Bitcoin has recovered again to $61,000 ranges over the previous day. Listed below are the potential elements behind this surge.

Bitcoin has recovered considerably previously 24 hours

After displaying lackluster value motion under $60,000 over the previous few days, Bitcoin has lastly proven some momentum previously 24 hours, with its value surging by greater than 4%.

Associated studying

The chart under exhibits the cryptocurrency’s latest actions.

On the peak of this rally, BTC topped $61,400, however the asset has since corrected. Nonetheless, even after the drop, BTC continues to be buying and selling round $60,800, which is a big enchancment from yesterday.

As for what’s behind this surge, maybe on-chain information can present some clues.

BTC’s latest on-chain growth has seen many constructive developments

Some latest developments within the cryptocurrency area may very well be constructive for Bitcoin. First, BTC buyers holding between 100 and 1,000 BTC have made appreciable shopping for efforts over the previous six weeks, in keeping with information from on-chain analytics agency Santiment.

As of the time Santiment shared the chart (yesterday), Bitcoin buyers with between 100 and 1,000 BTC held a complete of three.97 million cash. Of those, they bought 94,700 tokens previously six weeks.

Teams that maintain such wallets are sometimes called “sharks.” Like whales, sharks are additionally thought-about main buyers out there as a result of appreciable dimension of their token holdings.

So the truth that these large buyers had been accumulating funds when BTC was struggling earlier exhibits that large cash is assured that the cryptocurrency will flip issues round.

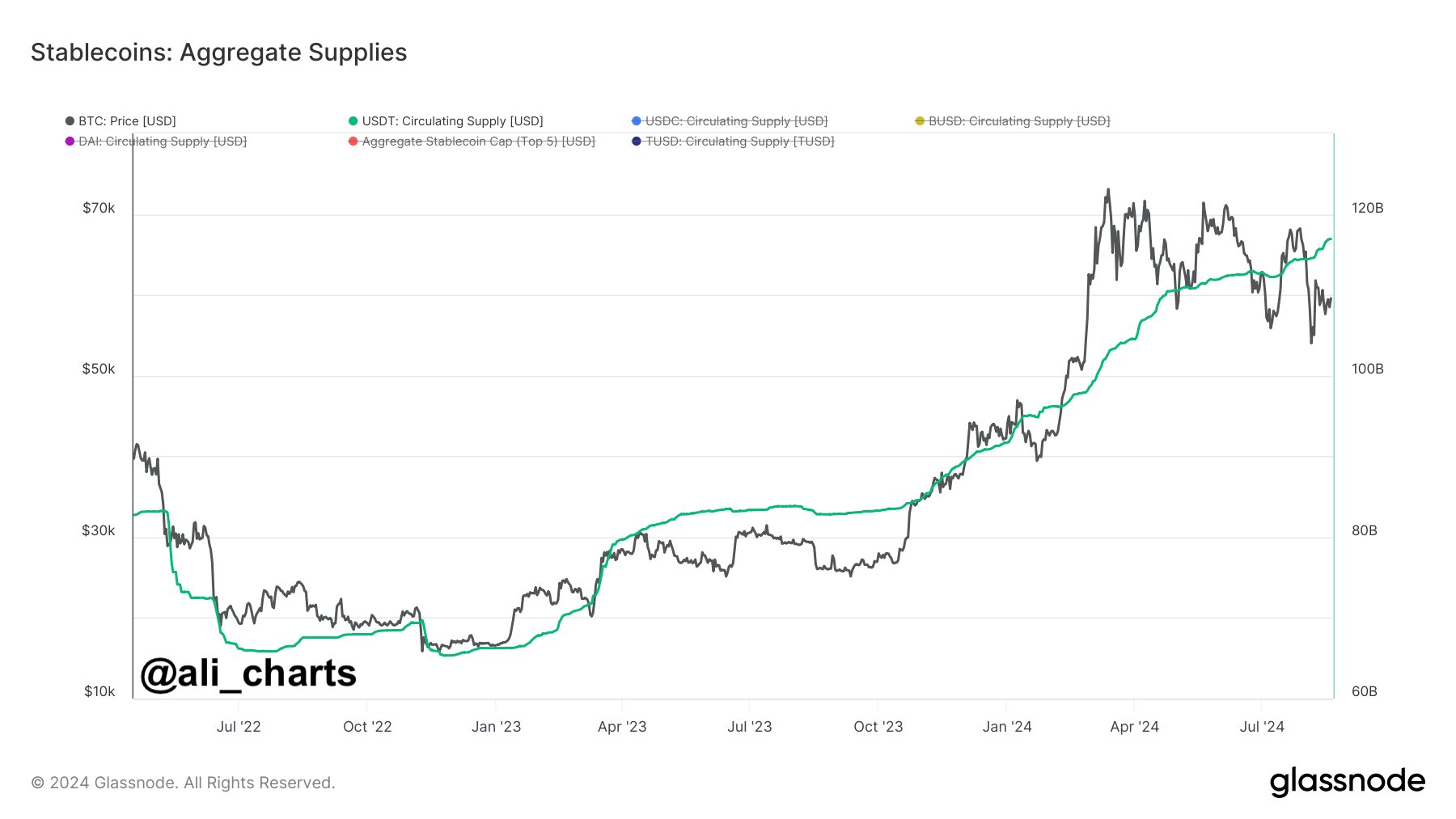

One other constructive growth is that the provision of Tether (USDT) has been trending upward lately, as analyst Ali Martinez famous in an X submit.

At any time when buyers need to escape the volatility related to property like Bitcoin, they typically flip to stablecoins like Tether. Nonetheless, buyers who retailer funds like this ultimately plan to reinvest in additional unstable cryptocurrencies, so the provision of stablecoins might act as a repository of dry powder that may be deployed into BTC and different currencies.

Associated studying

After all, when buyers trade secure property for these property, their costs will rise. With the latest vital enhance in Tether provide, buyers’ potential buying energy will be thought-about to have elevated.

This might occur via two processes: capital rotation from Bitcoin and different cryptocurrencies, and new capital inflows. The previous implies that buyers have at the moment bought unstable tokens, however as talked about earlier than, these buyers might purchase again into the market sooner or later.

The latter could be solely bullish because it means there’s new curiosity coming into the area. In reality, each situations are prone to occur to some extent, and as Bitcoin has efficiently rebounded, new capital inflows might make up for extra progress.

Featured photographs from Dall-E, Glassnode.com, Santiment.web, charts from TradingView.com