The biggest U.S. financial institution, JPMorgan Chase, disclosed publicity to identify Bitcoin exchange-traded funds (ETFs) as we speak in a brand new submitting with the U.S. Securities and Trade Fee (SEC).

Phoenix Buying and selling

JPMorgan’s submitting with the U.S. Securities and Trade Fee supplies particular insights into the financial institution’s publicity to its spot Bitcoin ETF. The financial institution presently holds spot Bitcoin ETFs issued by among the world’s largest asset managers: BlackRock, Constancy, Grayscale and others.

Nevertheless, the quantity allotted to every ETF appears a bit underwhelming contemplating how a lot different establishments have allotted to purchasing Bitcoin. that’s as a result of:

“JPMorgan, Susquehanna (which additionally owns these ETFs and was all around the web site final week) and others are merely market makers and/or APs. Their possession doesn’t essentially point out something apart from that they’re in 3 What number of shares to personal. “Should you make markets on these items, the variety of shares held can fluctuate wildly from daily. The 13F knowledge is only a snapshot of the *lengthy* positions held by 13F on 3/31 and doesn’t present shorts or derivatives. So We do not even have the total image of their true publicity on 3/31.

Bloomberg senior ETF analyst Eric Balchunas additionally commented on the information, saying we are going to “discover[ably] Noticed many huge banks reporting that they maintain some shares as Market Makers/APs.that is the distinction[ferent from] They purchase for publicity (and subsequently much less hypocrisy in JPMorgan’s case)…props for capturing this, though we’re nonetheless engaged on getting the just-released doc on bbg.

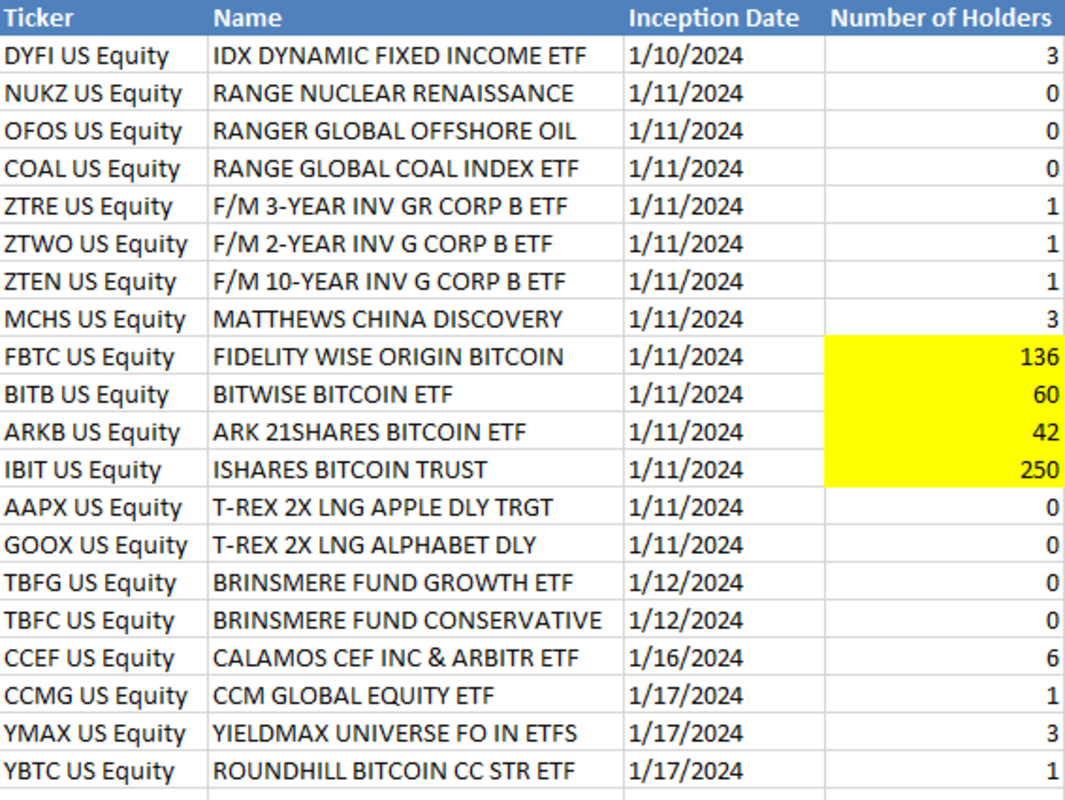

“What’s noteworthy in my view is the sheer quantity of every holder up to now. IBIT is as much as $250. That’s loopy for the primary quarter of the market,” Balchunas continued. “That is in comparison with different ETFs launching the identical week as BTC. We nonetheless have a few week of 13F to launch.”

Eric Balchunas

Simply hours earlier than JPMorgan’s disclosure, Wells Fargo, the third-largest U.S. financial institution, made an analogous disclosure about its publicity to a spot Bitcoin ETF.