N Rotteveel/iStock Editorial by way of Getty Pictures

Bitcoin (BTC-USD) Anticipated to See Marginal Features down 1.9% U.S. recession fears triggered a world sell-off on Monday.

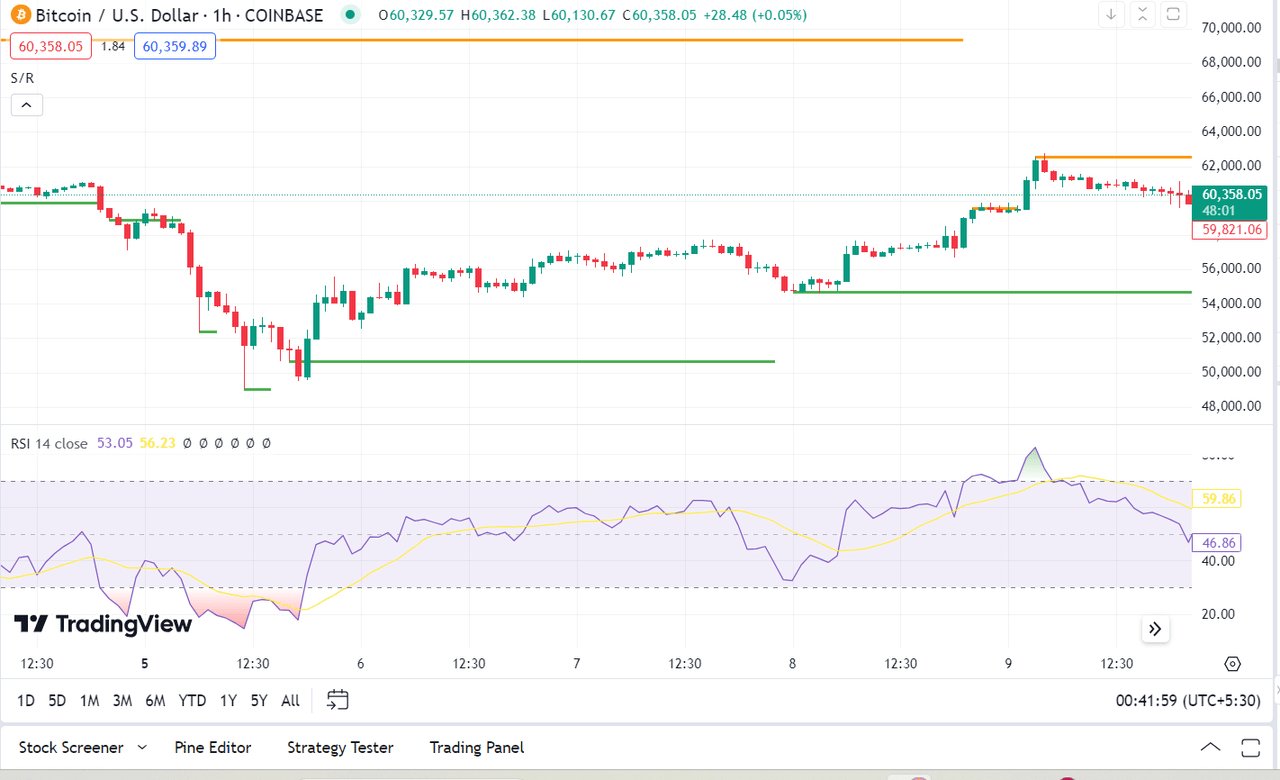

The world’s largest cryptocurrency fell beneath the $50,000 mark earlier this week after disappointing U.S. jobs report Final week sparked fears that the U.S. economic system is about to slide into recession. These considerations unnerved world markets that day.

“The preliminary response to Bitcoin (BTC-USD) as a ‘safe-haven’ asset isn’t a surprise,” mentioned Bernstein analyst Gautam Chhugani.

SA analyst Stony Chambers Asset Analysis mentioned that Bitcoin did not turn into a safe-haven asset throughout the latest market turmoil, plummeting from $62,000 to $52,000, whereas different property fell much less.

Swan CEO Cory Klippsten mentioned: “When the panic over the unwinding of the yen carry commerce started to unfold, folks began searching for liquidity and found that Bitcoin, as an asset that may be traded 24/7/365, can soak up the massive sell-off. strain.

Arbitrage buying and selling methods contain borrowing in low-interest-rate currencies to put money into higher-yielding property elsewhere. Buyers had been fast to unwind yen carry trades over the previous week because the yen strengthened after the Financial institution of Japan raised rates of interest greater than anticipated.

SA analyst Richard Durant mentioned: “Yen carry trades and ongoing financial dangers are prone to proceed to place strain on asset costs, so warning is required.”

Nonetheless, Bitcoin rebounded on Tuesday, recouping some losses and holding above the $50,000 mark.

Cryptocurrency costs rebounded on Thursday and supplied some consolation to traders, particularly after weekly U.S. jobless claims fell greater than anticipated.

Klippsten added that the worth rebounded from $48,000 to just about $60,000 in per week as folks purchased the dip and reallocated again to this very helpful asset.

Durant added that Bitcoin’s latest decline could also be resulting from pressured unwinding of leveraged positions, which can result in a short-term rebound.

Noteworthy information

- Dogecoin (DOGE-USD) is in rarity—it’s been value billions of {dollars} since its launch greater than a decade in the past—and tens of hundreds of meme cash haven’t reached that stage, in line with a examine printed on this article standing, as most such tasks die out shortly.

- Robinhood Markets (HOOD) CEO Vlad Tenev mentioned he has responded to the U.S. Securities and Alternate Fee’s Wells Discover concerning its cryptocurrency enterprise.

- FTX (FTT-USD) and buying and selling companion Alameda Analysis have been ordered by a U.S. decide to pay $12.7B to their collectors, ending a 20-month lawsuit introduced by the Commodity Futures Buying and selling Fee.

- Michael Saylor of MicroStrategy (MSTR) says he personally owns about $1B in Bitcoin (BTC-USD) and can proceed to build up extra.

- The U.S. SEC requested a New York court docket to dismiss a subpoena from cryptocurrency change Coinbase International (COIN) that requires the regulator handy over “considerably all cryptocurrency-related paperwork,” in line with court docket paperwork.

- Marathon Digital (MARA) mentioned its Bitcoin (BTC-USD) manufacturing elevated 17% from the earlier quarter to 692 BTC in July, whereas Riot Platforms (RIOT) produced 370 BTC.

Bitcoin, Ethereum costs

Bitcoin (BTC-USD) up 1.1% It rose to $60,300 at 3:14 pm on Friday. Ethereum (ETH-USD) was virtually flat at $2,600.

SA analyst Nikolai Galozi mentioned Bitcoin has entered a mid-cycle correction, including that “Bitcoin dominance ought to peak throughout the subsequent 1-2 months.”