In a brand new article titled “The Idiot’s Group,” Arthur Hayes, co-founder of cryptocurrency alternate BitMEX, is outspoken and significant of latest macroeconomic developments and their influence on the cryptocurrency market. Identified for his direct and sometimes provocative commentary, Hayes makes use of a mix of technical evaluation, central financial institution criticism and foreign money market insights to construct a case for what he sees because the return of the Bitcoin and crypto bull market.

A bunch of “fools”

He first emphasised the significance of the dollar-yen alternate charge as a macroeconomic barometer. Hayes believes that this indicator has an important influence on world monetary stability and coverage choices. “The dollar-yen alternate charge is an important macroeconomic indicator,” he asserted.

Hayes revisited his earlier proposal for a broad dollar-yen swap between the Federal Reserve (Fed) and the Financial institution of Japan (BOJ), arguing that such a transfer would empower Japan’s Finance Ministry to intervene via focused intervention. Boosting the Japanese yen in overseas alternate markets. Regardless of the theoretical advantages of this technique, Hayes famous with sarcasm and dismay that the G7 nations, which he calls the “Group of Fools,” have chosen a special route.

Associated Studying

The narrative then turns to a important examination of G7 central financial institution methods. Hayes identified that there are clear variations in rates of interest between main economies, with Japan sustaining rates of interest close to zero whereas different nations are hovering round 4-5%. He criticized typical knowledge in favor of rate of interest cuts as a software to handle inflation, with G7 nations typically concentrating on charges at 2% regardless of various financial circumstances.

“G7 central banks (excluding the Financial institution of Japan) have all raised rates of interest sharply in response to hovering inflation,” Hayes wrote. Nevertheless, he highlighted shock charge cuts yesterday by the Financial institution of Canada and the European Central Financial institution amid prevailing inflationary developments. , hinting at a deeper, unspecified financial technique aimed toward boosting the yen amid geopolitical and financial tensions with China.

He described the transfer as an finish to the “kabuki theater of charge hikes” that he stated was aimed toward sustaining the dominance of a worldwide monetary system dominated by Pax Americana.

Why the Bitcoin and Cryptocurrency Bull Run Returns

It’s towards this backdrop that Hayes turns to the implications for crypto markets. Trying forward, Hayes turned his sights to the cryptocurrency market, displaying that these latest adjustments portend a fortuitous setting for digital asset investing. Hayes speculated that regardless of greater inflation, coordinated motion by central banks to chop rates of interest is setting the stage for elevated liquidity in world markets, which has historically benefited riskier property similar to Bitcoin and subsequently altcoins.

Associated Studying

“This week’s rate of interest cuts from the Folks’s Financial institution of China and the European Central Financial institution kicked off the June central financial institution fireworks that may pull cryptocurrencies out of the northern hemisphere summer time droop. This isn’t the bottom case I anticipated. I assumed the fireworks would begin in August, simply When the Fed held its Jackson Gap symposium,” Hayes famous.

He believes these shifts in financial coverage might spark a bull marketplace for Bitcoin and cryptocurrencies, particularly as central banks seem like coming into a rate-cutting cycle. “We all know how you can play this recreation. It’s the sport we’ve been taking part in since 2009, when our Lord and Savior Satoshi Nakamoto gave us the weapons to defeat the TradFi satan. Go lengthy Bitcoin, then spamcoins. Hai Sure cited Bitcoin’s nameless creator.

Because the G7 assembly on June 13-15 approaches, Hayes expects additional developments that would influence world monetary markets. He expects the assembly’s communique could explicitly tackle foreign money and bond market manipulation, or no less than sign continued easing. Moreover, Hayes predicted that whereas there’s historically warning about coverage shifts close to main political occasions such because the U.S. presidential election, uncommon circumstances might set off surprising strikes.

Hayes concluded his article by underscoring his bullish stance on Bitcoin and cryptocurrencies with an evaluation of G7 financial coverage and its influence on world alternate charges and monetary stability. He referred to as on the crypto group to take motion to benefit from these developments and put together for what he predicts will probably be a profitable section out there.

“For my extra liquid crypto-synthetic USD money, […] It’s time to deploy it once more on perception rubbish cash. […] However suffice it to say, the crypto bull market is reawakening and is about to poke profligate central bankers within the face,” Hayes concluded.

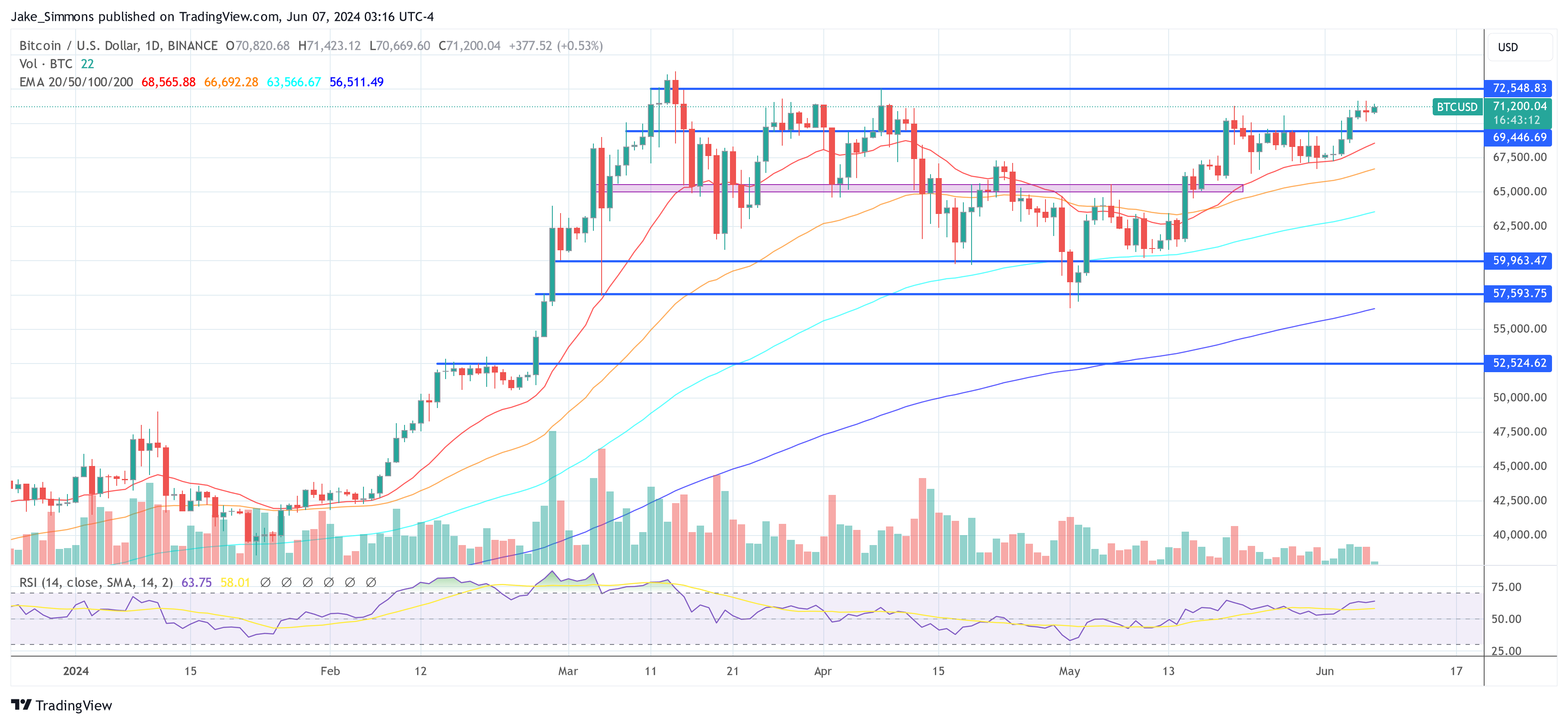

At press time, BTC was buying and selling at $71,200.

Featured picture created with DALL·E, chart from TradingView.com