Kwakot

NAREIT has its REITweek convention subsequent week, so now is an efficient time to search out out which REIT shares the SA Quant system has chosen as one of the best performers. Of the 114 shares that seem when every REIT class is included within the SA Inventory Screener, two The highest three SA Quant scores are cannabis-focused REITs.

Hashish REIT NewLake Capital Companions (OTCQX:NLCP) ranks highest amongst Robust Buys on SA Quant, adopted by retail REIT CTO Realty Progress (New York Inventory Alternate: Chief Know-how Officer) and modern industrial actual property (NYSE: IIPR), one other hashish REIT.

NLCP obtained prime marks for profitability, momentum and EPS revisions beneath the SA Quant system, whereas IIPR scored A+ for development and momentum.

CTO, additionally owns shares of web lease REIT Alpine Earnings Property Belief (NYSE: PINE), incomes prime marks for development and earnings per share revisions.

InvenTrust property (NYSE: IVT), the proprietor of multi-tenant retail properties within the Solar Belt, typically centered round grocery shops, ranked No. 4 within the screening with an EPS revision of an A+ mark.

Rounding out the highest 5 is Important Properties Realty Belief (NYSE: EPRT), which owns single-tenant properties and leases them to middle-market firms akin to eating places, automotive washes, gear firms, and medical and dental companies, has carried out greatest when it comes to development and profitability.

Trying on the common Wall Avenue ranking for these 5 firms, NewLake Capital (OTCQX:NLCP), CTO Realty (CTO), and Important Properties (EPRT) are all rated “Robust Purchase.”

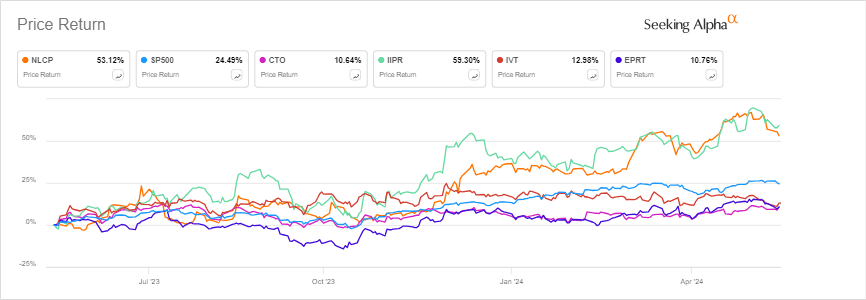

Of the 5 shares, hashish REITs have carried out greatest over the previous yr, with IIPR up 59% and NCLP up 53%, simply beating the S&P 500’s 24% achieve.

Two of those 5 firms shall be featured at REITweek – InvenTrust (IVT) on June 4 at 9:30 a.m. ET and CTO Realty (CTO) on June 5 at 3:30 p.m. Look.

A complete of 14 REITs are rated “Robust Purchase” by the SA Quant system. Different firms embody: Host Accommodations & Resorts (HST), Nationwide Well being Traders (NHI), Kite Realty Group (KRG), Cousins Properties (CUZ), Vici Properties (VICI), Alpine Earnings Property Belief (PINE), NetstREIT (NTST) and EPR properties (EPR).