Yesterday, August 5, LINK, the native foreign money of decentralized oracle supplier Chainlink, plummeted to a six-month low. LINK was altering fingers round $8, down 64% from its March excessive, and broke a bull flag to indicate weak point. The correction was throughout the board, with main altcoins like Solana and Cardano additionally seeing vital losses.

LINK holders proceed to extend, and trade fund outflows surge

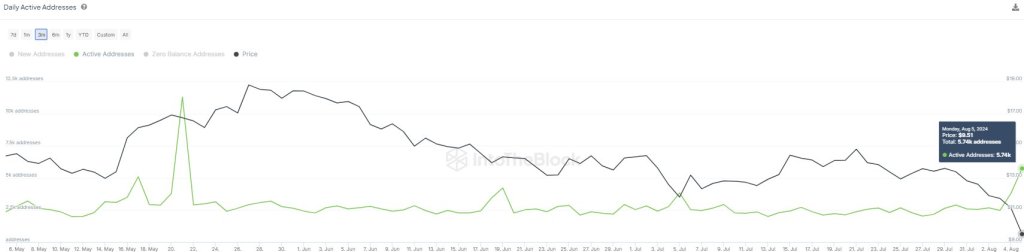

Nevertheless, with the market dropping floor and falling under key assist ranges, sensible traders see this as a chance to build up. In line with IntoTheBlock information Yesterday, August 6, the variety of lively LINK addresses elevated considerably, rising to ranges not seen in about three months.

Associated Studying

The rise in lively addresses coincides with a surge in trade outflows. This growth means that regardless of falling asset costs, customers are extra eager on accumulating LINK than promoting.

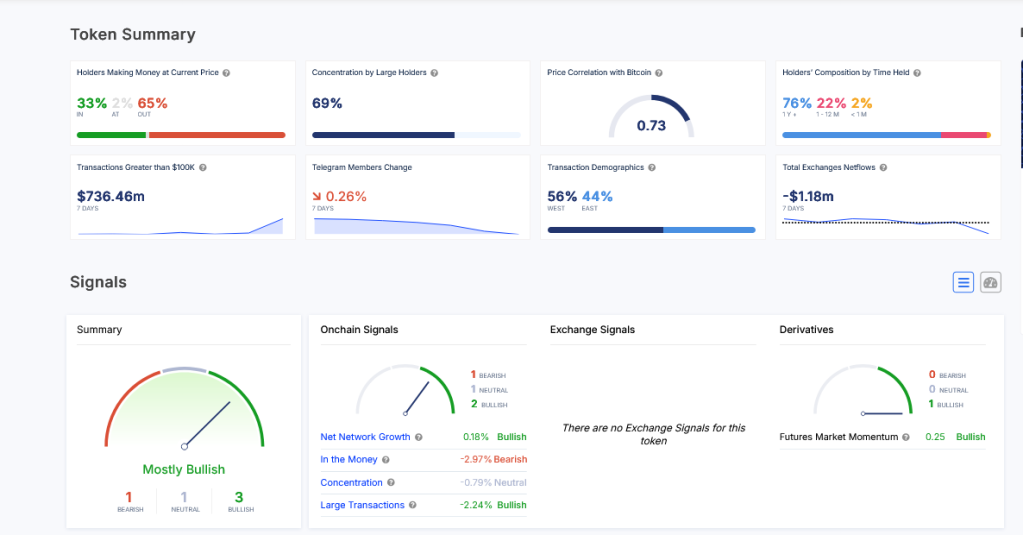

Outflows from centralized exchanges like Binance and Coinbase are usually thought-about internet optimistic. Since customers management tokens by non-custodial wallets, they can’t simply promote different liquid tokens or stablecoins.

Over time, each time there’s excessive worry, costs are likely to get well steadily, particularly amongst LINK holders. Like what occurred in March 2020, when cryptocurrency costs plummeted because of the COVID-19-induced crash, aggressive traders can view this decline as a shopping for alternative.

In March 2020, LINK plummeted 70%. Nevertheless, a couple of months later, as the cash printing presses kicked off, the cryptocurrency worth elevated, sending LINK up almost 35x at its peak in 2021.

Much like what occurred again then, the drop in worth mixed with outflows from exchanges and accumulation between entities makes it possible that LINK will rebound strongly.

Most holders are crimson, however Companions fascinated about Chainlink options

To this point, IntoTheBlock information reveal 65% of LINK holders are at a loss, and Solely 32% are inexperienced. Nevertheless, it’s encouraging to see that almost all of LINK holders are “diamond fingers” and have been holding onto their collections for over a yr.

The extra long-term holders or addresses which have held a token or token for greater than 155 days, the extra resilient the value shall be in waves of liquidations.

Along with worth motion, optimism amongst LINK holders can be excessive. Chainlink is a number one decentralized oracle supplier serving DeFi and NFT protocols.

Associated Studying

In the meantime, middleware developer Chainlink Labs continues to construct premium partnerships. Not too long ago, 21Shares built-in Chainlink’s Proof of Reserves on Ethereum to extend transparency.

Function footage are from DALLE, charts are from TradingView