Bitcoin costs started to fall beneath $57,000 on Friday, August 16, following a sudden 7% drop on Thursday. Whereas the most important cryptocurrency is exhibiting good indicators of restoration, a distinguished cryptocurrency analyst defined how the newest value drop might push BTC value right into a bearish section.

Bitcoin MVRV falls beneath 1-year SMA – what’s the impression on value?

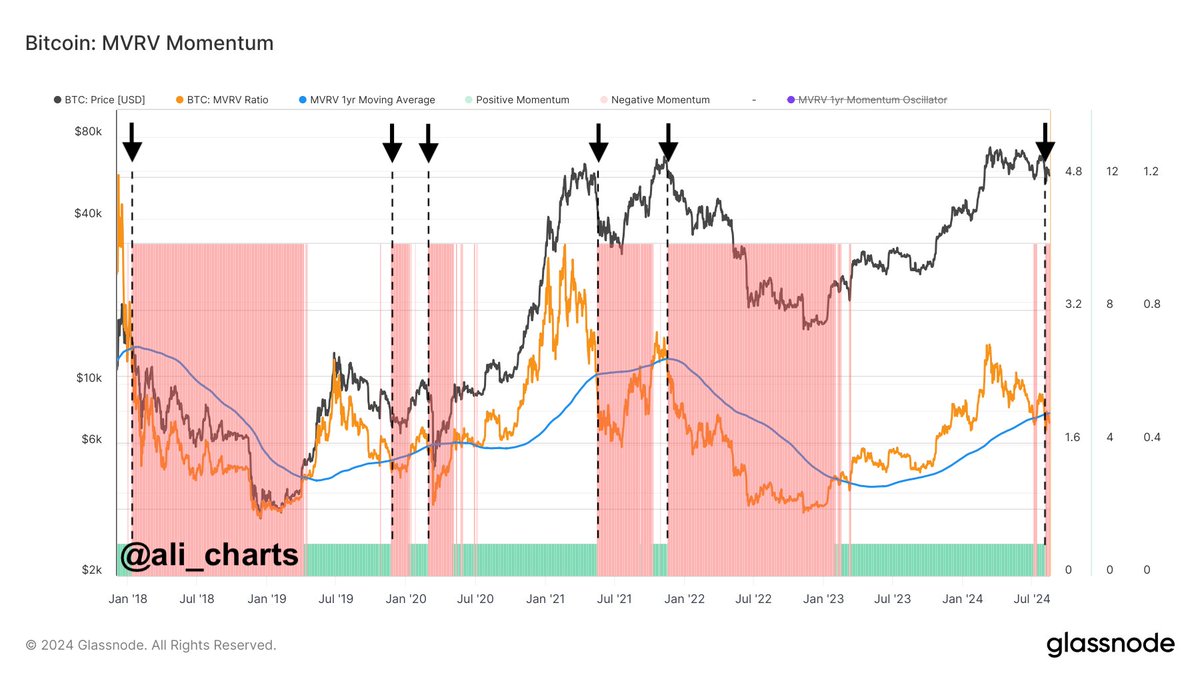

In an article on the This on-chain disclosure is predicated on the Glassnode MVRV (Market Cap vs. Realized Worth) momentum indicator, which is a software for figuring out macro market tendencies.

The MVRV momentum indicator primarily consists of the MVRV ratio and the 1-year easy shifting common (SMA). When the MVRV ratio breaks above this SMA, it alerts entry right into a bull market. In the meantime, a break beneath the one-year easy shifting common alerts a flip to the bearish section.

Sometimes, a extreme breakout of the MVRV 1-year SMA signifies that a lot of Bitcoins have been bought beneath the present value, suggesting that holders are actually taking income. Then again, when a shifting common breaks out strongly, exhibiting a considerable amount of Bitcoin purchased at a value greater than the present value, holders will face losses.

A chart exhibiting the Bitcoin value and the MVRV momentum indicator | Supply: Ali_charts/X

Martinez mentioned the BTC cycle shifted right into a bearish section after the value fell beneath $61,500. The most recent breakout of the SMA on the MVRV ratio signifies heavy shopping for of BTC above $61,500. Nonetheless, these tokens are actually buying and selling at a loss, which might result in giant allocations from traders seeking to minimize their losses.

When a lot of traders lose cash, promoting stress will increase, which might put additional downward stress on the value of Bitcoin. In the end, this might result in decrease costs resulting in extra promoting of the asset, reinforcing the momentum of the bearish section.

Bitcoin Worth at a Look

As of this writing, the value of Bitcoin continues to hover round $59,000, up 2.5% previously 24 hours. Nonetheless, the most important cryptocurrency is down practically 3% on the weekly timeframe, in response to CoinGecko knowledge.

The worth of Bitcoin hovers across the $59,000 stage on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView