This text seems in Bitcoin Journal’s “The inscription downside”. Click on right here Get an annual Bitcoin Journal subscription.

This text is predicated on information as of November 15, 2023.

Bitcoin, not blockchain

Bitcoin, not blockchain. Over the previous two eras, this has been a outstanding meme, guiding newbies towards a pure Bitcoin life-style and away from fraudulent “cryptocurrencies” that promise extra highly effective “blockchain expertise.” Nonetheless, we’re paying extra consideration to blockchain than ever earlier than. However this time is completely different: the world is taking note of the Bitcoin blockchain. The driving force of this consideration is a brand new meta-protocol – one constructed on prime of the Bitcoin protocol – referred to as Ordinals. Ordinals are a novel approach of “naming” particular person satoshis from the Bitcoin UTXO set, however maybe extra curiously, they embrace a approach of “writing” information information to the Bitcoin blockchain. This text analyzes how ordinal numbers will influence block area necessities on the Bitcoin blockchain in 2023, and explores the challenges and alternatives this growth brings.

A technical overview of ordinal numbers

Ordinals is a protocol constructed on prime of the Bitcoin protocol. It consists of two distinct elements: ordinal idea and inscription. Ordinal Quantity Idea is a protocol for assigning sequence numbers to satoshis (the smallest subdivisions of Bitcoin) and monitoring using these satoshis in transactions. This has led to some contentious conversations about fungibility, because the market might place higher worth on one satoshi than one other, however the market is more and more on this a part of the Ordinals protocol. The second and foremost focus of this text is on inscriptions. Inscriptions enable arbitrary content material to be connected to single satoshis, turning them into digital artifacts native to Bitcoin. Maybe the only instance to elucidate inscription is to inscribe (save) a photograph to the Bitcoin blockchain (a big storage exhausting drive or repository) and assign that photograph to a single Bitcoin Satoshi. This single satoshi reveals when the inscription was inscribed into the blockchain, and that inscription or single satoshi representing the photograph may be transferred from one particular person to a different. Many individuals don’t see the worth within the assortment or buying and selling of those inscriptions, some even consult with the inscriptions as “spam” or a “denial of service assault” on Bitcoin, however a brand new market has emerged for the Ordinals protocol, this one years have had a significant influence on the form, demand and price of block area. Much more attention-grabbing are the chances that inscriptions deliver to Bitcoin, a few of which we’ll talk about additional and which many haven’t but imagined.

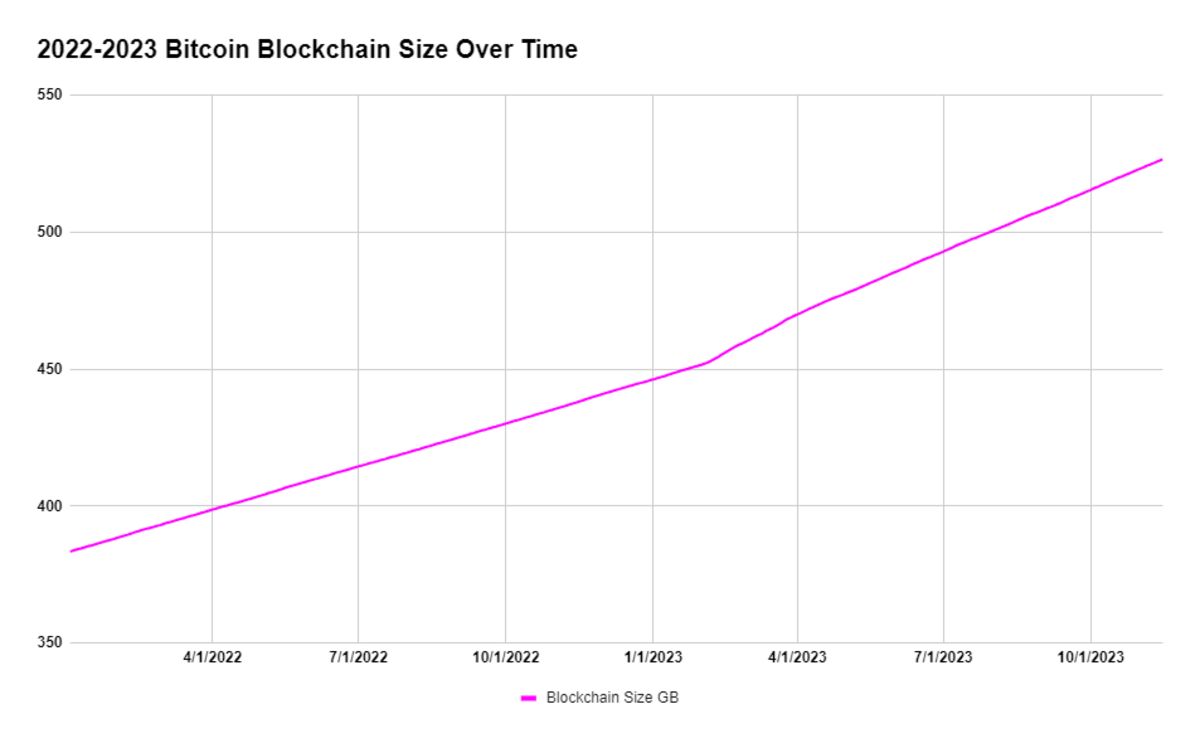

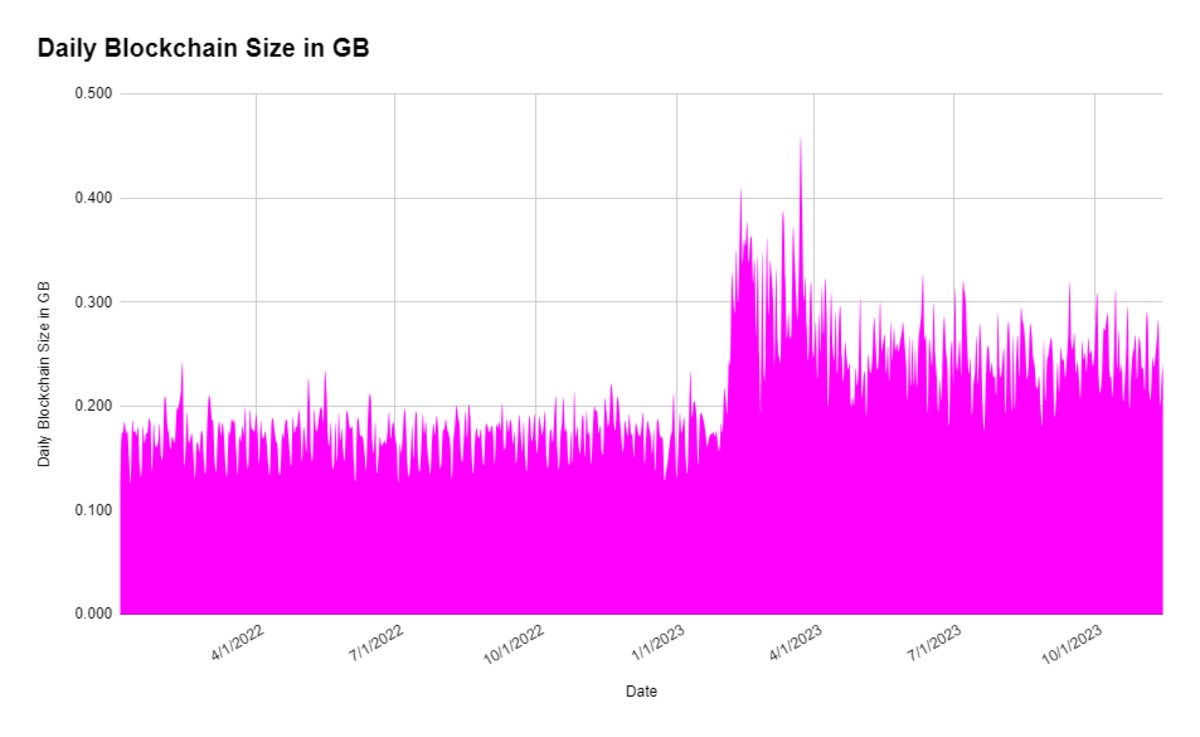

With Ordinals releasing a white paper in late 2022 and coming into manufacturing in 2023, we’re seeing vital development within the development fee of the Bitcoin blockchain. In February of this yr, you may see a transparent change within the every day development trajectory of blockchain. You will need to observe that the block measurement shouldn’t be rising, however extra block area is used each day. Block area is proscribed by the code within the Bitcoin protocol, with every block being roughly 4 MB. The chart reveals us that in February 2023, block area utilization elevated considerably.

Zooming in on the chart, you may see that the common block measurement elevated in a significant approach in February 2023, which is attributed to the widespread use of the Ordinal protocol. We’ll dive deeper into the block area within the subsequent part, however the important thing takeaway is that the trajectory of block area development has elevated, and this new demand doesn’t appear to be going away anytime quickly.

Block area requirement evaluation

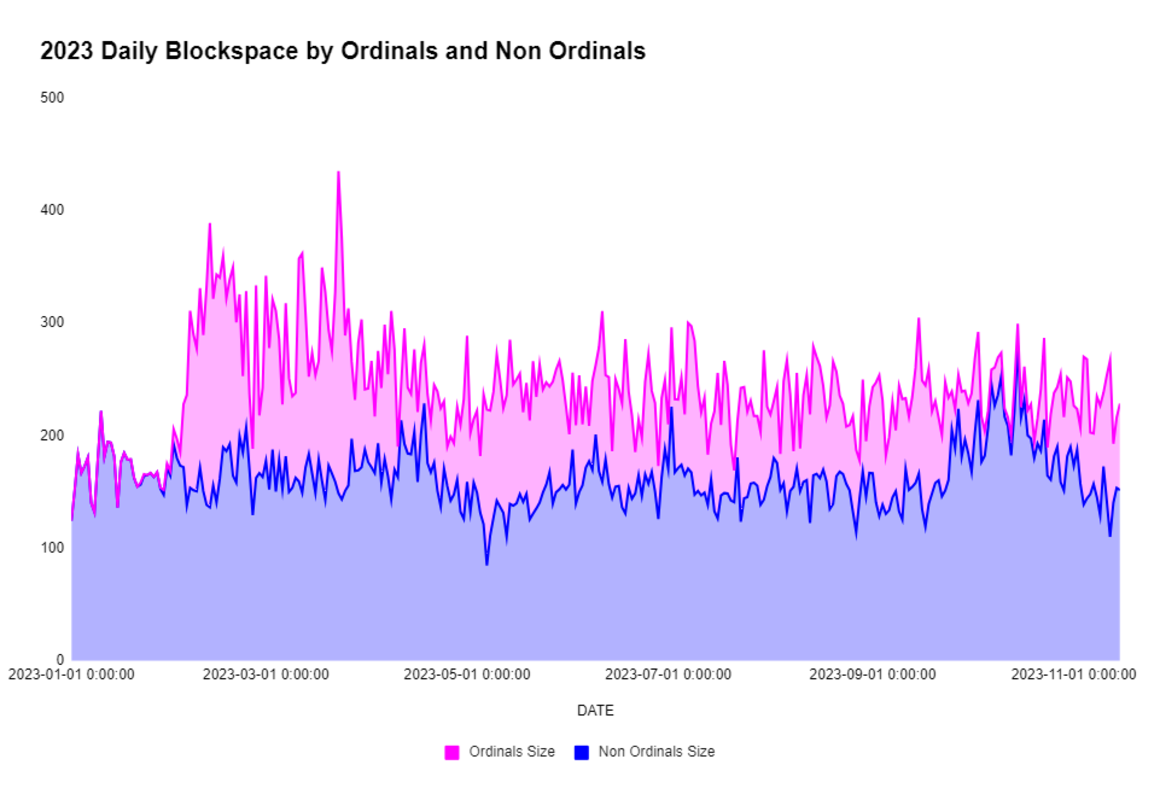

The emergence of ordinal numbers affected the market demand for the restricted block area offered by inscriptions. These inscriptions take up bytes in every block, and people who inscribe them pay a dynamic market worth for that area. For the reason that 2022 ordinal has not but appeared, we solely see the demand for block area from “financial” transactions. Now, as serial numbers come on-line, we see “financial” transactions competing with the inscriptions of block area. As a consequence of shortage of block area, solely a sure variety of bytes (and subsequently transactions) may be included in every block. With Inscription now requiring more room, a free market in block area is at work, with the market clearing out each 10 minutes or so.

As we dig additional into Inscription’s influence on Bitcoin’s block area economics, we’ll first dig into 2023 block area demand. Easy methods to begin occupying area within the block.

In February, you may see sequence numbers beginning to take maintain within the block area. In January, we noticed a median of 0.5 MB of inscriptions added to the blockchain per day, however from February by means of the remainder of the yr, a median of 85 MB of inscriptions have been added to the blockchain per day.

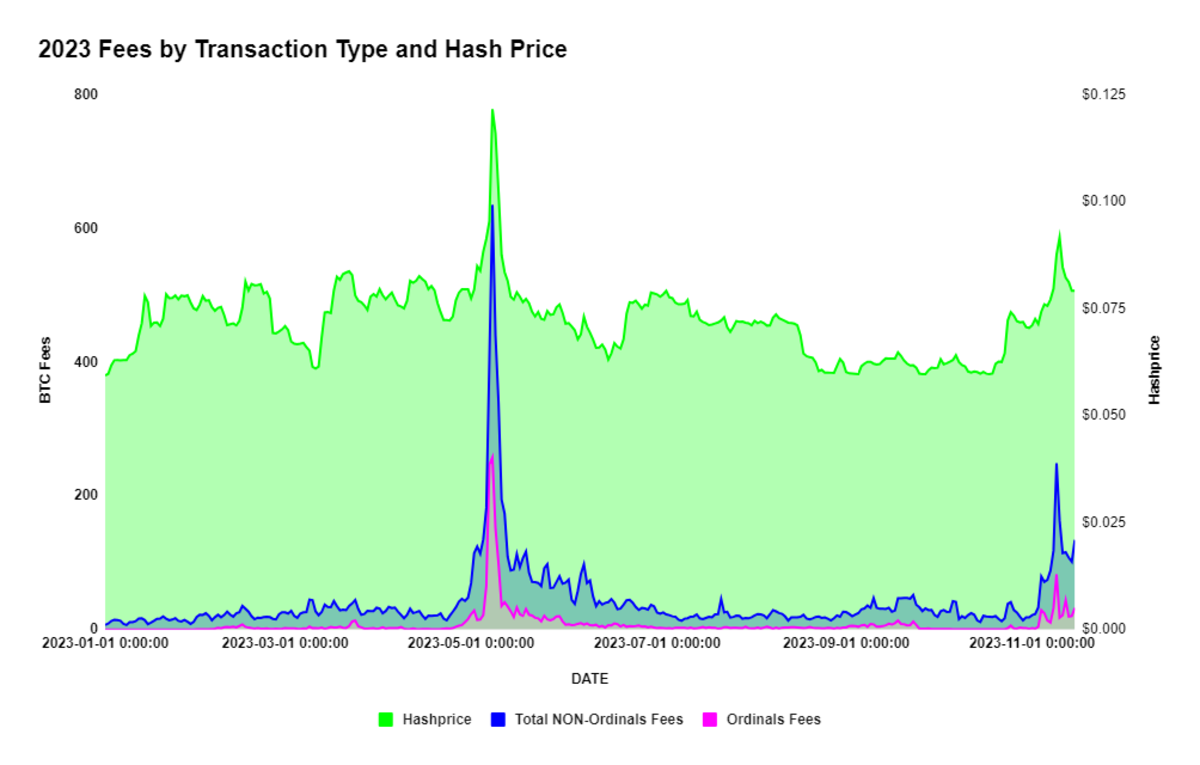

Financial influence

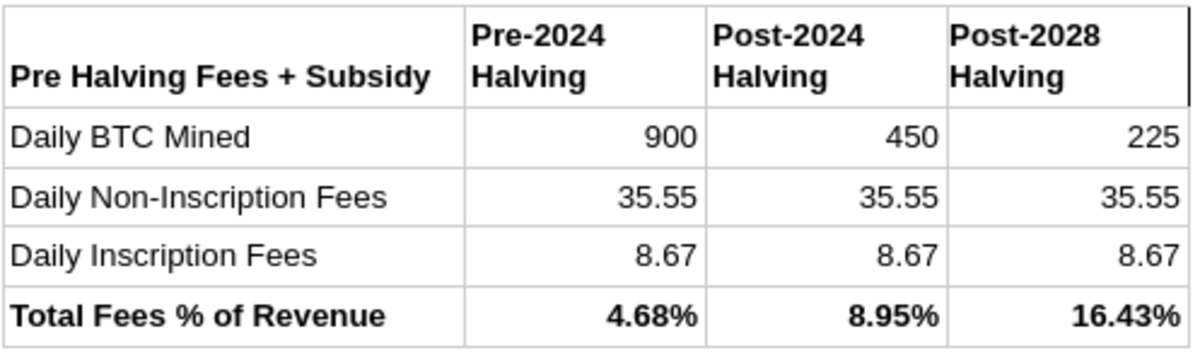

The financial influence of ordinal numbers is large, particularly by way of transaction charges and miner income. Evaluation of transaction charges in 2023 reveals that transaction charges are on an upward development, affecting each customers and miners. Miners, specifically, have benefited considerably from this development, as larger charges translate into extra income. Actually, over the previous few years, we’ve heard cries that Bitcoin is about to fail if charges don’t improve in a significant approach, and with the innovation of Ordinals, we’ve already seen charges improve considerably. Throughout January 2023, we paid a median of 12.97 BTC in charges per day, of which Inscription generated 0.005 BTC. However from February to November fifteenth, our common every day charges have been 44.22 BTC, a development of 240%, of which 8.67 BTC got here from Inscription.

Contemplating that the overall quantity of newly mined Bitcoins at present stands at round 900 BTC per day, complete transaction charges solely account for 4.5% of miners’ income. Whereas this isn’t sufficient to spice up small and medium-sized miners, it’s vital for industrial-scale miners as they’ve the added benefit of decrease electrical energy prices because of large-scale purchases. You may see a direct correlation between hashprice and transaction charges, particularly in Might 2023. We all know that as mining turns into extra worthwhile and extra miners start to reap the benefits of the elevated earnings, mining problem has exploded this yr, rising from 252 EH/s in January 2023 to 457 EH/s in November 2023. EH/s —Grew 81% in lower than a yr.

The longer term outlook and influence of halving

Because the April 2024 halving approaches, it will likely be attention-grabbing to see how blockspace dynamics change because the every day mining provide is halved. How would a hypothetical BTC worth improve make sats extra beneficial? Will we see continued demand for inscriptions, or will they change into too costly in greenback phrases? One thing else to contemplate is the emergence of latest information markets within the Bitcoin ecosystem which have the potential to deliver new purposes and future makes use of of the Bitcoin block area past conventional transactions and inscriptions. The potential of ordinal numbers to retailer completely different information varieties and the event of this information market opens up thrilling prospects for the longer term, from digital artwork storage to advanced information purposes, marking a brand new period of utility within the Bitcoin block area.

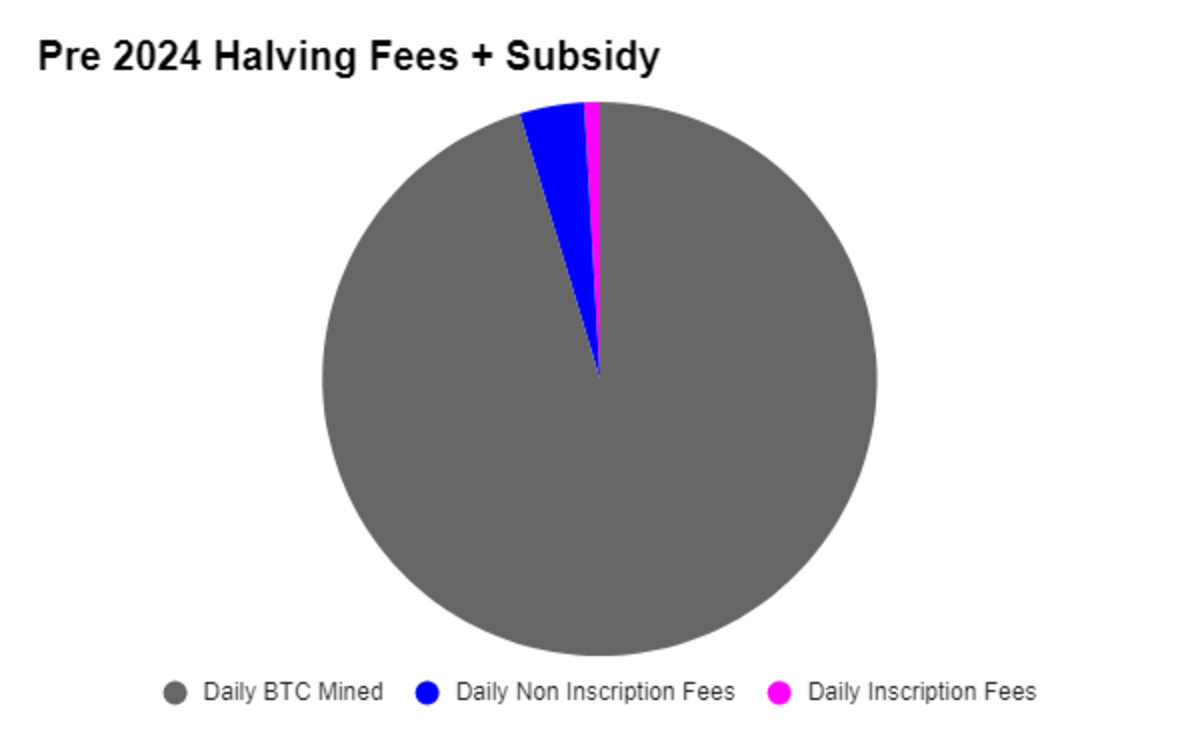

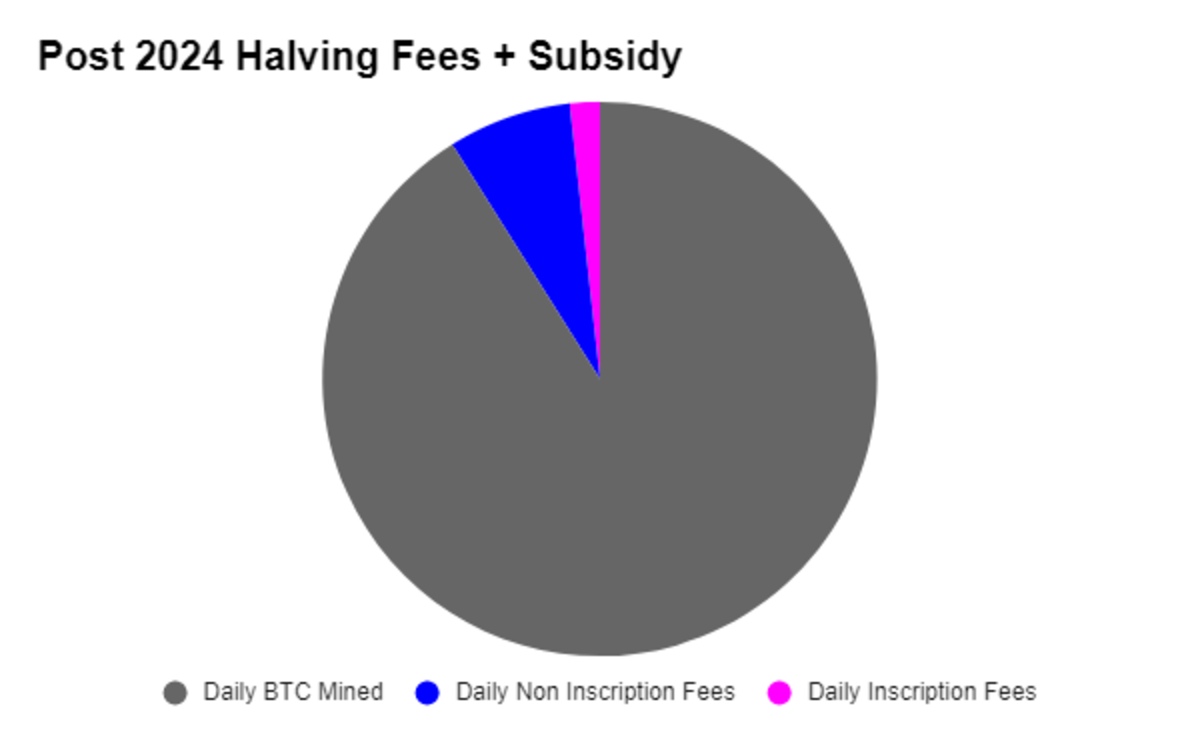

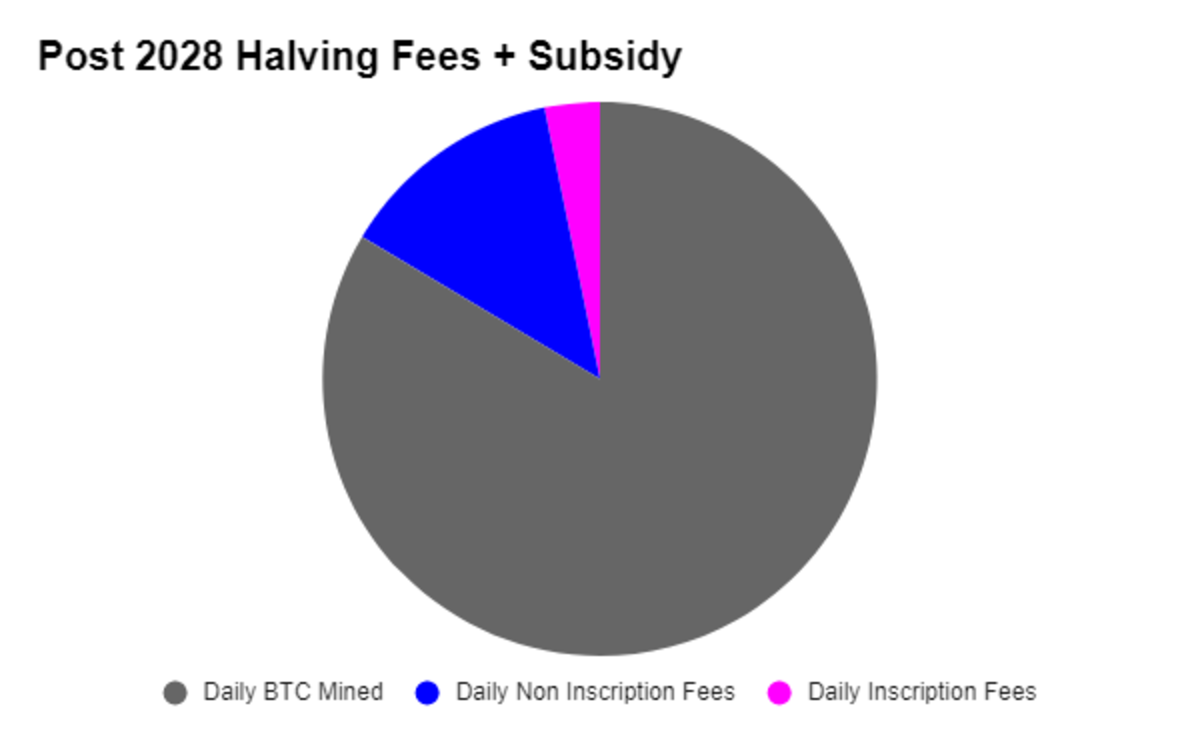

It is going to be thrilling to see what occurs to charges and subsidies earlier than and after the 2024 halving. We noticed earlier than that if the common every day earnings from transaction charges plus inscription charges is roughly equal to 4.5% of miners’ every day earnings. However what occurs after the halving? What would occur if we lived in a vacuum and saved charges flat till the 2028 halving?

If we proceed with the present state of affairs, you’ll discover that transaction charges change into extra necessary to mining income after the fourth halving and might be of serious worth within the 2028 post-halving setting. It’s exhausting to think about block area demand remaining flat between two halvings, and utilizing present demand is kind of conservative. It additionally prevents us from imagining the invention of latest methods to make use of block area.

market clears

Lastly, the emergence of ordinal inscriptions basically reshaped the Bitcoin blockchain, marking a serious shift in its technological panorama and financial dynamics. As we delve into the brand new world of Bitcoin’s evolution, we should take into account the broader implications of ordinal numbers and new makes use of for block area and their potential influence. The position of sequence numbers in shaping Bitcoin’s future turns into much more attention-grabbing because the upcoming halving will introduce new provide complexities. For my part, that is an thrilling chapter within the blockchain saga, stuffed with uncharted territory and big prospects. This isn’t about JPEG; that is a few censorship-resistant free market. Because the Bitcoin protocol continues to evolve, it stays to be seen how the market will adapt to those modifications and what different new makes use of for the block area will emerge. One factor is obvious: the journey forward might be unpredictable and unusual. However ultimately, the market cleared up.

This text seems in Bitcoin Journal’s “The inscription downside”. Click on right here Get an annual Bitcoin Journal subscription.