Bitwise Chief Funding Officer (CIO) Matt Hougan claimed in a brand new memo to buyers after the 2024 Bitcoin Convention that the market is probably not optimistic sufficient about the way forward for BTC. The assembly was a watershed second that attracted widespread political consideration and will severely impression Bitcoin’s future trajectory.

Why are you not optimistic about Bitcoin?

At this convention, distinguished political figures made many groundbreaking statements. In the beginning, Republican presidential candidate Donald Trump’s announcement about establishing a nationwide Bitcoin reserve has brought on enormous waves. Trump laid out his imaginative and prescient for the US because the “cryptocurrency capital of the world” and proposed establishing a “strategic Bitcoin reserve.”

Senator Cynthia Lummis (R-Wyo.) has launched a invoice that will require the U.S. Treasury Division to buy 1 million Bitcoins. Rep. Ro Khanna (D-CA) referred to as on Democrats to desert earlier restrictive insurance policies and deal with cryptocurrencies as an integral a part of the U.S. monetary system.

Associated Studying

In a extra bold name, impartial presidential candidate Robert F. Kennedy Jr. steered that the U.S. Treasury Division should buy 4 million Bitcoins. This determine is meant to be equal to the US’ share of the world’s gold reserves.

Hogan mentioned the political discourse round Bitcoin has quickly advanced from skepticism to strategic acceptance, a shift punctuated by latest crises and regulatory challenges. FTX’s collapse in late 2022 marked one of the important upheavals in cryptocurrency historical past, casting a protracted shadow over the whole business.

Nonetheless, as Hougan famous, the resilience of Bitcoin and the broader cryptocurrency market has been exceptional. “That is loopy. Lower than two years in the past, FTX collapsed in a historic rip-off, Bitcoin was buying and selling at $17,000, and skeptics have been dancing on the cryptocurrency grave. Now politicians are Discuss overtly about constructing a “Bitcoin Fort Knox.”

Associated Studying

He additional famous that lower than a yr after the SEC took aggressive motion towards Coinbase, the U.S. Division of Justice is now working with the identical platform to safe its crypto operations, reflecting the broader authorities’s perspective towards Bitcoin and cryptocurrencies. of readjustment.

Hogan believes these developments will not be simply opportunistic, however mirror a deeper consciousness of the rising affect of cryptocurrencies in American society. “Once you say ‘opportunism,’ I say, ‘That is how politics works,'” Hugan mentioned, acknowledging the shift in technique inside American politics.

Hogan mentioned the impression on buyers is profound. Buyers have to reassess the potential scale of Bitcoin’s progress. Hogan highlighted the asymmetry in threat notion, the place the main focus has historically been on draw back potentialities. “We spend plenty of time specializing in draw back dangers […] Nonetheless, the identical upside dangers exist now,” he mentioned.

Sentiment on Wall Avenue has additionally modified considerably. In a reported dialog on the convention, Goldman Sachs CEO David Solomon referred to as Bitcoin a possible retailer of worth, signaling rising curiosity from main monetary establishments.

Bitwise CIO muses: “Will we get up tomorrow and discover out {that a} G20 nation has added Bitcoin to its stability sheet and desires to get forward of the U.S.? As bipartisan assist grows for complete U.S. cryptocurrency laws Can it’s handed before anticipated? Can Wall Avenue embrace cryptocurrencies on a a lot bigger scale than most count on?”

General, Bitcoin Convention 2024 clearly served as a catalyst for rethinking Bitcoin’s function on the nationwide and international stage. “These concepts have been simply pipe goals a yr in the past. However based mostly on what I witnessed final week, they give the impression of being extra doubtless,” Hogan concluded.

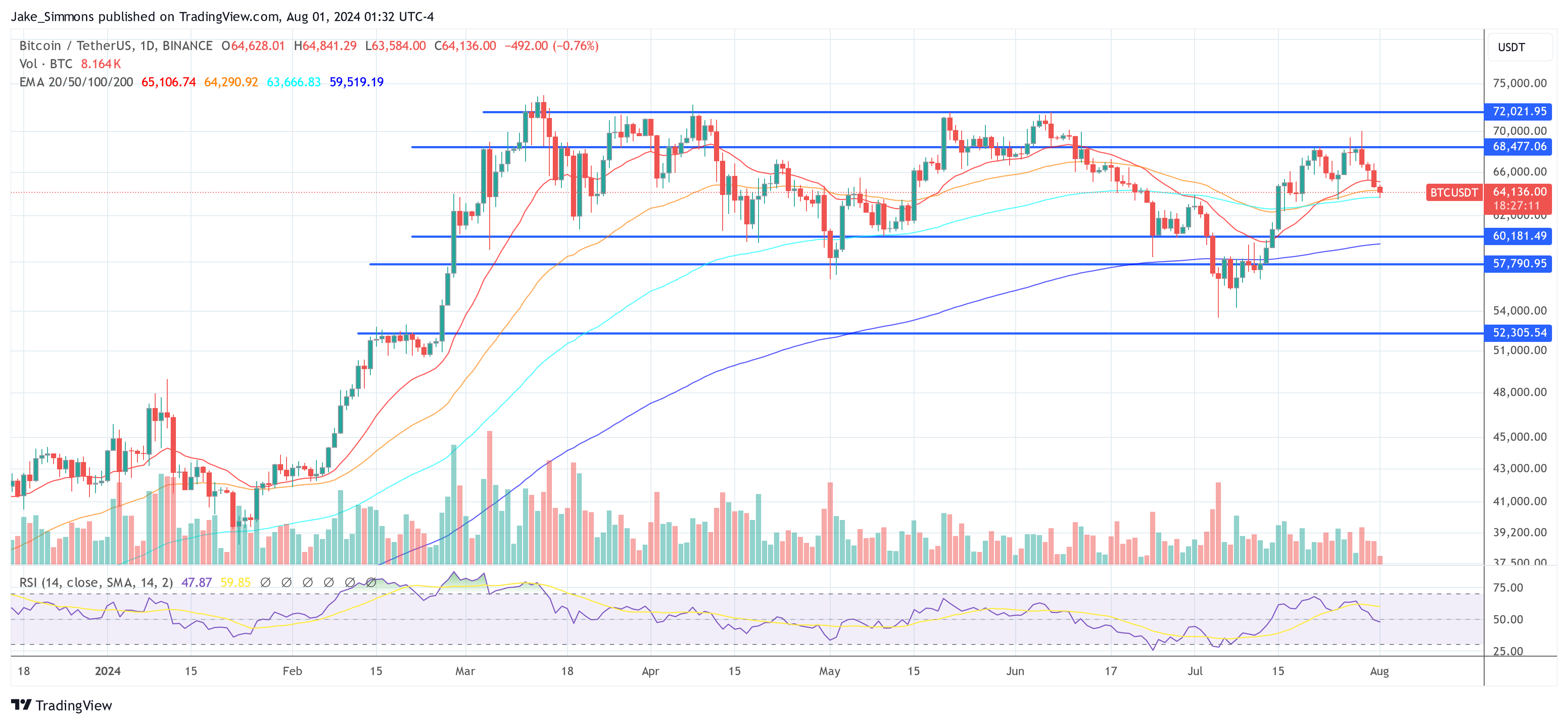

At press time, BTC was buying and selling at $64,136.

Featured picture from YouTube/Mr. M Podcast, chart from TradingView.com