On August 5, Bitcoin all of the sudden fell beneath $50,000, inflicting many components of the cryptocurrency market to be liquidated. This sudden drop, which unfold to different cryptocurrencies, took the market abruptly. Consequently, Bitcoin fell to its lowest value in six months, with many different altcoins following swimsuit. Though Bitcoin Now recovered 20% and Now I discover myself buying and selling Despite the fact that the worth is just under $60,000, many short-term holders are nonetheless dealing with unrealized losses.

the most recent one Report Main blockchain analytics firm Glassnode reveals the components resulting in this sudden market downturn. The report means that the plunge was largely brought on by an overreaction by short-term holders, who rapidly liquidated their positions within the face of the preliminary decline.

Quick-term Bitcoin holders have been fast to capitulate

Quick-term holders are usually outlined as these traders who maintain cryptocurrency property for a comparatively quick time frame (often round a month or so). Subsequently, throughout value corrections, they will rapidly succumb. This pattern was significantly evident in the course of the latest Bitcoin value correction/consolidation, which lasted far longer than many traders anticipated.

Associated studying

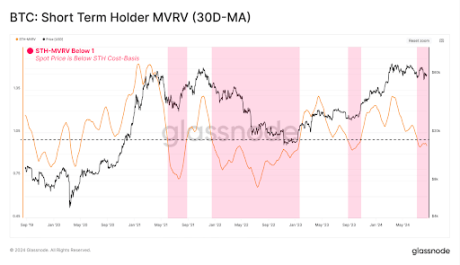

In accordance with Glassnode’s newest on-chain report, a key metric referred to as the STH-MVRV (Market Cap to Realized Worth) ratio has fallen beneath the crucial equilibrium worth of 1.0. When the STH-MVRV ratio is beneath 1.0, it signifies that the common new investor is dropping cash reasonably than making a revenue holding Bitcoin. These unrealized losses, typically referred to as paper losses, happen when the market worth of an asset is lower than the acquisition value however the asset has not but been bought. That is completely different from a realized loss arising from a accomplished transaction.

Whereas temporary unrealized losses are widespread throughout bull markets, they have a tendency to create promoting stress on Bitcoin’s value. It’s because STH-MVRV buying and selling constantly beneath 1.0 tends to result in a better chance of panic and capitulation amongst short-term holders. Notably, this phenomenon contributed to Bitcoin’s crash earlier this month.

Associated studying

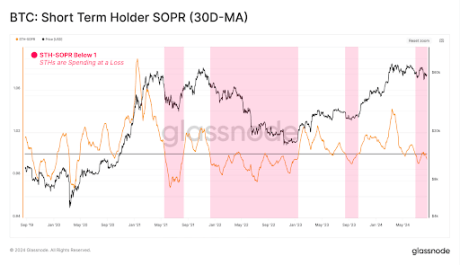

Moreover, Glassnode’s report reveals this correlation and promoting stress could have occurredSTH-SOPR (expenditure output revenue margin) can be beneath 1.0. The STH-SOPR ratio measures the profitability of output used, exhibiting whether or not an asset is bought at a revenue or loss. This basically signifies that many short-term traders take extra realized losses than earnings. It has been steered that many short-term holders are overreacting to cost changes.

Though short-term holders carried most of Regardless of the losses brought on by the latest financial downturn, long-term holders stay sturdy. On the time of writing, Bitcoin is buying and selling at $59,540, down 2.15% up to now 24 hours.

Featured picture created utilizing Dall.E, chart from Tradingview.com