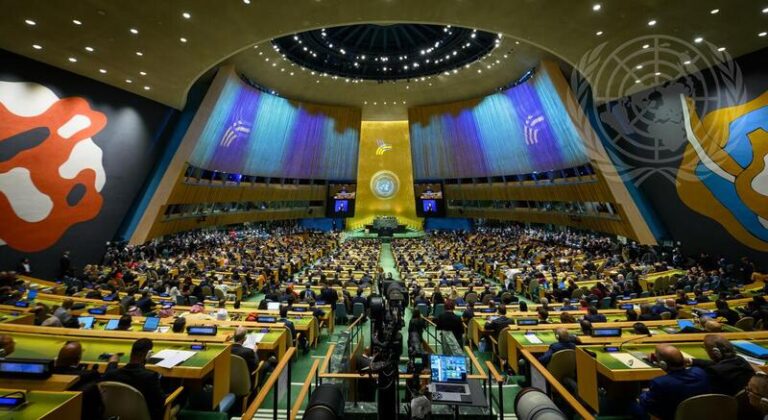

UNITED NATIONS, Sep 30 (IPS) – Whereas a lot of the world leaders attending the first-ever United Nations Future Summit – a two-day high-level occasion on the United Nations Headquarters in New York geared toward tackling essentially the most urgent world challenges of the twenty first century – agreed The world’s ageing multilateral system wants modernization, however not everybody agrees on find out how to get there.

“We is not going to reach overcoming our existential challenges if we’re not ready to alter the worldwide governance buildings which are rooted within the aftermath of World Battle II and are now not match for at the moment’s world,” Barbados Prime Minister Mia Mottley mentioned on September 22. on the summit.

For the international locations that make up the worldwide South, though they aren’t monolithic, the trail to reform begins with an overhaul of the worldwide monetary structure that presently traps creating international locations in an unsustainable cycle of debt. Nonetheless, doubts stay about whether or not the reform blueprint set out within the summit’s non-binding consequence doc, the Future Compact, is sufficient to muster the political will wanted for change.

Regardless of months of negotiations and the rejection of a last-minute Russian modification, the deal was adopted by consensus on the primary day of the summit.

Tim Hirschel-Burns, coverage liaison at Boston College’s Heart for World Growth Coverage, mentioned: “The Future Covenant designed an excellent constructing, but it surely didn’t depart many directions for its development.

The settlement is 42 pages lengthy and incorporates 56 motion objects overlaying 5 areas of worldwide concern: sustainable growth and financing, worldwide peace and safety, digital cooperation, youth and future generations, and world governance. It additionally consists of two separate annexes: the World Digital Compact and the Declaration on Future Generations.

Nevertheless, whereas Herschel-Burns described the wording within the settlement as “weak” and “fairly imprecise”, he instructed IPS that contemplating “it was signed by heads of state representing the peoples of the world, “There’s nonetheless some room for optimism,” so, he added, “you may have a really noble mission” to take motion. Notably, the leaders of the P5 (United States, United Kingdom, France, China and Russia) didn’t communicate on the summit.

One promising motion merchandise within the settlement calls on signatories to shut the financing hole for the Sustainable Growth Objectives (SDGs) in creating international locations, estimated at $4.2 trillion per yr. Established in 2015, the Sustainable Growth Objectives are a blueprint for ending poverty, starvation and inequality by 2030, a sequence of worldwide challenges.

Nevertheless, progress in the direction of sustainable growth objectives has been unstable for international locations mired in debt and missing sustainable financing choices. The most recent Sustainable Growth Objectives report estimates that “solely 17% of the Sustainable Growth Objectives are on monitor” and in some circumstances, progress has stalled and even reversed.

Nonetheless, Herschel-Burns instructed IPS that “even when a future deal doesn’t embrace a transparent roadmap for addressing unsustainable debt, the better outcomes promised within the deal is not going to be achieved except significant motion is taken on debt reduction.” will come true.

With regards to accessing finance, international locations within the World South have historically encountered a lot greater rates of interest than their Western neighbors. In keeping with the newest United Nations Convention on Commerce and Growth (UNCTAD) report, “borrowing charges in creating areas resembling Asia, Latin America, the Caribbean and Africa are 2 to 4 occasions greater than in the USA and 6 to 12 occasions greater than in the USA.” Larger than in Germany Out a number of occasions.

This dynamic has resulted in creating international locations accumulating $365 billion in exterior financeI Debt – cash owed to international traders, By 2022, governments and multilateral establishments will take motion.

A separate 2023 report by Debt Justice, a London-based group that goals to finish unfair debt practices, discovered that “debt funds in low-income international locations reached their highest ranges since 1998 in 2023.” “Exterior debt funds will common no less than 16.3% of presidency income in 91 international locations by 2023, rising to 16.7% in 2024, a rise of greater than 150% since 2011.”

Along with excessive rates of interest and an absence of political will, there are different structural causes for top debt ranges in creating international locations, mentioned Iolanda Fresnillo, coverage and initiatives supervisor on the European Community on Debt and Growth (EURODAD). Causes resembling unfair commerce relations, technological dependence on China and the World North, and the affect of exterior shocks resembling main local weather occasions, pandemics and wars.

Fresnillo instructed IPS that when international locations already deep in debt haven’t got the instruments to take care of the implications of hurricanes, earthquakes or adjustments within the worth of oil or different commodities, they must borrow more cash. Because of this, in an effort to repay rising debt, international locations have minimize spending on well being and schooling and investments in local weather adaptation and mitigation, leaving them unprepared for the subsequent main local weather occasion. “We name it the debt and local weather vicious cycle,” she mentioned.

Remarkably, it’s the extra emissions of nations within the Northern Hemisphere that trigger local weather change, whereas much less developed international locations within the World South bear the implications of exacerbating debt cycles.

“The worldwide neighborhood must take extra bold motion to handle this local weather disaster. In any other case, we are going to Everybody will understand it, and so will I.

In the meantime, Fresnillo instructed IPS {that a} “widespread framework” should be established earlier than any multilateral system or future blueprint can handle the problem of debt reform. “So after we say the debt structure wants reform, what we imply is we want a debt structure” as a result of there aren’t any guidelines when creating international locations face a disaster and have to restructure their debt.

“It is loopy,” Fresnillo mentioned. “When an organization goes bankrupt, there are guidelines that the corporate should comply with with a view to resolve the chapter,” however no such guidelines exist within the nation. “It is very unfair as a result of it is the folks of this nation who bear that burden.”

Follow @IPSNewsUNBureau

Comply with IPS Information United Nations Bureau on Instagram

© Inter Press Service (2024) — All rights reservedAuthentic supply: Inter Press Service