Africa is on the cusp of a monetary revolution as finance ministers and central financial institution governors within the ECOWAS area push forward with plans to launch a single foreign money initiative, or ECO. The Financial Group of West African States (ECOWAS) has dedicated to reshaping the financial panorama of 15 nations via the introduction of ECO. Amid the clamor for a unified foreign money, a digital competitor — Bitcoin — has emerged from the shadows to supply an unprecedented resolution to the continent’s remittance woes. Might Bitcoin be the important thing to a extra inclusive, cost-effective and resilient monetary future in Africa? It’s not even a query right here, it’s an expertise. Because the ECO foreign money initiative progresses, Bitcoin emerges as a compelling different that gives a novel resolution to Africa’s long-standing monetary challenges.

Discussing a few of the factual narrative in a press release, Mr. Wale Edun, Nigeria’s Finance Minister and his colleagues within the area mentioned, “ECO’s imaginative and prescient is extra than simply foreign money. It aspires to be the cornerstone of financial integration, streamlined commerce and enhanced financial stability throughout the area. One have to be curious in regards to the implementation plan for this imaginative and prescient. Sadly, one of many most important obstacles to the ECO foreign money is the tough process of coordinating financial coverage and regulation amongst 15 completely different nations. International locations have their very own financial circumstances, fiscal insurance policies, and political landscapes, which can complicate the implementation and governance of a unified foreign money. Regulatory variations could result in uneven adoption and effectiveness of ECO currencies, which can hurt their regional financial integration. Goal.

Apparently, the success of the ECO foreign money will rely closely on the present technological infrastructure of member nations. Many areas inside ECOWAS nonetheless lack dependable web connections and superior monetary know-how. These infrastructure gaps, if not addressed, will hinder the efficient implementation and operation of the ECO foreign money, limiting its accessibility and value to most of the people. Bitcoin has handed via these levels within the area, and the technical effectivity of its core working layer has been confirmed, even within the case of redundancy or no community connection, its dynamics are corresponding to ECO, via the area Bitcoin-based options create further benefits coupled with excellent resilience and effectivity.

ECOWAS nations exhibit huge financial disparities, starting from resource-rich nations corresponding to Nigeria to small, economically underdeveloped nations corresponding to Guinea-Bissau. One-size-fits-all financial coverage could not tackle the distinctive financial challenges confronted by every member state. Such variations may result in imbalances and tensions throughout the alliance, which may destabilize the ECO foreign money and regional economies. Nonetheless, Bitcoin has the benefit of breaking down regional biases whereas providing world acceptance and open commerce choices.

ECO intends to reinforce monetary inclusion by offering monetary providers to the unbanked. However ECO is a proposed regional foreign money that depends on the interoperability of conventional monetary programs in ECOWAS-controlled nations, which implies that ECO will subconsciously inherit native issues, corresponding to a big portion of the inhabitants resulting from restricted entry to conventional banking providers. No checking account. Wouldn’t this go away the foreign money topic to democratizing digital alternate options? That is positively a priority: as issues proceed to evolve, “effectiveness and effectivity” will do justice to extra time. Bitcoin affords another approach to receive monetary providers and not using a checking account. By offering a decentralized and easy-to-access monetary system, Bitcoin helps people and small companies, selling financial progress and seamless monetary operations.

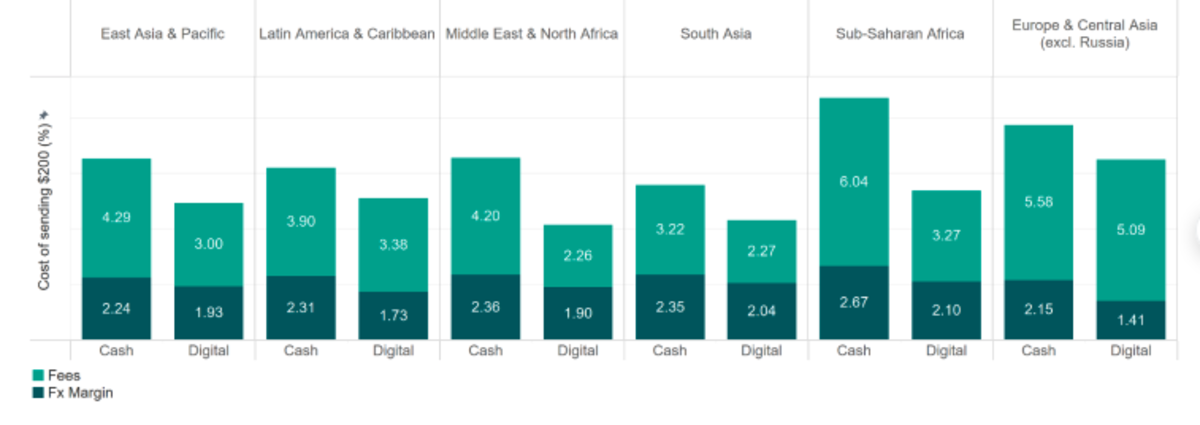

To additional examine the “remittance service prices” between completely different areas, the associated fee is damaged down into two components: dealing with charges and overseas trade margin. Inside every space, as proven beneath, it distinguishes between digital and non-digital remittances. It reveals charges account for a big portion of the price of remittance providers. As well as, the price of non-digital providers is all the time increased than the price of digital providers, whatever the area to which funds are despatched.

As the one decentralized digital foreign money, Bitcoin offers a revolutionary resolution to the excessive value of conventional remittance providers. As talked about above, migrant staff usually incur hefty charges when sending cash to their households, eroding the worth of their hard-earned cash. Nonetheless, Bitcoin transactions considerably cut back these prices by eliminating intermediaries and offering direct peer-to-peer transfers. This value effectivity is especially useful in Africa, the place remittances are an essential supply of earnings for a lot of households.

Facilitating seamless cross-border transactions for Bitcoin is a vital benefit of the ECOWAS area, which inspires intra-regional commerce. In contrast to ECO currencies, which nonetheless require a sure diploma of presidency oversight and regulation, Bitcoin operates with out nationwide borders. This independence allows clean and environment friendly transactions between firms and people in several nations, selling regional commerce and financial integration. Continued adoption of Bitcoin will drive financial progress by attracting funding in fintech and remittances, whereas creating new jobs and fee channels. The modern benefits of Bitcoin and blockchain know-how will stimulate continued technological progress and financial diversification. By adopting these applied sciences, African nations will step by step be on the forefront of the worldwide digital financial system and domesticate a tradition of innovation and entrepreneurship.

The blockchain know-how and encryption algorithms that underpin Bitcoin present a stage of transparency and safety that may improve belief in monetary transactions. The immutability of blockchain information ensures transactions are safe and verifiable, decreasing the danger of fraud and corruption. This transparency is essential for remittance providers to make sure funds are transferred safely and effectively. Moreover, Femi Lounge of the Human Rights Basis mentioned in response to a remittance query on Mara livedesk in Nashville: “Bitcoin’s decentralized nature makes the monetary system much less vulnerable to centralized failures or manipulations. In Africa, now we have 46 Foreign money, one of many largest points is settlement.

If Bitcoin have been totally adopted, there could be no want for West Africa to implement ECO currencies. Bitcoin’s peer-to-peer community and trade rails provide superior effectivity and utility in comparison with proposed ECO currencies. By leveraging the advantages of Bitcoin, West African nations can bypass the necessity for a brand new regional foreign money and create a robust, inclusive monetary system. This adoption will tackle regulatory challenges, improve technological infrastructure, enhance monetary literacy and guarantee a clean transition to a contemporary monetary ecosystem. The potential to decrease remittance prices, enhance monetary inclusion and facilitate cross-border transactions makes it a strong instrument for Africa’s financial improvement. The way forward for Africa’s monetary system lies within the adoption of modern options to handle its distinctive challenges. By leveraging some great benefits of Bitcoin, Africa will create a dependable, inclusive, and forward-looking monetary ecosystem that helps sustainable financial progress and improvement.

This can be a visitor submit from Fallowen Legacy. The views expressed are fully their very own and don’t essentially replicate the views of BTC Inc or Bitcoin Journal.