Current analytical insights from FireCharts 2.0 point out vital operations by main Bitcoin stakeholders (sometimes called “whales”) which are impacting the cryptocurrency’s value actions. These stakeholders are altering liquidity patterns, suggesting they’re strategically pushing for extra tightly managed buying and selling scope.

What Bitcoin whales are doing

In keeping with information from Materials Indicators, a complicated buying and selling evaluation materials, there was a transparent adjustment within the distribution of liquidity within the Bitcoin order ebook. Particularly, at increased value factors, promote liquidity decreases, whereas purchase liquidity will increase from $60,000 to $67,000. This dynamic will squeeze Bitcoin’s value right into a tighter vary, one thing the platform anticipates because the digital asset rises above $52,000.

Discussions about Bitcoin’s value trajectory are rife with hypothesis that Bitcoin’s value might rise to $73,000, particularly after its rebound from the lows of $52,000. Regardless of the current highs close to $70,600, which resulted in a pointy rejection, market sentiment stays cautiously optimistic. “There have been many requires a value enhance to $73,000 since late final week, and there are respectable the reason why this can be a near-term goal and why, regardless of the $70,600 rejection we noticed on Monday, It is nonetheless doable,” factors out the fabric index.

Associated Studying

From a macroeconomic perspective, Bitcoin’s prospects seem extraordinarily optimistic. “The outlook for Bitcoin is certainly as constructive as ever,” a consultant from Materials Indicators stated in a current livestream. They didn’t reiterate particular particulars, urging viewers to revisit final week’s evaluation for a deeper understanding.

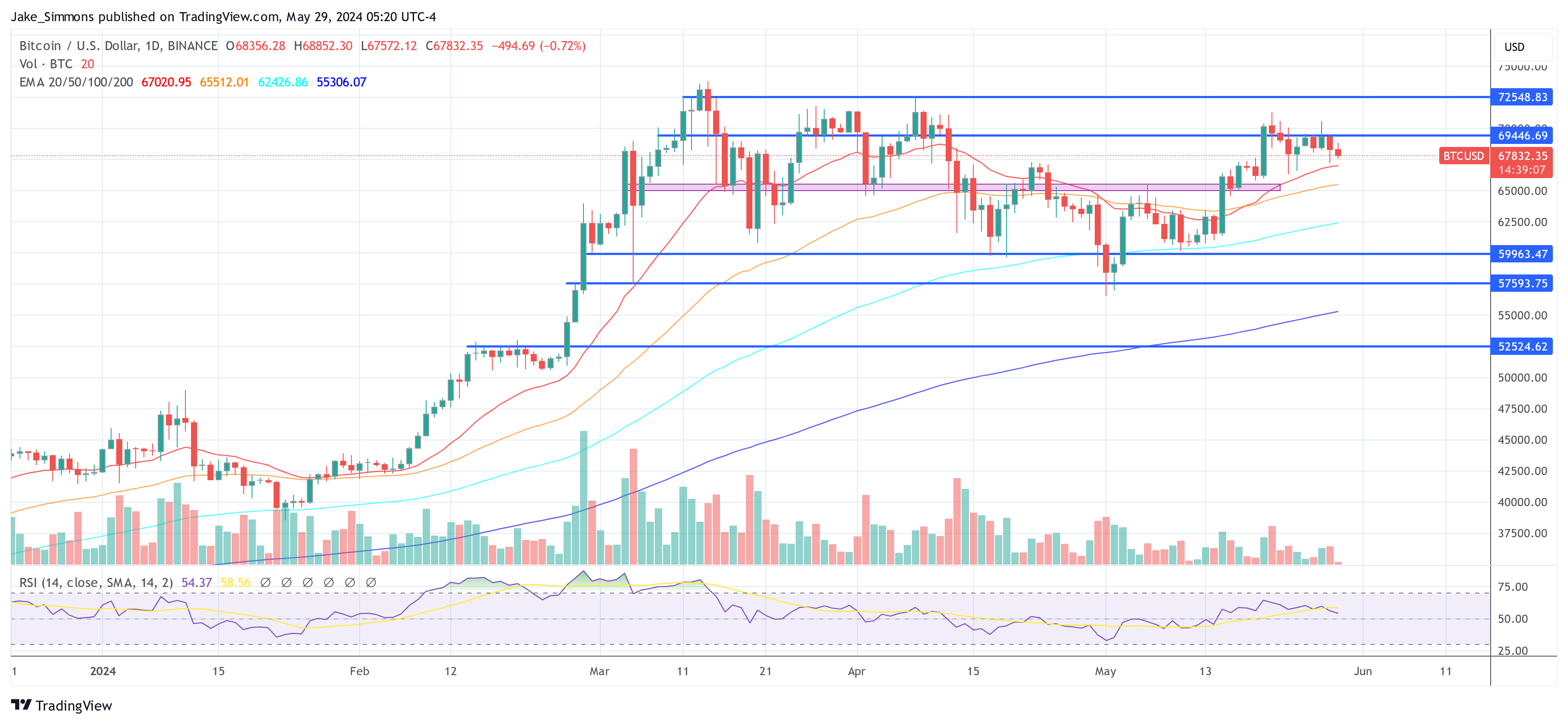

Compared, technical evaluation paints a extra nuanced image. Regardless of the favorable macro outlook, Bitcoin has been unable to verify a resistance/assist (R/S) flip at $69,000 – a key stage to verify bullish momentum. This continued failure is emblematic of bulls’ efforts to keep up upward stress and safe new all-time highs (ATH). By combining order information with technical indicators, analysts noticed a gradual decline in ask liquidity, initially from round $75,000-76,000 to extra lately nearer to $70,000-71,500.

Wanting forward, the important thing query is: How low can Bitcoin truly go earlier than discovering substantial assist? To unravel this drawback, analysts at Materials Indicators mix technical evaluation with real-time order information. The convergence of Bitcoin’s 21-day, 50-day, and 100-day shifting averages round $65,000 to $66,000 gives a compelling case for potential assist. Specifically, the 21-day shifting common is favored for its historic reliability as a resistance and assist stage.

Associated Studying

Order ebook information corroborates this evaluation, exhibiting promote liquidity with resistance above $70,000, whereas purchase liquidity has strategically dropped to $58,000. The very best focus of bid liquidity exhibits the strongest assist at $60,000 and $65,000, with assist round $66,000 and $67,000.

Regardless of the advanced interaction of things within the brief time period, the long-term outlook stays extraordinarily constructive. The basic query available in the market is when a respectable breakout will happen, not if. A have a look at the order ebook confirmed greater than $200 million in asking costs between $71,000 and $75,000, whereas bids ranged from $65,000 to $67,000 for about $90 million. If ask liquidity doesn’t diminish, bid liquidity might want to strengthen considerably to set off a sustainable breakout above $70.

In keeping with Materials Indicators, essentially the most favorable situation is for Bitcoin to ascertain a stable consolidation vary above $65,000, confirm the R/S flip at $69,000, and stabilize above that stage earlier than focusing on a brand new ATH. Such a improvement not solely confirms the bullish development but additionally paves the way in which for continued upward momentum primarily based on present order developments and technical evaluation. They imagine this trajectory will present the healthiest market improvement primarily based on present situations.

At press time, BTC was buying and selling at $67,832.

Featured picture created with DALL·E, chart from TradingView.com