Binance customers reacted to information in regards to the Ethereum exchange-traded fund (ETF) by actively lusting after the cryptocurrency, knowledge reveals.

Ethereum web taker quantity on Binance simply had its largest candle ever

As CryptoQuant neighborhood supervisor Maartunn defined in a submit on

“Internet taker quantity” right here refers to a metric that tracks the distinction between ETH taker shopping for quantity and taker promoting quantity on any given centralized change.

Associated Studying

When the worth of this indicator is constructive, it implies that the recipient’s shopping for or lengthy buying and selling quantity on the platform exceeds the recipient’s promoting or quick buying and selling quantity. This pattern reveals that bullish sentiment amongst traders is dominant.

However, a unfavorable worth for this indicator signifies a majority bearish mentality amongst customers of this change, because the variety of shorts exceeds the variety of longs.

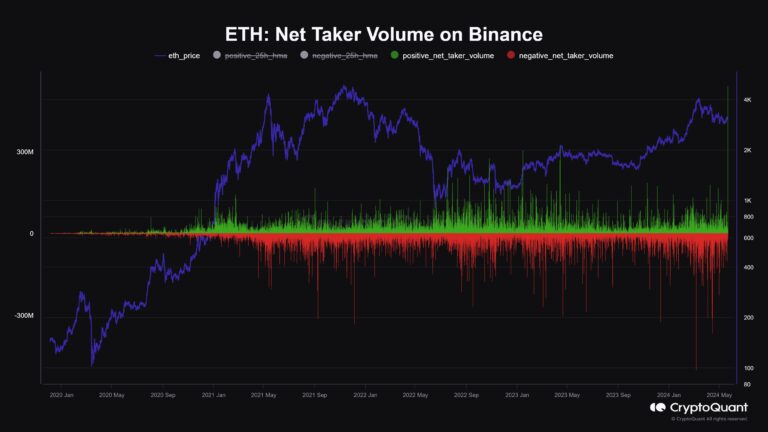

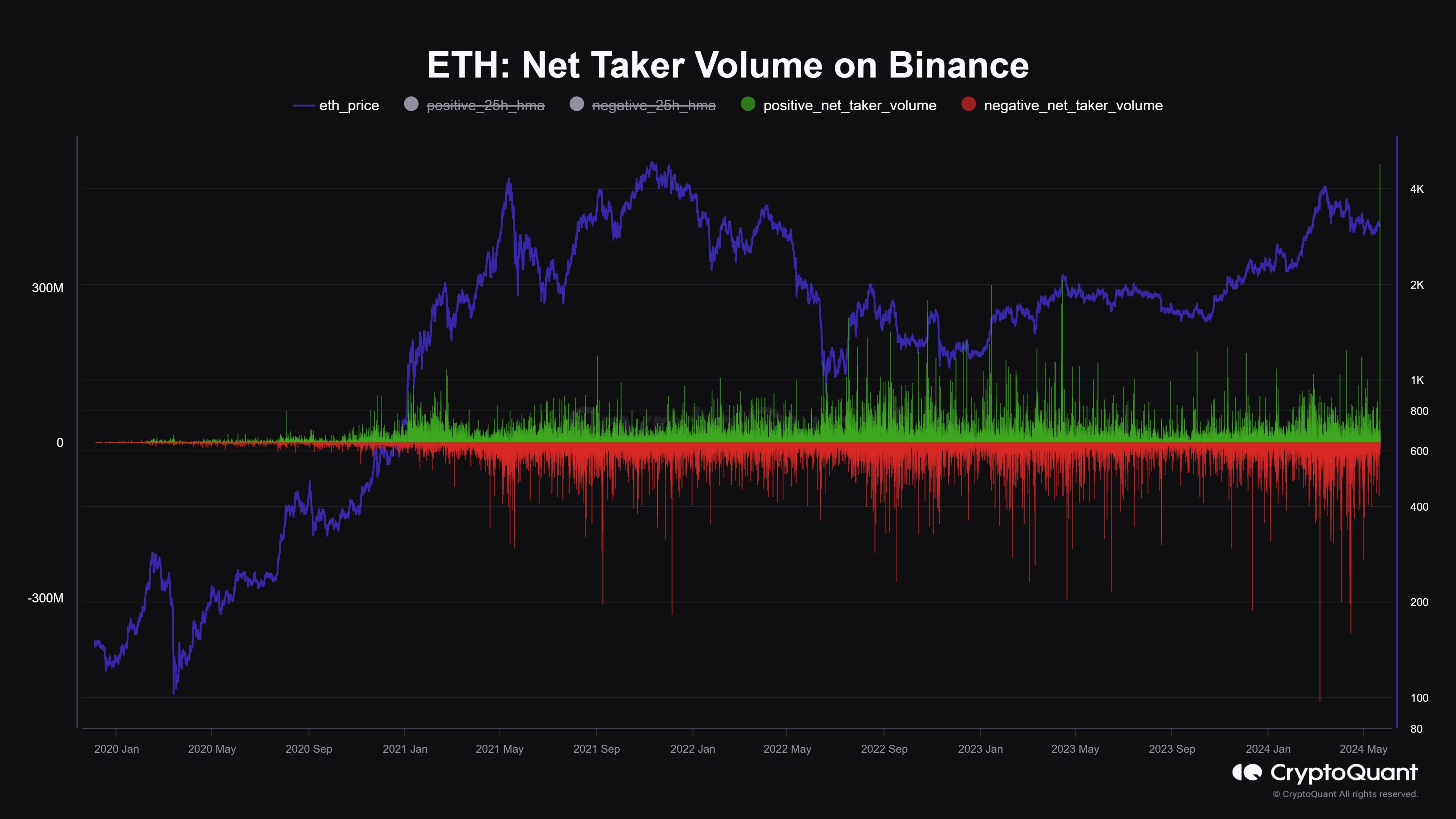

Now, the chart beneath reveals the pattern in Ethereum web taker buying and selling quantity on cryptocurrency change Binance over the previous few years:

As proven within the chart above, Ethereum web acceptance quantity on Binance has simply seen an enormous constructive progress, which implies traders have simply established a lot of longs on the platform.

Extra particularly, the metric was valued at $530 million throughout this surge, which based on analysts was the most important single surge in cryptocurrency historical past.

Maartunn famous: “Binance merchants are hungry for Ethereum ETF information like there’s no tomorrow.” This isn’t notably shocking, because the market, after witnessing Bitcoin’s decline, is properly conscious of what spot ETFs imply for the asset. What.

The ETF information pre-approval was bullish for BTC, and whereas the approval itself initially led to bearish value motion, it in the end paid off for the asset as capital started flowing in rapidly via these funding autos and the token skilled a rally , leading to a brand new all-time excessive (ATH).

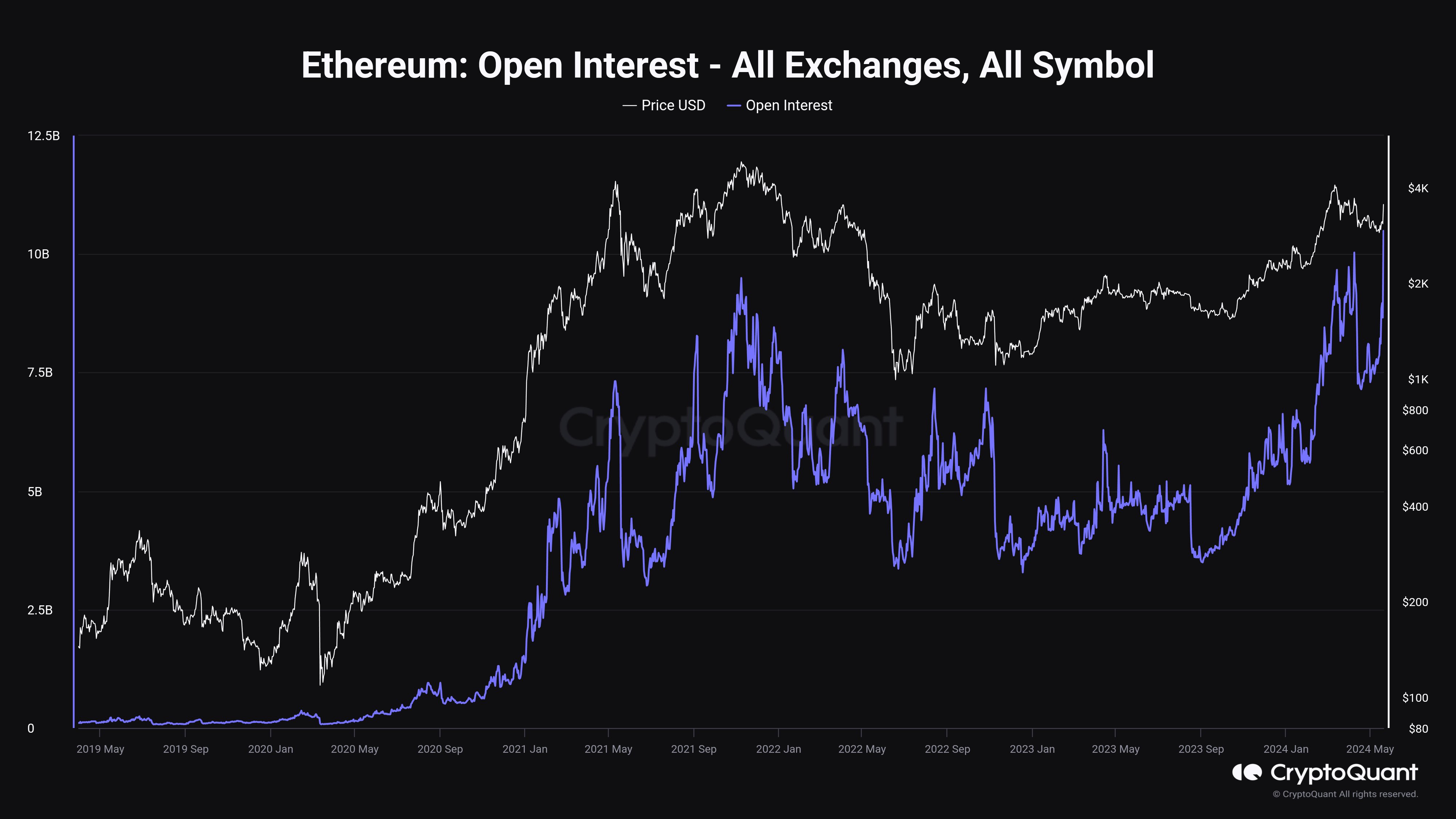

In one other X submit, CryptoQuant analysts famous that Ethereum holdings have additionally risen considerably. “Open Place” measures the whole quantity of ETH-related positions at the moment open on all derivatives exchanges.

This pattern isn’t a surprise on condition that derivatives customers have already established massive lengthy positions within the asset. Following this speedy surge, Ethereum open curiosity has managed to hit new highs.

Associated Studying

Traditionally, intense hypothesis typically leads to higher token volatility, as the danger of large-scale liquidations could be excessive throughout such durations. Due to this fact, the surge in open curiosity could possibly be an indication of some turbulent instances forward for Ethereum.

Ethereum value

To this point, in a rally fueled by ETF information, Ethereum has managed to interrupt above $3,800 ranges, a milestone the token has not reached since mid-March.

Featured photographs from Shutterstock.com, CryptoQuant.com, charts from TradingView.com