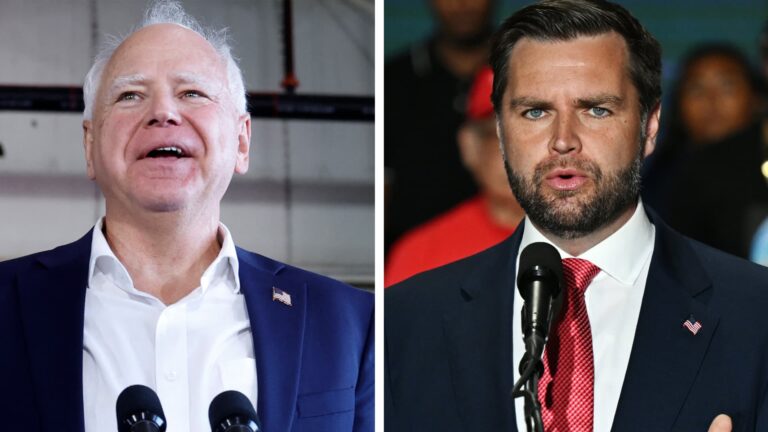

Democratic vice presidential candidate, Minnesota Governor Tim Walz (left) and Republican vice presidential candidate Senator J.D. Vance (Ohio).

Getty Photographs

housing

Vance is also a supporter of affordable housing, emphasizing the issue in his acceptance speech at the Republican National Convention and on the campaign trail.

“Before running for the Senate, Vance believed that one of the keys to solving poverty was to address affordable housing,” Seberg wrote, and he opposed institutional ownership of rental homes and Chinese buyers of U.S. real estate.

child tax credit

If Congress fails to act, Trillions of tax cuts enacted by Trump are set to expire after 2025, including the child tax credit, which will drop from $2,000 to $1,000 per child.

Congress approved a temporary expansion of the child tax credit in 2021 to include monthly advances, which reduced the child poverty rate to a historic low of 5.2% in 2021, according to a Columbia University analysis.

Consistent with federal policy, Minnesota enacted a refundable state child tax credit in 2023, which Walz called a “landmark achievement.”

Minnesota’s new child tax credit is narrow but among the most generous in the nation for low-income families.

Jared Walczak

Vice President of National Projects, Tax Foundation

“Minnesota’s new child tax credit is unusual in its narrow scope,” said Jared Walczak, vice president of state programs at the Tax Foundation. “But it’s a major step across the country for low-income families. Most generous.”

However, making a permanent federal child tax credit expansion could be difficult, especially with a divided Congress and growing concerns about the federal budget deficit.

Walz’s campaign did not respond to CNBC’s request for comment.

Senate Republicans blocked an expansion of the federal child tax credit last week, with Sen. Mike Crapo, R-Idaho, the ranking member of the Senate Finance Committee, describing the vote as a “blatant attempt to score political points.”

Despite the procedural vote failure, Crapo said he was open to negotiating a “child tax credit solution that most Republicans can support.”

Democrats scheduled the vote in part as a response to Vance, who has positioned himself as a pro-family candidate. Vance was not present for the Senate vote but expressed support for the child tax credit.

Vance’s campaign did not respond to CNBC’s request for comment.

student loans

Vance has spoken out against student loan forgiveness.

“Forgiving student debt is a huge windfall for wealthy, college-educated people, especially America’s corrupt college administrators,” said Vance, a Yale Law School graduate. Wrote April X, 2022.

The excellent instructional debt in america is roughly $1.6 trillion. Almost 43 million folks, or one in six U.S. adults, have scholar loans. Ladies and folks of colour bear the best debt burden.

Vance does seem to favor mortgage forgiveness in excessive circumstances. In Might, he helped introduce laws that may forgive mother and father’ scholar mortgage debt for youngsters who’re completely disabled.

Jane Fox, president of the UAW native 2325 authorized help affiliation’s bar union chapter, mentioned Vance’s view of debt aid as a profit for rich folks is hypocritical and incorrect.

“Pupil debt aid is a working-class difficulty,” Fox mentioned. “The 1% who get into elite establishments after which work at non-public fairness companies like Senator Vance hardly ever want debt aid.”

Vance’s marketing campaign didn’t reply to CNBC’s request for remark.

In the meantime, increased schooling skilled Mark Kantrowitz mentioned Walz, a former schoolteacher, helps plans to ease folks’s scholar debt burdens.

Kantrowitz mentioned he signed on to a scholar mortgage forgiveness program for nurse practitioners in Minnesota and a free tuition program for low-income college students.

“As my daughter prepares to go to school subsequent yr, affordability and scholar mortgage debt are prime of thoughts,” Walz wrote on Fb in 2018. “Each Minnesotan ought to have entry to an excellent schooling. , and won’t be hindered by hovering housing costs.