On-chain knowledge reveals that Bitcoin has been transferred to Coinbase from different exchanges. That’s the historic significance of this pair of belongings.

Bitcoin Coinbase visitors pulse has just lately returned to inexperienced

As CryptoQuant creator Axel Adler Jr explains in a brand new article on X, Coinbase has just lately resumed inflows from different exchanges. The related metric right here is the “Coinbase Circulation Pulse,” which tracks the web quantity of Bitcoin flowing between Coinbase and different cryptocurrency exchanges.

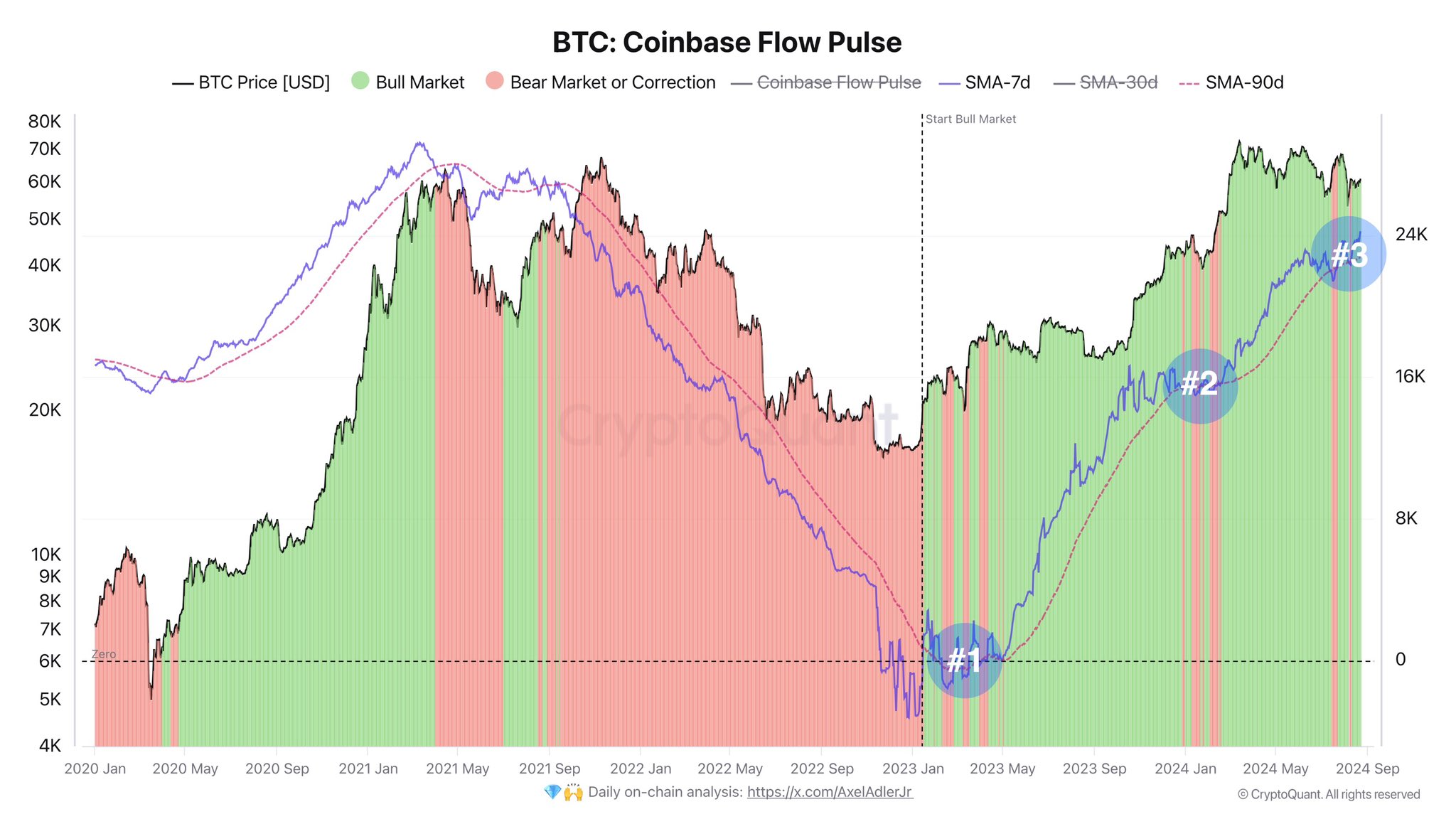

Beneath is a chart shared by analysts displaying the pattern of the indicator’s 7-day transferring common (MA) over the previous few years.

Appears like the worth of the metric has been heading up in latest days | Supply: @AxelAdlerJr on X

As proven, the Bitcoin Coinbase visitors pulse has been constructive since mid-2023, which means Coinbase has been receiving internet inflows from different centralized exchanges.

Nonetheless, the indicator’s pattern with respect to its 90-day transferring common is extra related, as proven on this chart. Analysts have outlined two zones for BTC primarily based on the comparability of the 7-day transferring common with the long-term transferring common.

BTC might exhibit bearish strikes when the 7-day EMA crosses the 90-day EMA, so such intervals are categorised as “bear markets or corrections” (highlighted in crimson). Likewise, indicators above this line imply “bullish” (inexperienced).

As is clear from the chart, the 7-day MA for Coinbase Circulation Pulse simply fell under the 90-day MA, however now the 2 have crossed over, which means the demand to maneuver cash to Coinbase has picked up.

The final time the cryptocurrency shaped this sample was earlier than rallying to new all-time highs (ATH). Due to this fact, this sign may be constructive for costs this time.

As for why Coinbase is likely to be associated to the asset on this manner, the reply might lie in the truth that the platform is a identified vacation spot for U.S. institutional entities. Due to this fact, the move of tokens from different exchanges into Coinbase might imply demand from these US whales.

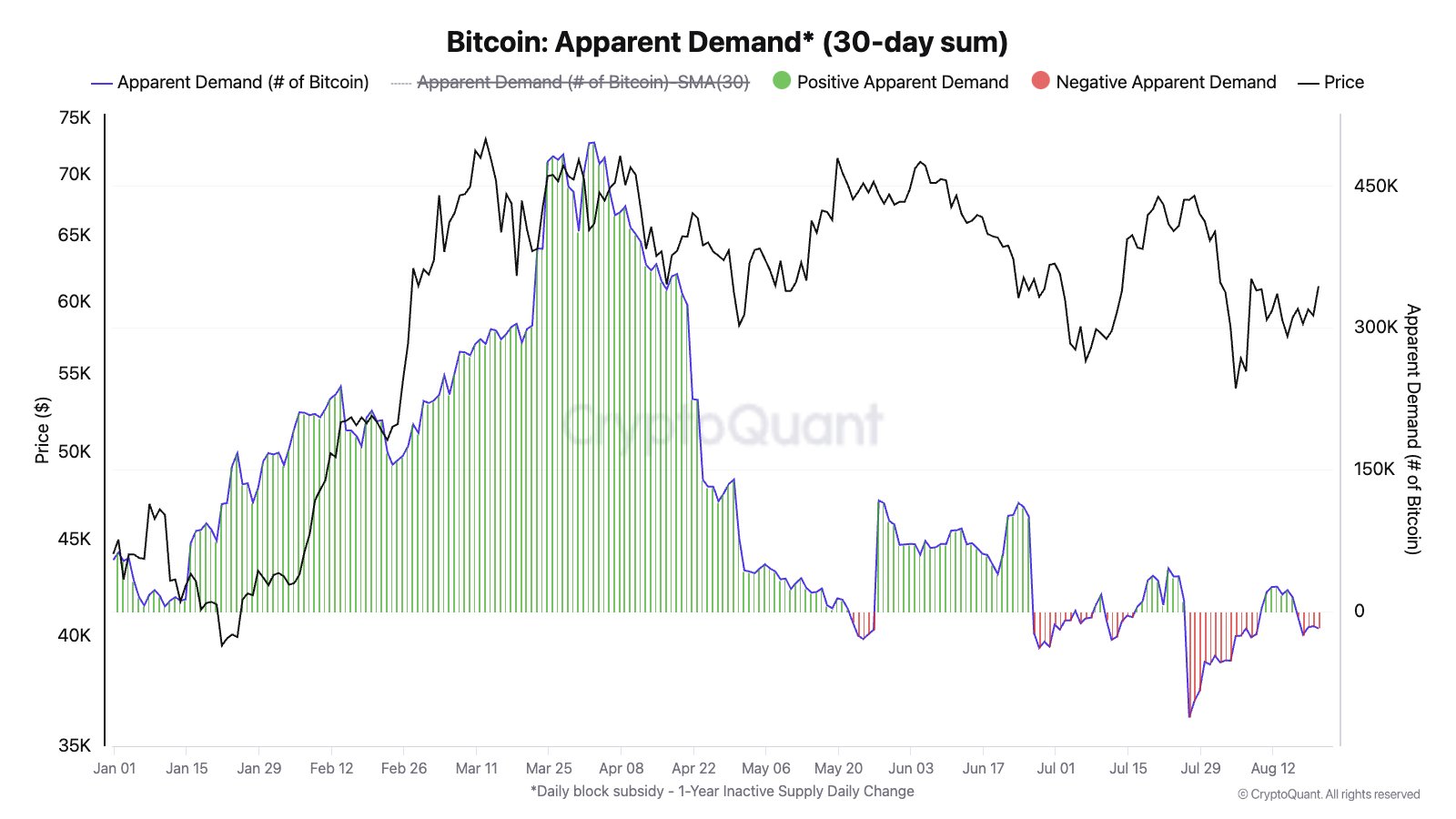

Whereas the market outlook seems constructive from the attitude of Coinbase Circulation Pulse, one other indicator from on-chain analytics agency CryptoQuant is probably not as vibrant.

As CryptoQuant head of analysis Julio Moreno defined in an Circulation like a part of the heart beat.

The worth of the metric seems to have been impartial just lately | Supply: @jjcmoreno on X

Whereas demand for Bitcoin was at vital ranges earlier this 12 months, it seems to have declined considerably after a chronic interval of consolidation, as obvious demand is now roughly impartial.

bitcoin worth

As of this writing, Bitcoin is buying and selling round $61,000, up greater than 5% over the previous week.

The worth of the coin appears to be slowly making its manner up | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, CryptoQuant.com, charts from TradingView.com