The Wisconsin Funding Board (SWIB) has elevated its funding in BlackRock’s iShares Bitcoin Belief (IBIT), in line with a brand new SEC submitting right this moment, first reported by MacroScope on X .

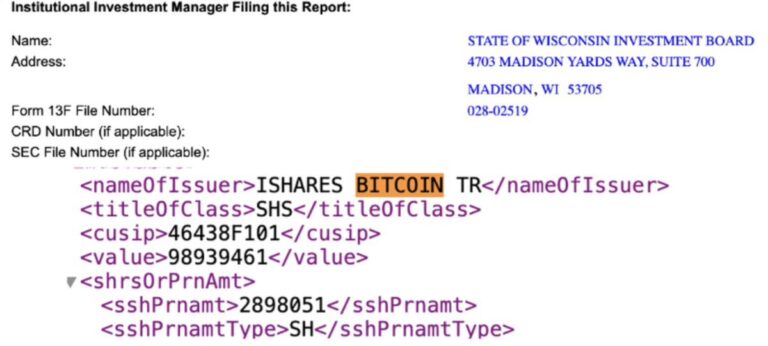

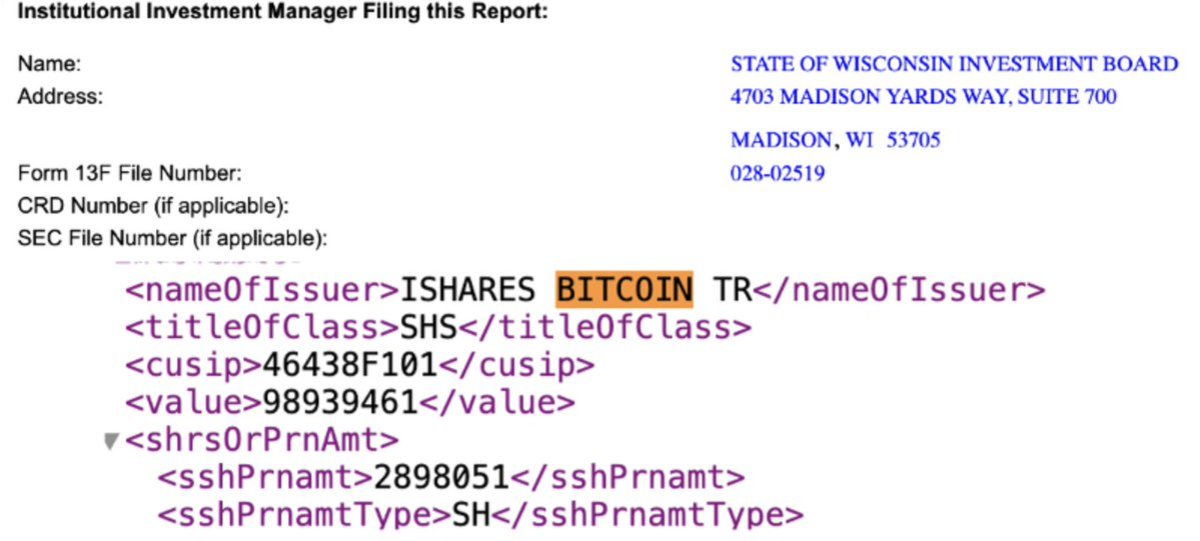

In a submitting with the SEC right this moment, the Wisconsin Funding Fee reported that it owned 2,898,051 iShares Bitcoin Belief shares as of June 30 (price $98.9 million as of that date).

This is a rise from the two,450,400 shares Wisconsin beforehand reported in Might…

— MacroScope (@MacroScope17) August 14, 2024

As of June 30, the board owned 2,898,051 shares price $98.9 million. This marks a big enhance of 447,651 shares from the two,450,400 shares reported in Might. Notably, the submitting additionally revealed that the board now not holds any positions in Grayscale Bitcoin Belief (GBTC), a change from Might when it reported holding 1,013,000 shares.

In early Might this yr, SWIB turned the primary state pension fund to buy a spot Bitcoin ETF, marking one other main milestone within the integration of Bitcoin into conventional funding portfolios. The board’s resolution to extend its funding in IBIT highlights the rising desire for direct funding in Bitcoin by spot ETFs and displays broader institutional confidence in Bitcoin’s long-term potential.

Regardless of the latest decline in Bitcoin costs, funds have continued to pour into spot Bitcoin ETFs, with inflows totaling $243.06 million since July 24.

US🇺🇸Bitcoin spot ETF👇 has inflows for two consecutive days pic.twitter.com/8txUOkdT61

— HODL15Capital 🇺🇸 (@HODL15Capital) August 14, 2024