Just like most altcoins, Ethereum is dealing with important promoting stress and is struggling to shake off the weak spot seen in early August. Regardless of some power following the height of the sell-off on August 5, the value stays under $2,800.

The one constructive for the time being, at the least on the every day chart, is the spectacular resilience of the bulls. Regardless of a wave of decrease lows, patrons remained immersed in intense promoting stress, maintaining the value above the $2,500 mark.

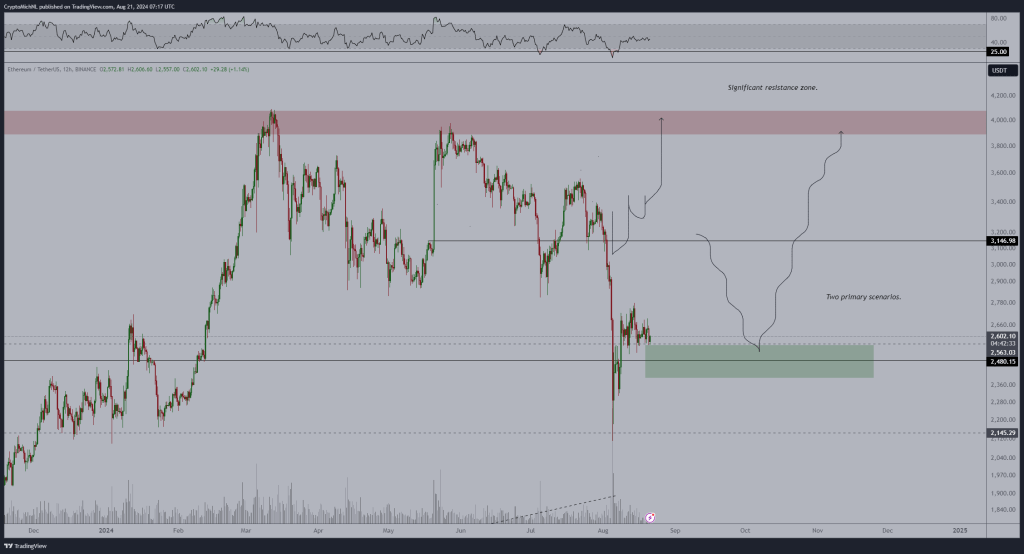

Nonetheless, the bearish formation stays, however one analyst believes that rejection of costs under $2,500 is essential.

Ethereum bulls should hold worth above $2,500

In an article by X, the analyst clarify Bulls should maintain Ethereum above $2,500 to maintain the uptrend. Trying on the worth evolution on the every day chart, the spherical numbers mark the underside of the bull flag sample.

Associated studying

Ethereum has been falling under the $2,700 and $2,800 resistance zones over the previous few buying and selling days since its surge on August 8. In the meantime, help at $2,500 stays clearly seen. As worth motion consolidates, a bull flag sample has shaped, signaling power.

The analyst stated that if patrons use $2,500 as their anchor, Ethereum will surge to $3,150 within the subsequent buying and selling session. Contemplating that the August 1-5 sell-off was a bearish breakout sample, this restoration is welcome. The sell-off broke via the important thing April-July 2024 help space.

The affect of spot ETFs and ecosystem progress

Analysts added that the rise could possibly be pushed by inflows into spot Ethereum ETFs. Because the approval of spot ETFs in July, establishments have been eager to search out funding alternatives.

An ETF Analyst notes Excluding outflows from Grayscale ETHE, inflows at the moment exceed $2 billion. BlackRock’s iShares Ethereum ETF has been driving demand throughout this era.

Along with inflows into the spot Ethereum ETF, Vitalik Buterin suppose The constructive developments which were made are prone to help costs. This contains decrease fuel charges for layer 2 options reminiscent of mainnet and Base.

Associated studying

Moreover, the co-founder famous that Arbitrum and Optimism’s decentralization efforts are substantial. Arbitrum and Optimism lately introduced their failure proofs. Nonetheless, after the audit report was launched, Optimism restored the centralized error-proofing system, which mounted the flaw.

Characteristic footage are from DALLE, charts are from TradingView