Hedge fund methods within the cryptocurrency area are present process a major shift, with Bitcoin publicity falling to its lowest degree since October 2020.

Specifically, ETC Group’s newest analysis highlights a major discount in these funds’ Bitcoin holdings, signaling a shift in technique that might have wider implications for the cryptocurrency market.

Throwing out the towel for Bitcoin

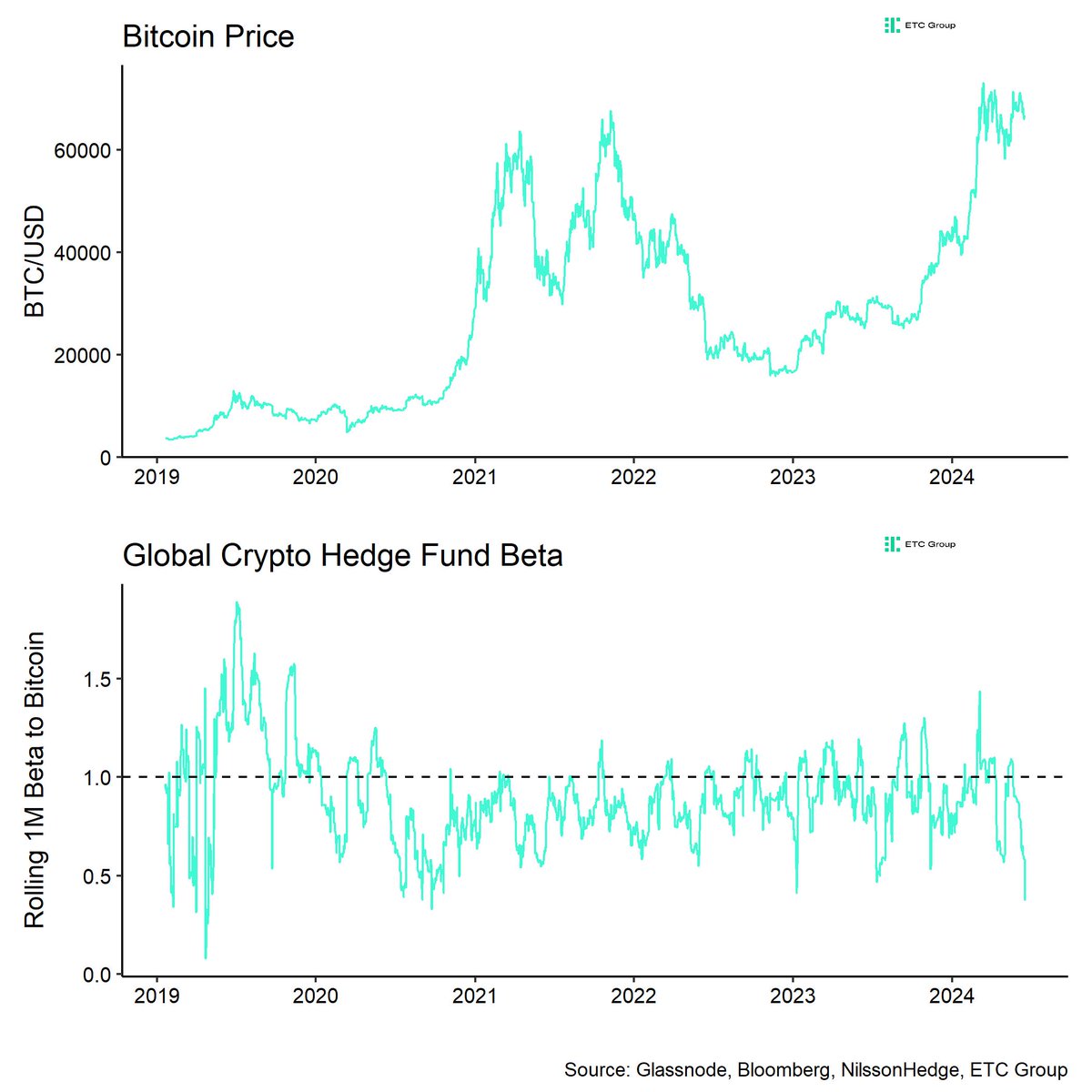

André Dragosch, head of analysis at ETC Group, identified that cryptocurrency hedge funds have considerably decreased their BTC publicity. Dragosch revealed that over the previous 20 buying and selling days, publicity has fallen to only 0.37, the bottom degree since October 2020.

This lower displays the skilled funding neighborhood’s cautious or bearish sentiment in direction of Bitcoin because it at present struggles to rebound.

This cautious perspective from hedge funds coincides with continued outflows from cryptocurrency exchange-traded merchandise and is indicative of a broader pattern of declining institutional investor confidence.

Dragosch additionally famous that hedge funds typically exhibit procyclical habits — an inclination to put money into response to market developments — which may imply Bitcoin will slowly come again if the market rebounds.

BOOM: Cryptocurrency hedge funds have certainly thrown within the towel #bitcoin current.

they decreased Bitcoin USD Market publicity prior to now 20 buying and selling days was solely 0.37.

lowest since October 2020. pic.twitter.com/WZCRK9QlMG

—Andre Dragosch | Bitcoin and Macro

(@Andre_Dragosh) June 19, 2024

Bitcoin’s Resilience Amid Headwinds

BTC, then again, confirmed indicators of rebounding, briefly touching the $66,000 mark earlier at this time, however fell barely again to $65,142 on the time of writing, nonetheless sustaining a every day achieve of 0.4%.

The exercise was pushed by the broader market downturn and several other key elements. CryptoQuant analysts consider that miner capitulation, lack of latest stablecoin issuance, and heavy ETF outflows are the principle drivers of the current market decline.

Particularly, decreased miner income will increase the quantity of Bitcoin bought to cowl working prices, thereby exacerbating downward stress on its worth.

On the identical time, the issuance of main stablecoins resembling USDT and USDC has slowed down, leading to fewer new funds coming into the market, affecting liquidity and intensifying volatility.

The background to those dynamics contains speculative habits, such because the German authorities’s allegedly Bitcoin holdings are being bought, including to market jitters.

The German authorities is now in Arkham.

The German Federal Prison Police Workplace (BKA) seized practically 50,000 BTC ($2.12B) from the operators of https://t.co/ck07DiJUAf, a film piracy web site lively in 2013.

BKA obtained the Bitcoin in mid-January after “voluntarily…” pic.twitter.com/0kC5tOPq6e

— Arkham (@ArkhamIntel) January 31, 2024

Regardless of these pressures, the CryptoQuant analyst revealed a glimmer of hope: present worth ranges are near an essential assist space that has traditionally offered robust rebound potential.

Featured picture created utilizing DALL-E, chart from TradingView