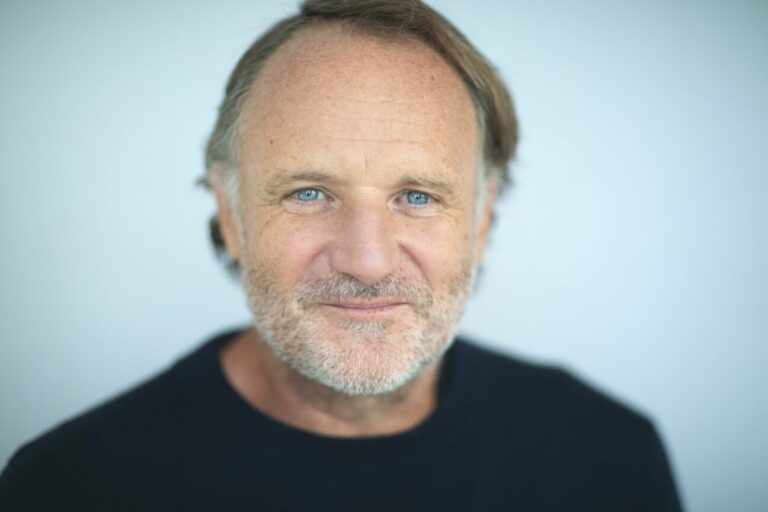

Denis Radheri “Consider”

Elsewhere in Consider, the corporate studies adjusted Curiosity, tax, depreciation and amortization advance revenue of 31.3 million eurosup An annual enhance of 29.3%, or margin 6.6%an annual enhance of +80bps.

As of the tip of June 2024, the corporate’s internet money was €183.6 million.

Different highlights famous by the corporate within the first half embody Optimistic bidding firma consortium of managed funds TCV、EQT and Dennis loading storewas accomplished in June.

Based on Consider, when earnings had been launched after the shut at present, the consortium held 96.02% Fairness that believes.

Consider additionally introduced that it’ll solely launch interim and full-year outcomes sooner or later and can now not launch quarterly income outcomes.

Denis Ladegaillerie, Founder and CEO “Regardless of continued market headwinds in a few of our key geographies, Consider continued to ship strong earnings development in the course of the semester,” Consider mentioned.

“Our strategic roadmap is to construct the perfect artist growth firm within the music trade whereas finishing a restructuring of our capital construction that gives us with higher monetary flexibility and companions who can speed up our worthwhile development story.

“I consider it will likely be helpful to the subsequent stage of development and trade integration.”

Wanting ahead to the second half of 2024, Consider mentioned, “paid streaming development stays very resilient, however won’t be boosted by vital worth will increase within the second half.”

It added: “Advert-funded streaming development is predicted to stay secure within the second half of the yr [2024] with H1 [2024].

“Whereas Consider is predicted to proceed to realize market share within the second half of 2024, it’s unlikely to completely mitigate the impression of a barely weaker-than-expected market development outlook within the second half. [2024] (Pushed by weak advert funding and the shortage of extra DSP worth will increase.”world music enterprise