In a latest report analyzing the second quarter (Q2) efficiency of layer 1 (L1) blockchain Algorand (ALGO), information analytics agency Messari highlighted a number of noteworthy milestones achieved by the community throughout the interval, Amongst them, transaction data are some of the noteworthy.

Fast development of the Web

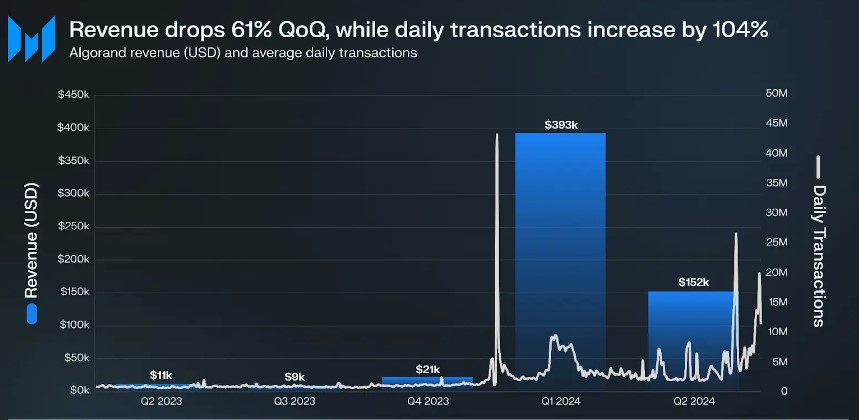

One of many key indicators Probably the most putting factor is the surge in Algorand’s common every day transaction quantity, which surged 104% to 4.7 million transactions. Complete transaction quantity elevated 6% from the earlier quarter to 425 million transactions.

Regardless of the rise in buying and selling quantity, Algorand’s income took a success, falling 61% to $152,000. The report attributed this to ALGO’s 46% depreciation in worth in opposition to the U.S. greenback from the earlier quarter. though common buying and selling quantity Bills rose 44% and general greenback income remained down.

Associated studying

The 61% drop in quarterly income was additionally attributed to changes after ALGO surged 1,747% within the first quarter, pushed by a 43 million single-day surge in transaction quantity associated to the ORA memecoin venture.

Nevertheless, in comparison with the identical interval final yr, Algorand’s earnings A large 1,241% soar, climbing from $11,000 to $152,000.

On the optimistic aspect, Algorand achieved the necessary milestone of two billion transactions throughout the quarter, demonstrating the expansion and adoption of the community. Notably, it took the community 4 years to attain its first billion transactions, whereas the second billion was reached in only one yr.

Algorand staking drops to lowest stage in a yr

Within the second quarter of 2024, the quantity of ALGO pledged on the Algorand community decreased by 38% yearly and 6% quarterly, reaching the bottom stage in a yr, with 1.6 billion ALGOs pledged. Messari believes this might be because of fewer rewards being distributed every governance cycle.

P.c of Algorand eligible provide guess on It dropped 4.7% month-on-month and is presently 20.2%. On the similar time, Algorand’s circulation elevated by 1.2% to eight.2 billion ALGOs.

Lastly, information exhibits that the market worth of stablecoins on Algorand elevated by 15% month-on-month, from US$73 million to US$85 million, primarily because of the 32% enhance available in the market worth of Circle’s USDC stablecoin, which presently accounts for 78% of the entire stablecoins in Algorand market worth.

Quite the opposite, Tether’s USDT market worth fell by 22%, accounting for 21% of Algorand’s market worth Stablecoin market share. The market capitalization of EURD nonetheless accounts for 1% of the market capitalization of Algorand stablecoins.

ALGO Value Faces Make or Break Second

The value of the ALGO token has surged in latest weeks, following a difficult second quarter for each value and the broader market. Coin Gecko information The coin’s value is proven to have elevated by 14% previously two weeks and by 12% previously seven days alone.

This has resulted in ALGO buying and selling at $0.1357, just under its 200-day exponential shifting common (EMA), as proven by the yellow line on the every day chart of ALGO/USDT under, which presently acts as resist for the token.

Associated studying

This hurdle have to be cleared to make sure that costs are more likely to proceed rising within the coming days and set up the identical near-term help on a pullback.

Featured photos from DALL-E, charts from TradingView.com