introduce:

Luxor Know-how’s newest Q1 2024 Hashrate Index report takes an in-depth take a look at the efficiency of the Bitcoin mining business following the fourth Bitcoin halving. The report offers key insights into key metrics comparable to Bitcoin hash price, hash price costs, hash price forwards and Bitcoin mining shares, highlighting the adaptability of Bitcoin mining and the challenges confronted by miners in a world of three.125 BTC block subsidies problem.

Bitcoin Hash Worth and Computing Energy Fluctuations

Now that the fourth halving has handed, Bitcoin miners are paying explicit consideration to 2 metrics: hash worth and community hash price.

Hash worth is a measure of how a lot income a miner can earn per day whereas hashing utilizing a completely paid-per-share mining pool. Then, all else being equal, we should always anticipate the halving (i.e. the Bitcoin block subsidy halving) to halve the hash worth.

Nevertheless it did not occur instantly. Hash costs skilled excessive volatility each earlier than and after the halving. Inside an hour of the halving going down, hash worth dropped to $74/PH/day, however it shortly rose to a peak of $183/PH/day as transaction charges spiked with rune buying and selling exercise. Runes’ hype was short-lived, with hash costs shortly falling to an all-time low of $44/PH/day earlier than stabilizing at present ranges of $50/PH/day. The earlier all-time low of hashrate costs was $55/PH/day, which occurred in the course of the 2022 FTX crash, and the brand new hashrate worth actuality highlights the brutal economics that miners now face.

This brings us to the following main indicator of the halving’s impression: computing energy. Within the first quarter of 2024, Bitcoin’s seven-day common computing energy elevated by 19%, reaching 611 EH/s, and can develop by one other 6% in April, reaching a report excessive of 650 EH/s. Because the mud settles after the halving, Bitcoin’s computing energy has dropped by 10% from its all-time excessive to 580 EH/s.

Given the squeeze on mining earnings and the approaching summer season, which is able to possible end in lowered energy consumption at industrial-scale mines in locations like Texas, which poses a headwind to hashrate progress, we anticipate Bitcoin’s hashrate to solely see marginal beneficial properties this yr improve.

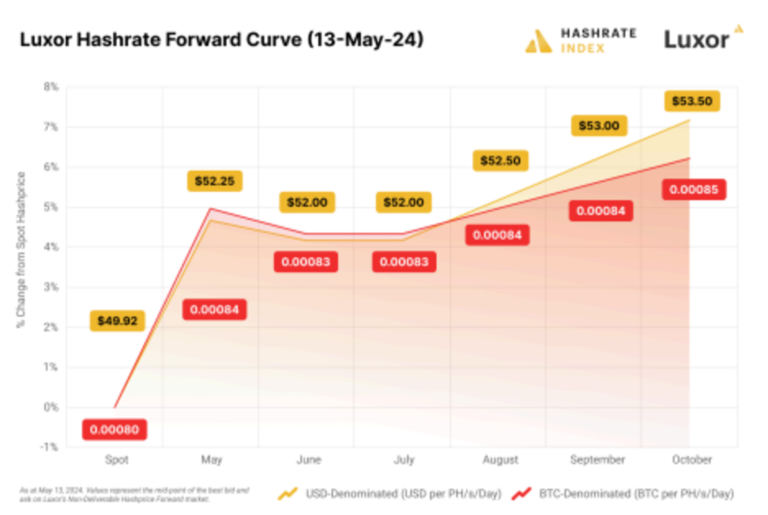

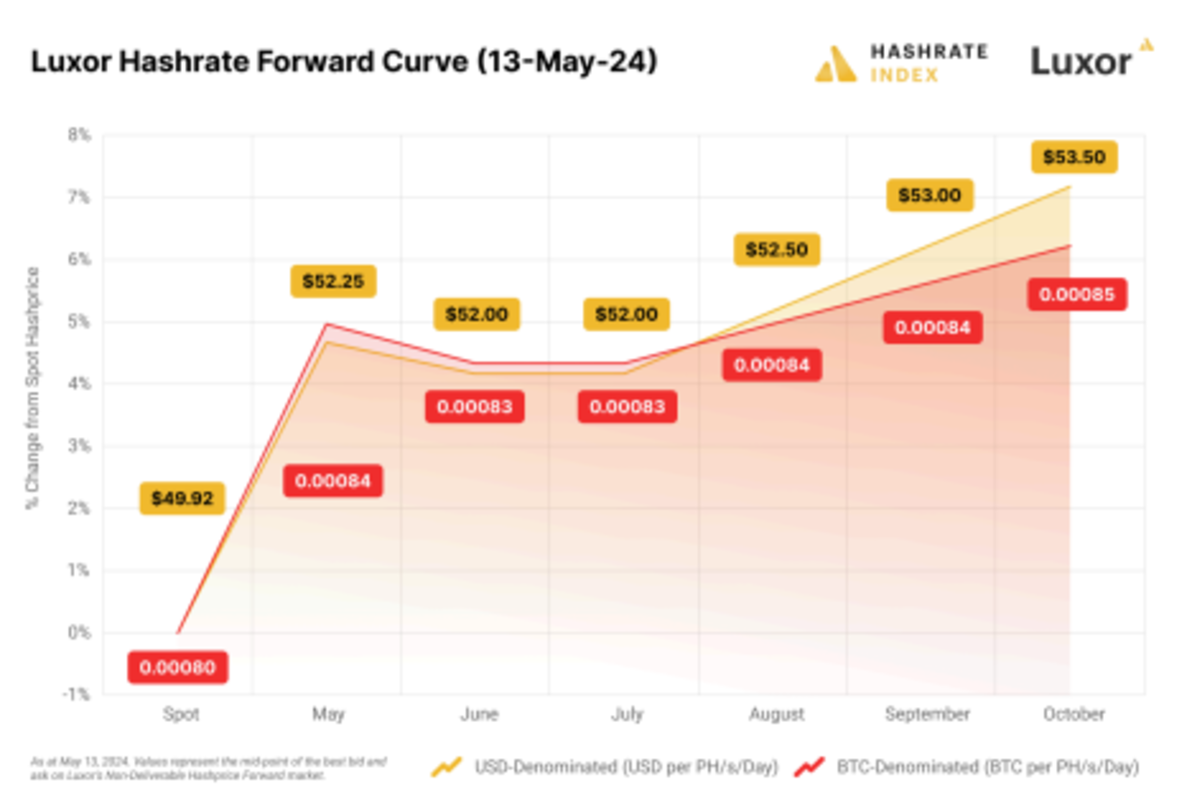

Hashprice is buying and selling as Contango

It’s price noting that merchants within the hashrate market imagine that hashrate costs have bottomed out (at the least for now).

Luxor’s hash energy forwards are a Bitcoin mining by-product that permit miners and different contributors to purchase and promote hash energy at a set worth at a future date. The hash energy ahead commerce makes use of contango, which implies that hash energy merchants anticipate The value of computing energy within the coming months might be greater than the present spot worth. This reveals the bullish sentiment amongst hashrate ahead merchants, who predict that the value of hashrate might improve as a consequence of greater transaction charges or decrease mining issue.

As we mentioned within the earlier part, energy brownouts in mining hotspots comparable to Texas may cause hashrate to quickly go offline, thereby rising hashrate costs and mining earnings.

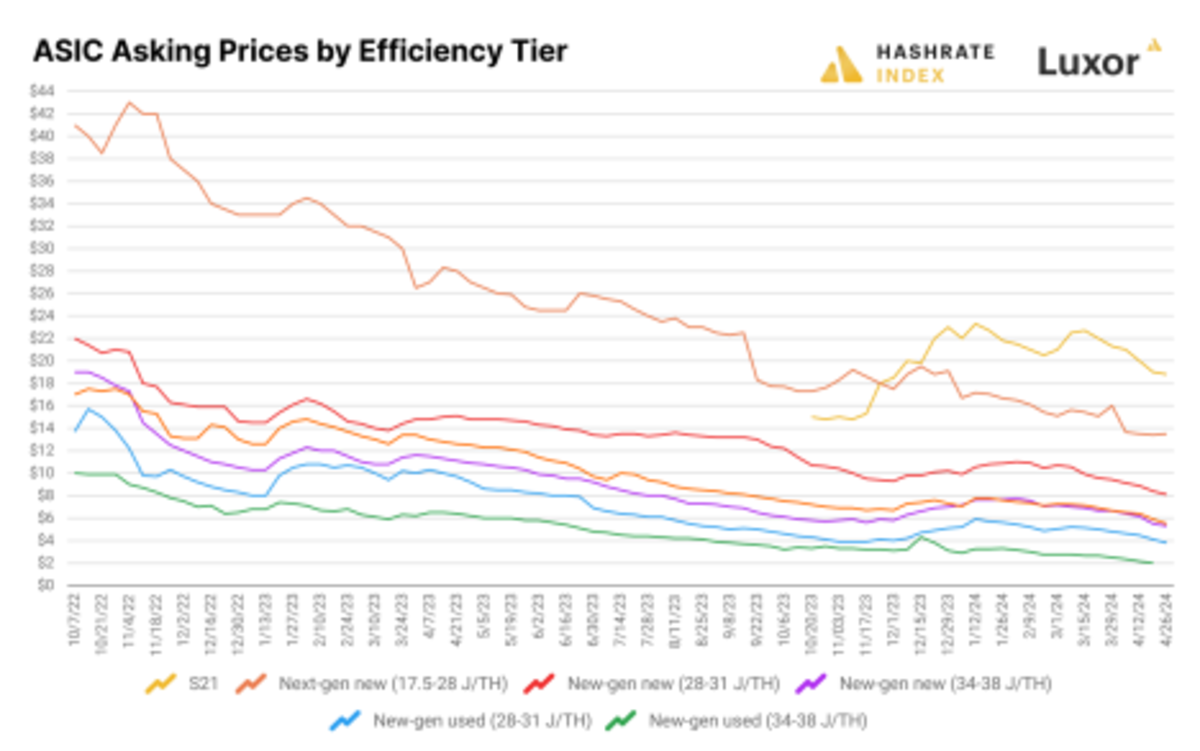

The ASIC market is experiencing worth discovery

Because the halving approaches, the ASIC market has skilled a big slowdown, with costs falling considerably throughout numerous fashions regardless of greater common hash costs within the first quarter of 2024. As anticipated, the Antminer S21’s worth premium has elevated in comparison with different fashions, suggesting that Bitcoin miners are strategically shifting to extra environment friendly {hardware} to mitigate the post-halving income decline.

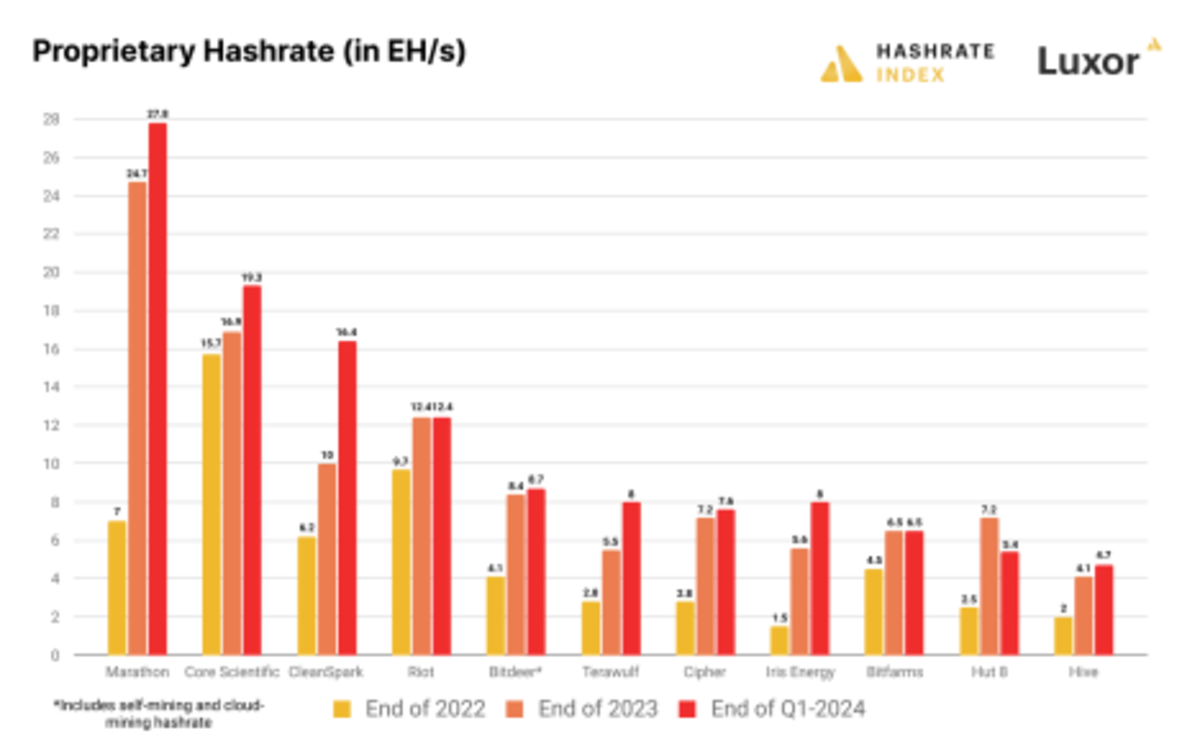

Bitcoin mining shares are in a hashrate and effectivity arms race

All main public Bitcoin miners elevated hashrate in 2023, however some miners took extra aggressive steps to extend hashrate in early 2024. Its ASIC fleet is provided with the newest {hardware} to remain aggressive within the computing energy arms race and scale back working prices per unit of computing energy.

Forecasts and Outlook to 2024 and Past

Barring a significant worth surge and/or a bull run in transaction charges, 2024 might be a difficult yr for Bitcoin miners. Now greater than ever, transaction charges will play an important function in miners’ earnings.

Firms that didn’t accomplish that in 2023 might want to get inventive with their working methods in terms of coping with the brand new regular. Along with utilizing the newest ASIC fashions to optimize the facility effectivity of their fleet and acquire extra favorable energy contracts, they will additionally undertake aftermarket firmware to optimize their ASICs, make use of extra subtle hedging methods, and discover various income streams or locations to chop Working prices.

Within the US and Canada, we anticipate M&A to drive consolidation as corporations reap the benefits of hearth sale costs on ASICs and mining amenities. Because the mining business continues to mature, it’ll turn into extra entrenched and built-in with the vitality system, and we imagine the present halving period will speed up this integration as miners might be pushed in the direction of energy manufacturing sources to reap the benefits of the bottom doable energy prices .

It is a visitor submit by Alessandro Cecere and Colin Harper. The views expressed are fully their very own and don’t essentially mirror the views of BTC Inc or Bitcoin Journal.