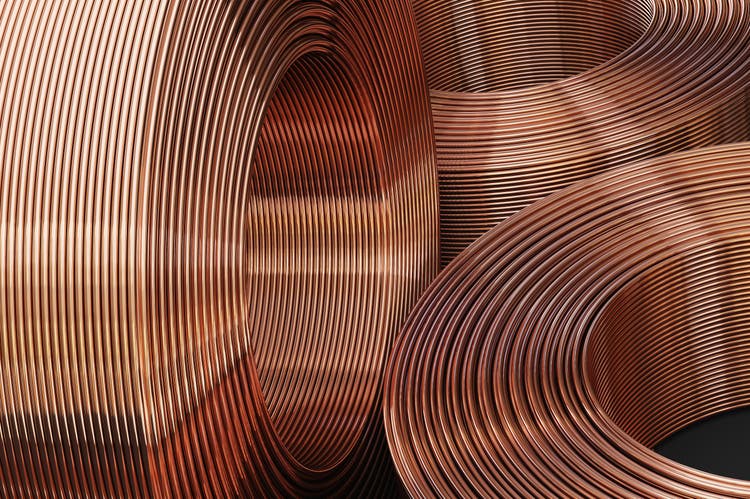

SimoneN/iStock through Getty Photographs

Hedge fund supervisor Pierre Andurand, one of many world’s most well-known commodity merchants, believes that as provide struggles to maintain up, copper costs will proceed to rise for a very long time and will practically quadruple within the subsequent few years to succeed in $40,000/ Ton. Demand surged.

French fund managers instructed Caijing Monetary Occasions On Friday, he argued that demand for copper will outstrip provide within the second half of the last decade and that copper will play a central position within the international vitality transition, sending copper costs up 28% yr up to now to a document excessive of $11,104.50/metric ton earlier this week. time time.

“Our copper demand progress will double as a result of electrification of the world, together with electrical autos, photo voltaic panels, wind farms, but in addition navy makes use of and knowledge facilities,” Andurand mentioned. Monetary Occasions.

Andurand can be bullish on different commodities, together with aluminum, which he believes will proceed to rise for comparable causes to copper as it will probably displace the pink metallic, however he now not expects crude oil costs to rise considerably.

“Geopolitical dangers like Russia and Gaza haven’t had an influence on provide, so I believe that is why oil costs are comparatively secure, and I count on oil costs to remain that approach,” he mentioned.

U.S. copper futures fell for the primary time this week after rising for eight consecutive weeks, with the front-month Comex Might contract (HG1:COM) -5.5% This week it reached $4.7785/MMBtu.

As well as, the entrance month Might Comex Gold (XAUUSD:CUR) ended -3.3% Might Comex silver (XAGUSD:CUR) closed this week at $2,332.50 per ounce. -2.3% to $30.330 per ounce.

ETF: (NYSE:CPER), (NYSE: COPX), (OTC:JJCTF), (GLD), (GDX), (GDXJ), (JAU), (NUGT), (PHYS), (GLDM), (AAAU), (SCHOOL), (BAR), (OUNZ ), (SLV), (PSLV), (SIVR), (SIL), (SILJ)

Macquarie analysts mentioned progress in international copper demand was offset by slower demand progress in China, which in flip modified investor sentiment in direction of copper.

“Given present basic indicators, this transfer seems overdone and the chance of a pointy correction, even when it has not but begun, may be very excessive,” the corporate mentioned.