In a brand new YouTube evaluation posted to his 502,000 followers, cryptocurrency strategist Miles Deutscher shared his insights into the altering cryptocurrency investing panorama. Deutscher’s presentation delves into the inefficiencies of the standard enterprise capital (VC) funding mannequin within the cryptocurrency house and proposes an alternate technique that focuses on sure altcoins that he believes are poised for important progress.

Deutscher criticized conventional enterprise capital-backed token choices, saying: “Enterprise capital enters the market at ultra-low valuations. […] Then, when these tokens are launched, they’re incentivized to situation them as excessive as doable at a completely dilutive valuation. He believes that this method will result in issuance costs which might be too excessive and hinder the efficient worth discovery mechanism required for retail buyers to take part healthily available in the market. revenue.

Deutscher highlighted the shift in market dynamics, noting that meme cash have grown in reputation as a type of revenge towards a enterprise capital-dominated ecosystem. “Individuals do really feel like the sport is rigged and so they wish to acquire a bonus,” he defined. He stated the success of meme cash might be attributed to the truth that their issuance course of is mostly fairer in comparison with conventional venture-backed tokens.

Purchase 8 Altcoins Now

All through the video, Deutscher lists eight altcoins that align with this new funding “greenback,” emphasizing that the tokens are “absolutely dilute and have equally good narratives.” Every token was chosen based mostly on its token economics, “absolutely diluted valuation” (FDV), market place, and potential to develop with out important promoting stress from preliminary massive holders:

Associated Studying

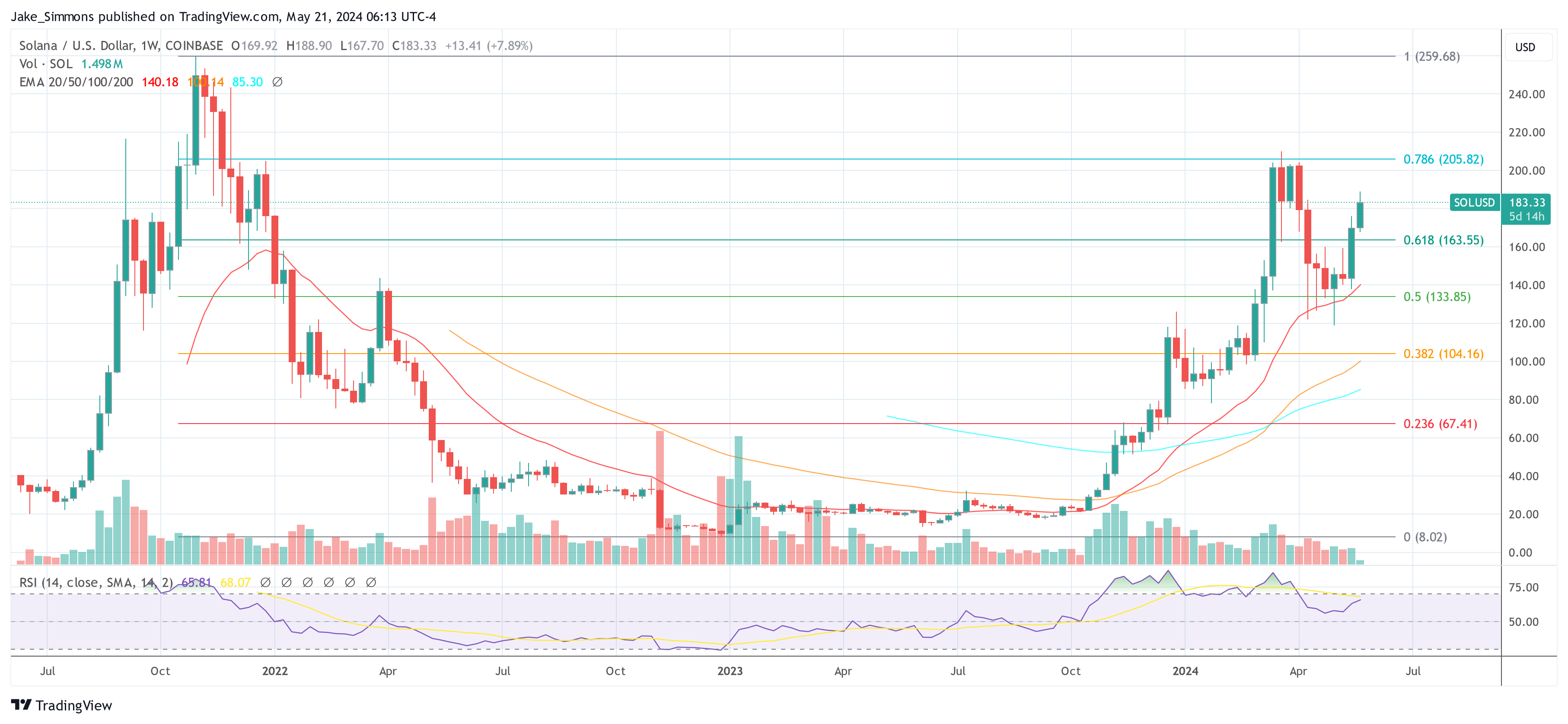

Solana (Suns): Deutscher sees Solana as a frontrunner as a consequence of its technical prowess and robust neighborhood help. The corporate has demonstrated resilience and innovation, making it one in every of his prime holdings due to its continued outperformance. “Resulting from Solana’s outperformance, it has grow to be one in every of my largest holdings. It’s the market chief for a cause, and congratulations to everybody who obtained on board the Solana practice with me.

uncle): In contrast with different high-valuation merchandise, TON’s engaging FDV ratio signifies secure market entry and fewer speculative danger. Deutscher emphasised its progress potential with out important promoting stress. He stated: “TON is one other layer, not simply one other blockchain. Properly, its valuation is comparatively excessive, however most of it’s diluted available in the market, which is sweet. Its FDV ratio is definitely It is 68, so it is a secure funding.

NEAR Protocol (NEAR): NEAR is taken into account a strong synthetic intelligence agent as a consequence of its technological basis and management place. Its excessive dilution (91% FDV) means the vast majority of the token is in circulation, decreasing promoting stress. “NEAR is absolutely diluted at 91%, which implies there’s not plenty of promoting stress. I do assume NEAR is without doubt one of the prime L1s, particularly as a really sturdy AI agent as a result of the founders are rooted in AI,” Deutscher clarify.

Injection protocol (INJ): INJ has a market capitalization to FDV ratio of 94% and is taken into account to have sturdy market well being, with much less worth suppression from unlocking. Deutscher believes the corporate is anticipated to recuperate based mostly on its sturdy fundamentals and up to date market habits. “Injective’s market cap to FDV ratio is 94%, which is de facto spectacular, and it was doing very well earlier within the 12 months, but it surely’s beginning to get just a little stagnant. I believe sooner or later, that is positively going to be a story once more, “He stated.

Associated Studying

Aviv (AR): Deutscher praised Arweave as one of many prime infrastructures not just for information storage but additionally for its potential to combine with synthetic intelligence. The truth that it’s absolutely diluted means there will probably be minimal promoting stress going ahead. “Arweave positions itself as one of many prime infrastructure corporations. Contemplating it has 100% float market cap, that is nonetheless not a loopy 3.1 FDV, which implies all of the unlocking has already occurred.

AIOZ Community (AIOZ): AIOZ incorporates synthetic intelligence and decentralized content material storytelling with its distinctive decentralized streaming and storage options. The absolutely diluted standing of the AIOZ token makes it notably engaging. This can be a coin of the deep tech/synthetic intelligence house. I like what they’re constructing, it additionally contains decentralized storage, however it is usually a decentralized synthetic intelligence computing community,” Deutscher defined.

Wi-fi community: Deutscher stated Dogwifhat’s truthful issuance course of and full dilution are its key benefits, serving to it obtain sturdy worth efficiency with out the promoting stress usually triggered by enterprise capital.

PEPE: Deutscher personally sees sturdy returns from Pepe, citing his current “wholesome calm” as an excellent time to build up. The token’s community-driven method and meme standing present distinctive market resilience. “Pepe is one other main meme coin in my view. Very wholesome coolness, and as somebody who desires extra publicity, I welcome that,” he revealed.

Excessive potential cryptocurrency with low float, excessive FDV

Deutscher additionally mentioned the potential for investing in low-float, high-FDV tokens underneath sure situations. Utilizing Ondo Finance (ONDO) as a case research, he particulars how a deep understanding of token economics can reveal hidden alternatives. “ONDO’s vesting schedule is public, suggesting most insiders are locked in till 2025, minimizing promoting stress and permitting worth appreciation,” he famous.

In concluding his evaluation, Deutscher urged viewers to undertake a meticulous funding technique that leverages market tendencies and in-depth token evaluation. He emphasised the significance of shopping for in instances of “excessive concern” and promoting in instances of “excessive greed” to maximise returns.

At press time, SOL was buying and selling at $183.33.

Featured picture created with DALL·E, chart from TradingView.com