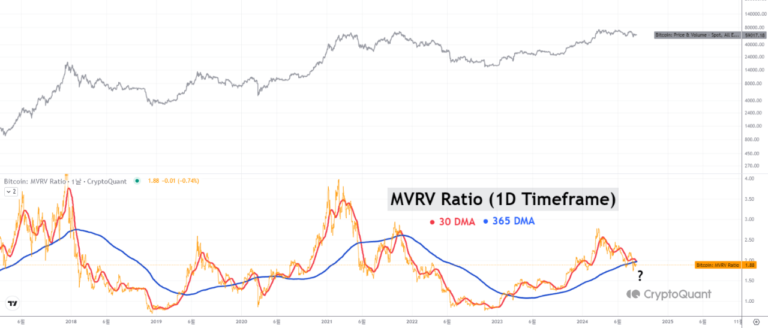

On-chain knowledge reveals that the Bitcoin market cap to realized worth (MVRV) ratio has not too long ago approached a demise cross sample.

Bitcoin’s 30-day transferring common MVRV ratio could also be about to interrupt by means of the 365-day transferring common

As one analyst defined in a CryptoQuant Quicktake put up, the MVRV ratio is liable to a demise cross. The “MVRV Ratio” is a well-liked Bitcoin on-chain metric that, merely put, tracks the worth of buyers’ holdings (i.e. market cap) in comparison with the worth they put in (realized cap).

Associated studying

When the worth of this indicator is bigger than 1, it implies that buyers as a complete are at the moment in a state of internet revenue. Then again, something beneath this threshold signifies that losses dominate the market.

In fact, an MVRV ratio of precisely 1 implies that BTC holders are holding precisely the identical worth as they initially invested, in order that they merely break even.

Now, the chart beneath reveals the development of the Bitcoin MVRV ratio and its 30-day and 90-day transferring averages (MA) over the previous few years:

As proven within the chart above, in March, when the cryptocurrency’s worth rose to all-time highs (ATH), the Bitcoin MVRV ratio surged to fairly excessive ranges.

However the indicator has fallen as buyers took income and offered within the ensuing extended consolidation part. Nonetheless, the indicator stands at a price of 1.88, which signifies a market capitalization that’s virtually double the realized market capitalization. Subsequently, buyers must be comparatively reassured.

What’s regarding, nonetheless, is the speed at which the MVRV ratio is declining. As you may see from the chart, the indicator’s 30-day transferring common has skilled a pointy decline and is at the moment retesting the 365-day transferring common.

Traditionally, the 30-day transferring common of the MVRV ratio beneath the 365-day transferring common often causes the cryptocurrency to enter a bearish part. This demise cross final occurred close to the tip of 2021, signaling a bear market in 2022.

Presently, the demise cross of those transferring averages for the Bitcoin MVRV ratio has not but been decided, so this indicator could be monitored within the close to future. If the 30-day EMA continues on this trajectory and falls beneath the 365-day EMA, BTC might ultimately expertise one other interval the place bears are on the helm.

Associated studying

Nevertheless, additionally it is doable that the indicator reverses itself and the demise cross sample doesn’t really find yourself forming.

bitcoin worth

Bitcoin broke by means of the $61,000 stage yesterday, however the surge doesn’t seem like sustainable because the asset has fallen to $59,400.

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com