At press time, Ethereum was below strain, down about 15% since March 2024.

Ethereum holders mined 298,000 ETH in 24 hours

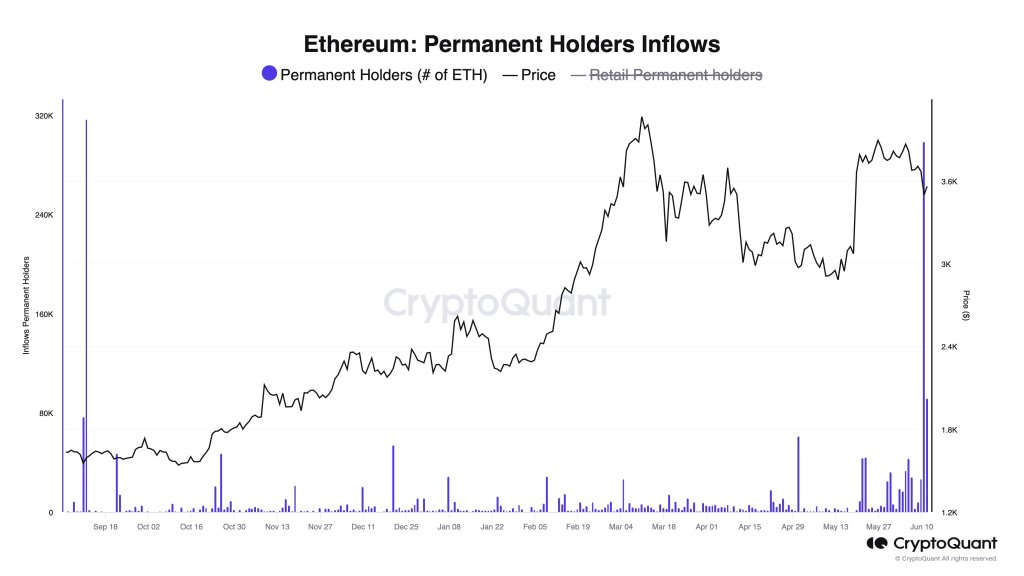

An analyst talks about X notes ETH demand is surging, particularly from everlasting holders. Most definitely, these everlasting holders are establishments with deep pockets and a willingness to stay round. Not like retailers, these entities typically have the choice to carry for longer intervals of time and are usually not shaken by market fluctuations.

Citing knowledge from CryptoQuant, the analyst stated these everlasting holders have the second-highest each day shopping for quantity on report. On June 12, when the value briefly elevated, they bought a staggering 298,000 ETH. Impressively, this quantity is just under the all-time excessive of 317,000 ETH bought on September 11, 2023.

In mild of this, regardless of a transparent wave of decrease lows on the each day chart, the surge in demand factors to sturdy bullish sentiment.

Associated Studying

Moreover, given the quantity of ETH taken from the market, this could possibly be an indication that establishments (maybe hedge funds or billionaires) are beginning to place themselves available in the market.

them It appears Reap the benefits of decrease costs.

At press time, Ethereum was weak, which is clear on the each day chart. Even with a rebound on June 12, bulls weren’t capable of utterly reverse the losses on June 11.

Trying on the candlestick association on the each day chart, $3,700 is rising as resistance. After the breakout on June 7, ETH has been free-falling to the spot price, actively filling the Might 20 hole.

If the sell-off continues, ETH may retest $3,300 once more whilst optimism abounds within the cryptocurrency house.

Spot ETFs to start out buying and selling this summer time: Gensler

It stays to be seen whether or not the value will get better from present ranges or drop to $3,300. General, the market is optimistic Remark stated Gary Gensler, Chairman of the U.S. Securities and Trade Fee (SEC).

Gensler instructed a Senate listening to {that a} Kind 194-b for the spot Ethereum exchange-traded fund (ETF) was authorised in Might and will tentatively start buying and selling in the summertime. BlackRock has refiled its S-1 submitting and is awaiting approval.

Associated Studying

If the product is authorised within the coming weeks, it will likely be a significant enhance to ETH liquidity. As with spot Bitcoin ETFs, establishments could also be funneling billions of {dollars} into ETH to provide their purchasers publicity.

Characteristic footage are from DALLE, charts are from TradingView