In a put up by Talking to his legion of followers, Deutscher elaborated on the affect of the speedy enhance within the variety of new crypto tokens, which he believes is on the coronary heart of altcoins’ underperformance this cycle.

The proliferation of cryptocurrencies

Since April 2024, greater than 1 million new crypto tokens have been launched within the crypto area, half of that are memecoins created totally on the Solana community. In line with Deutscher, the convenience of deploying these tokens on-chain has led to an inflated variety of tokens, however has additionally highlighted deeper problems with market saturation and dilution.

Deutscher defined: “We now have 5.7 instances the variety of crypto tokens we had on the peak of the 2021 bull run. That is the primary cause why cryptocurrencies have been struggling this 12 months, regardless of Bitcoin hitting all-time highs.” He listed the brand new token Likens over-issuance to inflation, “the extra tokens are issued, the larger the availability strain that accumulates out there.”

Associated Studying

The analyst additionally make clear the dynamics of enterprise capital (VC) funding within the cryptocurrency area, noting that the most important quarter of VC funding peaked at $12 billion within the first quarter of 2022, when the market started to show bearish. Deutscher criticized the timing and techniques of enterprise capital corporations, arguing that though capital injections from enterprise capital corporations are essential to challenge improvement, they typically result in market imbalances.

“Enterprise capitalists, like retail traders, are opportunists. Their funding timing is usually aimed toward maximizing returns quite than supporting sustainable challenge development, leading to cyclical peaks and troughs out there. He continued to debate later The market affect, whereby tasks are delayed in launching beneath adversarial circumstances, will solely flood the market when sentiment shifts, thereby exacerbating dilution.

The continual launch of latest tokens not solely strains market liquidity, but in addition impacts the boldness of traders, particularly retail traders. Deutscher emphasised that “the lean towards non-public markets is among the greatest and most damaging points in cryptocurrencies, particularly in comparison with different markets like shares and actual property.”

Associated Studying

This surroundings created obstacles to the entry of latest liquidity and left retail traders feeling marginalized, a sentiment exacerbated by high-profile collapses reminiscent of LUNA and FTX. Deutscher believes that “if retail traders really feel like they can not win, they will not play the sport, which is why memes have dominated this 12 months – it is the one meta that retail traders really feel like they’ve a combating likelihood.”

Going ahead, Deutscher proposed a number of methods to mitigate these points. Exchanges can implement higher token allocation standards and prioritize allocations to the bigger neighborhood. Moreover, adjusting the share of tokens unlocked at launch will help handle promoting strain extra successfully.

“Even when insiders do not power change, the market will ultimately accomplish that,” Deutscher asserts. He urged that exchanges ought to undertake strict requirements for the itemizing of latest tasks and undertake equally strict delisting measures for tasks that don’t meet the present requirements, in order to keep up the integrity and liquidity of the market.

Within the epilogue, Myles Deutscher hopes that his insights will promote higher understanding and immediate a reassessment of present practices. “Decentralization will not be the one concern, however it’s actually a serious concern and one which must be mentioned extra overtly to foster a more healthy crypto ecosystem.”

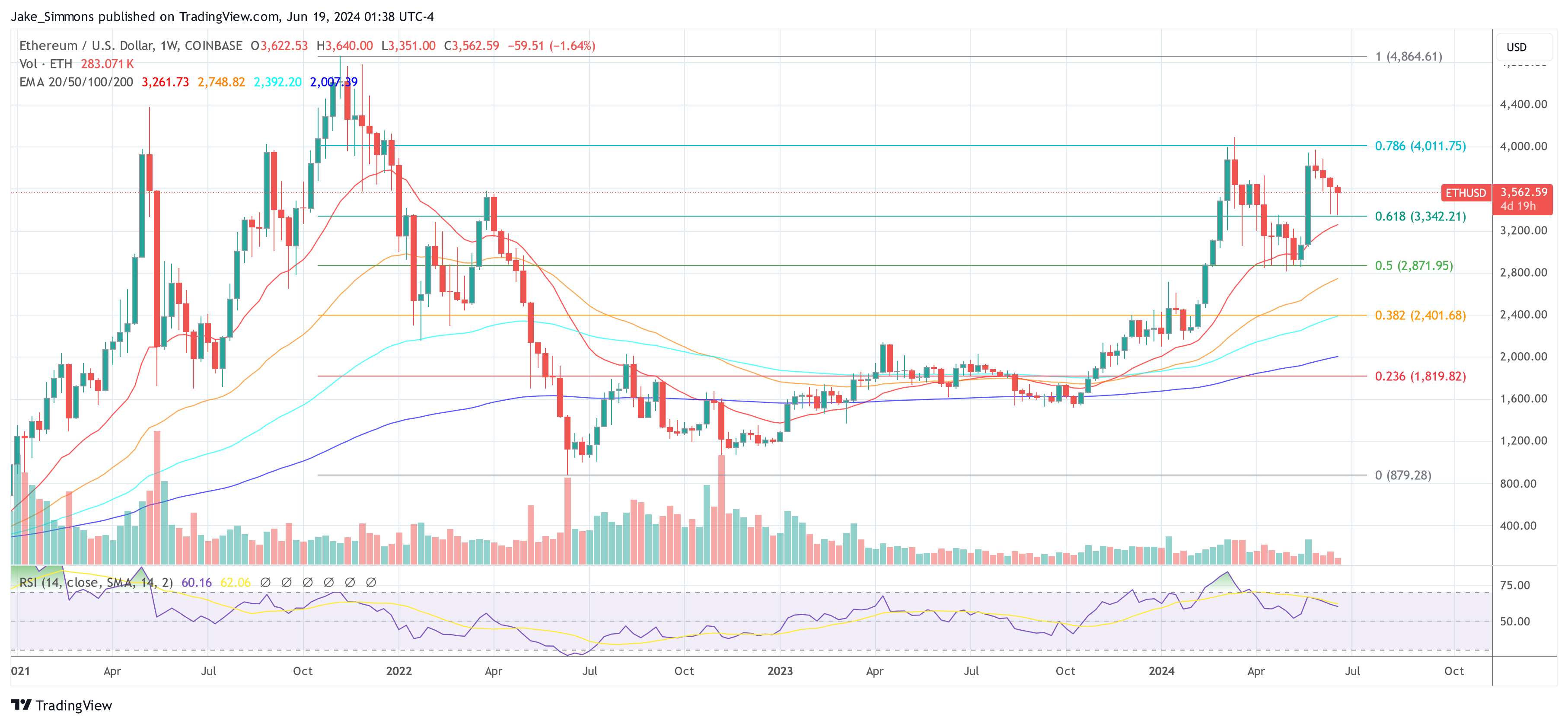

At press time, Ethereum (ETH) was buying and selling at $3,562.

Featured picture from Shutterstock, chart from TradingView.com