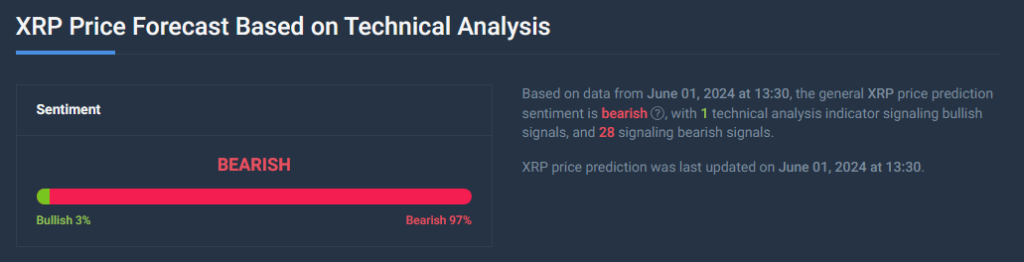

Cryptocurrency buyers are holding a detailed eye on Ripple (XRP) as technical indicators paint a worrying image for the altcoin’s value. After 4 consecutive days of closing under the 20-day exponential transferring common (EMA), XRP has entered what many analysts take into account to be bearish territory.

Associated Studying

This technical indicator reveals a potential shift in market sentiment, with the typical value of XRP over the previous 20 days appearing as resistance. With costs now under that key benchmark, analysts fear demand could also be about to fall.

As of writing, XRP is buying and selling at $0.52, down 0.3% up to now 24 hours and three.1% up to now seven days, in accordance with Coingecko.

Demand for XRP loses momentum

Including gas to the bearish hearth, XRP’s momentum indicator supplies insights into the power and path of the value motion. Each the Relative Power Index (RSI) and the Cash Move Index (MFI) are presently buying and selling under the impartial level. This means that the shopping for stress behind XRP is waning and buyers could look to promote somewhat than accumulate.

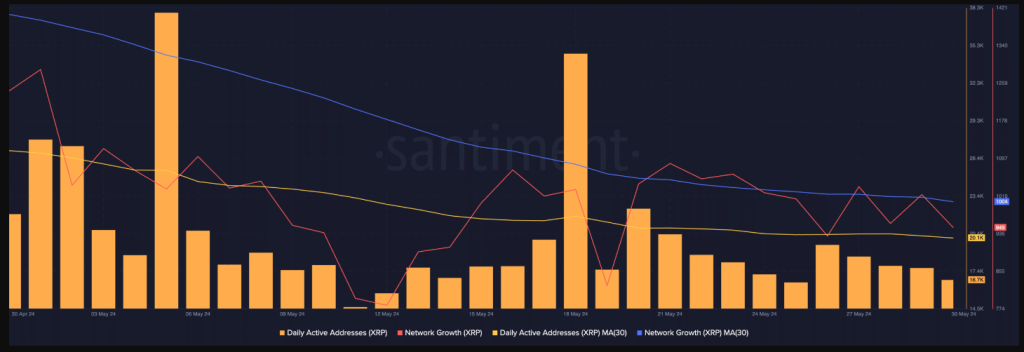

The sharp drop in XRP’s lively on-chain addresses additional weakened market sentiment. In keeping with information from Santiment, the variety of every day lively addresses on the XRP community has dropped by 30% up to now month. This drop is commonly seen as a precursor to a value crash, because it indicators a decline in total net exercise and person engagement.

Benefiting from an financial downturn?

Nonetheless, XRP bulls nonetheless see some hope. An fascinating information level reveals that every day merchants are nonetheless managing to make earnings. An evaluation of earnings and losses on XRP’s every day buying and selling quantity reveals that for each commerce that led to a loss, 1.16 trades generated a revenue. This means that regardless of the general bearish sentiment, short-term buying and selling alternatives could exist for expert buyers capable of make the most of market volatility.

The MVRV ratio supplies a unique perspective

One other issue that will entice some buyers is XRP’s destructive market worth to realized worth (MVRV) ratio. This metric primarily compares the present market value of XRP to the typical value of buying all XRP tokens.

The destructive MVRV ratio reveals that XRP is presently undervalued, which might present a shopping for alternative for buyers trying to commerce the asset under its historic value factors.

Associated Studying

XRP Worth Prediction

In the meantime, whereas technical indicators mirror bearish market sentiment, present XRP value predictions level to a 20% rise to $0.626627 by July 1, 2024. The Worry & Greed Index is at 72, indicating a excessive diploma of greed amongst buyers, indicating sturdy shopping for habits, however there’s additionally a danger of overbought situations and a potential value correction if sentiment adjustments.