In per week of consolidation within the cryptocurrency market, Uniswap’s native token UNI bucked the pattern and soared greater than 15%, surpassing the $10 mark. The bullish transfer comes amid constructive developments inside the Ethereum ecosystem and Uniswap’s ongoing authorized battle with the U.S. Securities and Change Fee (SEC).

Associated Studying

Using the Ethereum Wave

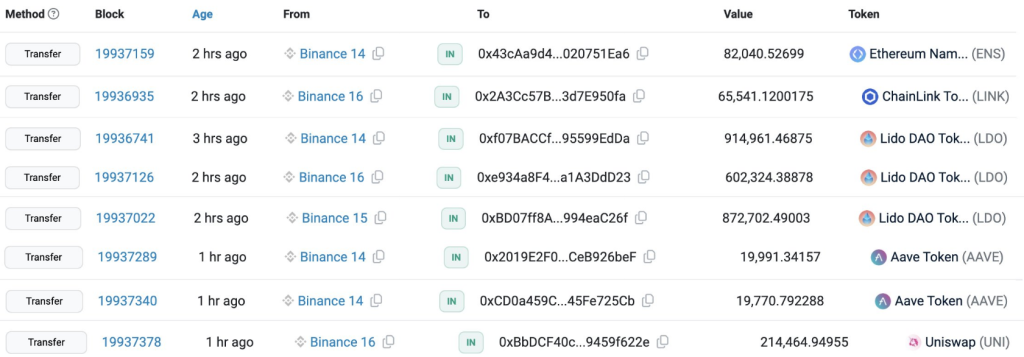

Along with the authorized dispute, the present momentum inside the Ethereum ecosystem can be driving the worth of UNI larger. On-chain knowledge reveals a lot of whales withdrawing funds from cryptocurrency exchanges following information of a possible Ethereum ETF spot.

One other new pockets withdrew 213,166 UNI ($1.96 million) from the next deal with: #binance Simply now. pic.twitter.com/kyOBv0TB5G

— Lookonchain (@lookonchain) May 24, 2024

This pursuit of safety, coupled with the general bullish sentiment surrounding Ethereum, is having a ripple impact that advantages UNI, a key participant within the Ethereum DeFi area.

From a technical perspective, UNI’s breakout from the month-to-month consolidation section paints a promising image. Technical indicators and on-chain knowledge each counsel that UNI’s worth might rise by 25%.

The coin’s current surge indicators a possible bull run, with analysts anticipating a worth goal of $12.80 if present momentum continues.

Santiment’s Age Consumed Index provides gasoline to the hearth, measuring the motion of dormant tokens. Surges within the index usually precede worth will increase, and the newest rise in late April seems to be indicative of UNI’s present upward pattern.

This on-chain indicator reinforces UNI’s bullish outlook and reveals traders are realizing its potential.

Bulls take energy, quick sellers undergo losses

The current worth improve has additionally been accompanied by a big improve in buying and selling exercise. Knowledge from Coinalyze reveals that Uniswap liquidated greater than $1 million on the final day.

The vast majority of these liquidations (over $750,000) had been in brief positions, indicating that merchants who had been quick UNI had been feeling the pinch. As extra merchants go lengthy UNI, the surge in open curiosity additional strengthens the bullish grip on the coin’s worth.

Uniswap versus SEC

This present of defiance instilled confidence in traders, who seen it as a constructive signal for Uniswap’s future. The favored decentralized change (DEX) lately obtained a Wells Discover from the regulator claiming that UNI is a safety. Nevertheless, Uniswap has vowed to problem this declare, claiming that the SEC’s arguments are weak.

Associated Studying

The U.S. Securities and Change Fee’s case towards Uniswap stays unresolved, and a detrimental consequence might dampen investor sentiment. A broader market correction might nonetheless have an effect on UNI’s worth.

Featured pictures are from Wallpapers, charts are from TradingView