Cryptocurrency analyst Alan Santana stated Cosmos is at the moment in a dilemma available in the market. To him, this can be a very opportunistic time for long-term traders, particularly these with a bullish outlook.

Associated studying

He believes ATOM is at the moment buying and selling at a substantial low cost to its increased ranges, thus positioning itself as a really compelling risk-reward entry. Santana stated Cosmos has “wonderful charts” because the coin is buying and selling at a really low value in comparison with historic costs.

✴️ Cosmos (ATOM) bull market accumulation areas and techniques earlier than 2025

Cosmos has an excellent chart…

My pricey pal, how are you?

Are you prepared for a brand new yesterday, tomorrow, and as we speak?

Are you able to discover this chart with me on this lovely day?Cosmos has an excellent chart as a result of it… pic.twitter.com/SH4yrF76yd

— Ellen Santana (@lamatrades1111) August 14, 2024

Cosmos: Accumulation Phases and Dangers

Santana emphasised that Cosmos is at a important stage of accumulation. ATOM, then again, has traditionally fashioned increased secular lows, which might be a technical indicator setting the stage for future positive aspects.

Nevertheless, accumulation additionally comes with dangers. The important thing stage to observe is $1.923, the low since March 2020.

This decline might be interpreted as a shift in market sentiment and result in poorer efficiency in comparison with different cryptocurrencies.

One other stress on ATOM got here from insider promoting. As soon as a developer, miner, or trade begins promoting their holdings en masse, it often turns into a pink flag that there are issues inside the undertaking, or at the least a insecurity in its additional prospects.

This can be the rationale why Cosmos has underperformed in comparison with different altcoins, as different altcoins have been capable of keep above the June 2022 lows.

Bearish Forecasts and Market Sentiment

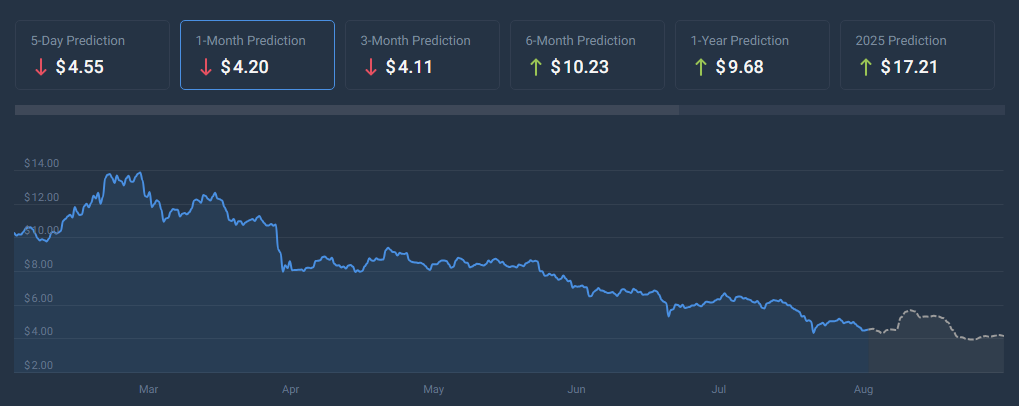

Whereas Santana’s sentiment was barely overly optimistic, market sentiment was overwhelmingly pessimistic. In accordance with the newest prediction from CoinCodex, Cosmos will fall by 8.56% by September 15, 2024, and the value will additional fall to $4.13.

All technical indicators on this forecast are bearish. The Worry and Greed Index lastly reached 27, exhibiting the extent of concern available in the market. For Cosmos, there have been 9 inexperienced days up to now 30 days (out of a doable 30 days).

This represents a optimistic return of 30%. Its present value volatility is 11.64%, indicating a excessive diploma of uncertainty and danger in the time-frame.

Nicely, given the present market circumstances, now will not be the best time to spend money on Cosmos. Based mostly on the components talked about above, particularly value drop predictions and the present sense of concern available in the market, warning seems to be warranted.

Associated studying

Weigh dangers and rewards

Whereas Santana’s evaluation suggests this might truly be good for future earnings, the outlook is not that optimistic. Subsequently, traders should think about these components earlier than shopping for.

Cosmos is a high-risk, high-reward situation. The present low value and former increased lows might deliver large rewards to long-term traders who can climate the storm. Nevertheless, destructive sentiment, insider promoting, and value minimize expectations are all dangers.

Featured photos from Zipmex, charts from TradingView