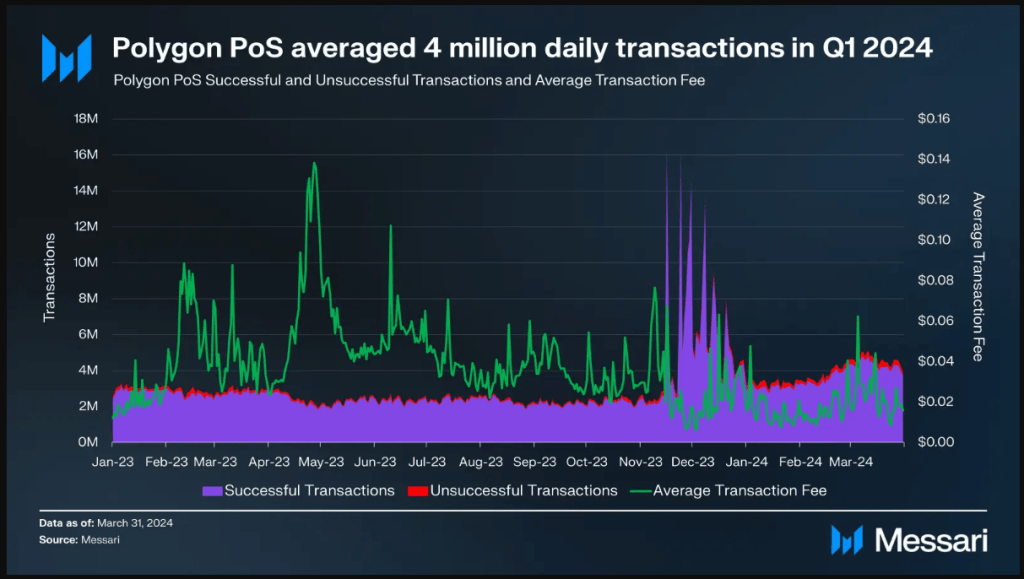

Polygon (MATIC), a layer 2 scaling resolution for the Ethereum blockchain, finds itself in an odd place. The most recent information from Messari paints an image of a vibrant Web: every day energetic addresses surged by almost 120%, new consumer registrations surged by 70%, and every day transactions reached a staggering 4 million. Nonetheless, beneath this bustling floor is a troubling undercurrent: quarterly income fell 19% from the earlier quarter and dropped considerably by 40% year-on-year.

Associated Studying

Polygon: The recent net

Polygon’s consumer base is clearly smitten. The primary quarter of 2024 noticed a land rush, with new addresses flooding the community at an unprecedented price. The surge in consumer adoption translated right into a buying and selling frenzy, with every day interactions on the platform quadrupling.

The decentralized finance (DeFi) subject on Polygon can be booming, with the full worth locked (TVL) of DeFi tasks climbing 30% from the earlier quarter. The non-fungible token (NFT) ecosystem on Polygon additionally received a shot within the arm, with gross sales rising by almost 20%.

The earnings thriller

So why the lengthy faces amid the celebratory confetti? The reply lies in Polygon’s shrinking income streams. Whereas exercise has grown exponentially, the community’s funding has taken successful.

Income of $7 million within the first quarter of 2024 pales compared to the $10 million it earned within the earlier quarter and the $12 million it earned in the identical interval final yr. The disconnect between booming financial exercise and falling incomes is the million-dollar query that has analysts scratching their heads.

MATIC market cap at present at $6.8 billion. Chart: TradingView.com

Payment fiasco or money circulate?

There are two principal suspects behind this earnings paradox. The primary wrongdoer could also be Polygon’s buying and selling price construction. Maybe, in an effort to appeal to extra customers, the community lowered its charges, and though transaction quantity elevated considerably, total income suffered.

One other chance lies in a possible shift in Polygon’s income stream. Maybe income from a particular supply, equivalent to grants or partnerships, fell, and progress in different areas failed to completely compensate for that decline.

Associated Studying

what sort of future

Polygon is dealing with a crunch. The community’s capability to draw customers and foster a vibrant DeFi and NFT ecosystem is simple. Nonetheless, its long-term sustainability may very well be in danger if it fails to unravel its income puzzle. Going ahead, Polygon’s transparency about its price construction and income sources will probably be important to allay investor considerations.

Moreover, exploring different income fashions, equivalent to premium service choices or strategic partnerships, could also be key to unlocking Polygon’s full monetary potential.

Featured photographs from Zameen.com, charts from TradingView