Regardless of the chance for consumers, Bitcoin is steady at time of writing, teetering on the $60,000 degree. After rejecting the August lows, the rally by way of the $60,000 spherical to highs of $63,000 by the tip of final week was spectacular.

Nonetheless, trying on the day by day chart, the value is buying and selling sideways and could also be bounded by the bullish engulfing bar of August 8.

Bitcoin is shifting sideways and is “boring”

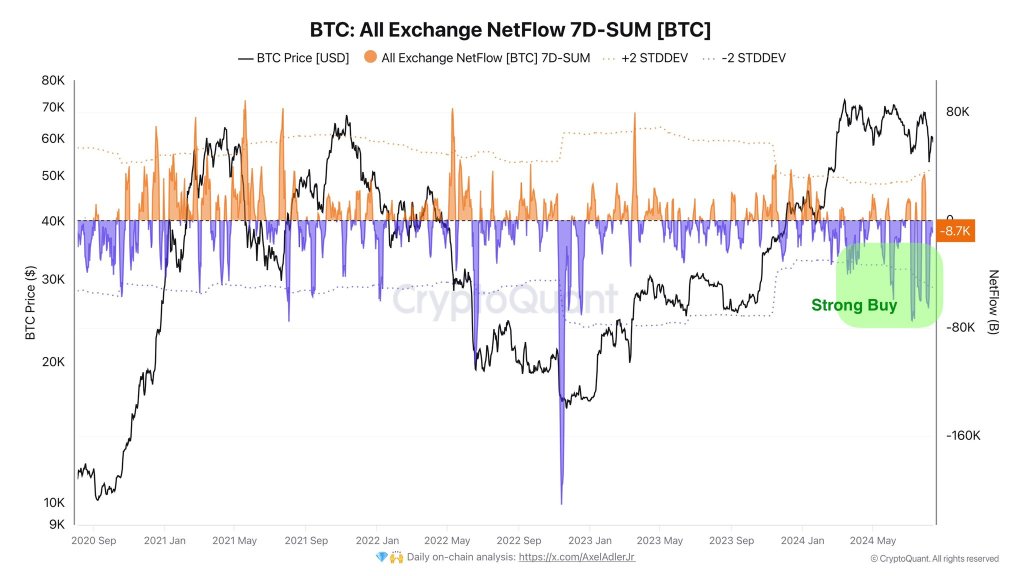

Cryptocurrency markets are quiet, even boring, amid a cloud of optimism. An analyst at X identified this case, Quote On-chain growth noticed that the market downturn explains the widely low exercise. For instance, analysts mentioned that Bitcoin internet flows had been -8,748 BTC over the previous seven days.

Associated studying

this It signifies that extra Bitcoins are purchased than offered, present Accumulate funds when the market is mostly calm. Merchants and buyers need to purchase on the present value, which is a internet constructive for bulls and should assist stabilize the value because it dropped to a low of $49,000 on August 5.

The attainable accumulation isn’t a surprise and is in keeping with broader crypto market habits. To date, Bitcoin, like Ethereum and even XRP, is within the midst of a bullish restoration after the crash in early August. Though the bull market on August 8 boosted market sentiment, there was no subsequent pattern.

Rapid resistance is at $63,000, with assist at $57,000 to $60,000. If consumers proceed to push ahead, a transfer above $63,000 might set the stage for additional good points in the direction of $70,000 and even all-time highs.

The chance of miners liquidating their positions is low, and BTC holders improve their holdings

Even so, forward of this, Bitcoin is shifting sideways and inside a bullish bar, which is a internet constructive for optimistic merchants from an effort versus outcomes perspective.

On-chain knowledge is the second content material of this preview. in keeping with glass nodeBitcoin is within the HODLing stage, and customers are eager to build up. The choice to double spot charges when costs are decrease might sign confidence and expectations for additional good points within the coming days.

Associated studying

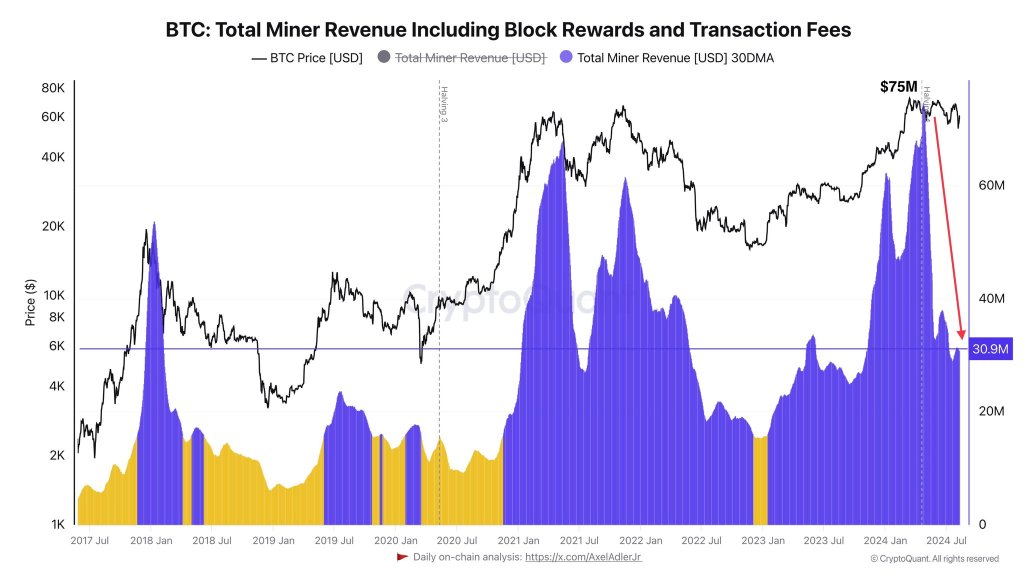

It’s encouraging to see that the attainable rally received’t face resistance, particularly from miners who could select to promote. A couple of weeks after the halving in late April, miners started promoting BTC, forcing costs decrease, and this was evident all through June. YCharts, presently, there may be stability because the hash fee (a measure of computing energy) rises.

Day by day miner income, one analyst notesAfter the halving, it fell by about 60%, from $75 million to $30 million. In the meantime, their reserves have decreased by 50,000 BTC over the previous 720 days as they promote Bitcoin to improve their gear and keep aggressive. Even with the liquidation, analysts imagine miners will not be in quick hazard as their reserves nonetheless exceed 713,000 BTC.

Characteristic footage are from DALLE, charts are from TradingView